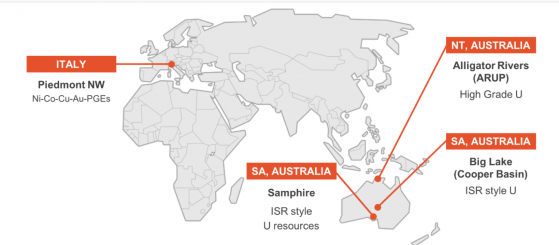

Alligator Energy Ltd (ASX:AGE) has delivered strong progress across its multi-jurisdictional portfolio prospective for uranium and energy metals across Australia and Italy.

At Samphire Uranium Project, the company submitted a first draft of its retention lease (RL) application to the SA Department for Energy and Mining, to conduct pilot in-situ recovery (ISR) field trials.

With resource drilling nearing completion, AGE is targeting an updated mineral resource (MRE) and an updated scoping study for Samphire in November.

At Nabarlek North, a significant IP survey has been completed over a portion of the Nabarlek North tenements in the Alligator Rivers Uranium Province (ARUP).

Meanwhile, at Big Lake, Alligator is awaiting advice on timing for an indigenous field survey for the inaugural drill program.

In Italy, the Piedmont Project is calling for more systematic exploration as the tenure still holds considerable untested potential for nickel, cobalt and copper mineralisation on the doorstep of Western Europe.

Alligator Projects

Samphire Project

Resource drilling operations continue at the Blackbush Deposit focusing on increasing the confidence of the MRE through conversion of the inferred category to indicated status.

Work has kicked off on preparing an exploration target range for the Samphire Project covering both the wider Blackbush Deposit and Plumbush Deposit.

Meanwhile, off-site fabrication of the field recovery trial pilot plant is well underway.

$AGE Alligator Energy aims to hold Field Recovery Trial at Samphire Uranium Project https://t.co/43Bity8qx9 @AlligatorEnergy #AGE #ASX #ASXNews— Proactive Australia (@proactive_au) August 30, 2023

Nabarlek North

A gradient IP program covering 17 square kilometres over the southern portions of the Narbalek North tenements EL31480 and 28390 has now been completed.

More than 200 basement sampling air-core holes have been completed at the project with samples sent for assay, with all results to feed into an updated geochemical and geological model.

An initial RC drill program may be undertaken late this year testing deeper basement structure and lithologies, dependent on rig availability.

Via @proactive: $AGE is making good progress in its exploration efforts at the Nabarlek North Project in the Alligator Rivers #Uranium Province (ARUP) of the Northern Territoryhttps://t.co/BLsPSE5XkP pic.twitter.com/tyPgOEKtU6— Alligator Energy (@AlligatorEnergy) July 5, 2023

Big Lake

A reconnaissance visit was undertaken in late June 2023 to gauge access, accommodation alternatives and logistical issues.

A pre-clearance site visit with the Yandruwandha Yawarrawarrka Traditional Landowners Aboriginal Corporation (YYTLOAC) was then undertaken in late July 2023 to appreciate Traditional Owner heritage concerns and finalise areas for drill hole siting.

Advice on the timing of a full heritage clearance for drilling by the YYTLOAC is currently awaited and is expected to occur in the last quarter of 2023.

An inaugural drilling program at Big Lake is now likely to be deferred to February/March 2024.

Piedmont Project

A field mapping program in May acquired 81 samples for geochemical assay. Sampling focused on the Alpe Laghetto and La Balma mineral occurrences, the former being a historical nickel-copper-cobalt working.

Geochemical assaying covering 52 elements and compositions was accompanied by petrology and petrophysical analyses on 9 and 34 samples respectively.

When integrated with the 2022 EM survey results, the combined datasets do not provide compelling cases to proceed to a drilling program at this stage.

Read more on Proactive Investors AU