Alkane Resources Ltd (ASX:ALK, OTC:ALKEF) has completed a strong December quarter, meeting gold production guidance at its Tomingley operations in Central West New South Wales and notable advancements in exploration and infrastructure projects.

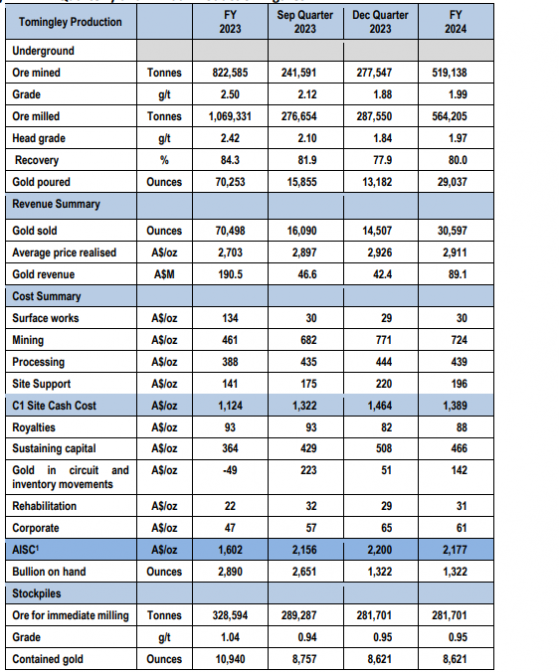

At Tomingley, gold production aligned with forecasts, reaching 13,182 ounces, with site operating cash costs at A$1,464 per ounce and AISC of A$2,200 per ounce.

The Tomingley Gold Extension Project (TGEP) saw a hive of activity with about 17,000 metres of infill drilling completed at the Roswell orebody – results from which will be incorporated into an updated mineral resource in the next quarter.

The quarter also resulted in an updated mineral resource estimate for the Boda Deposit at the Northern Molong Porphyry Project (NMPP) to the north of Tomingley, estimated at 583 million tonnes at 0.58 g/t gold equivalent for 10.9 million ounces gold equivalent.

At the office, Alkane demonstrated robust finances of A$73.4 million in cash, bullion and listed investments.

“High level of activity”

Alkane managing director Nic Earner said: “We've had another good quarter at Tomingley, again meeting our production guidance.

“The Tomingley Extension Project is continuing with a high level of activity with the Paste Plant pad completed and over 17,000 metres of infill drilling occurring at Roswell during the quarter.

“The Roswell resource model will also be updated this quarter as we undertake further development in the mining areas.

“The quarter also saw the release of the updated Boda resource model, which increased grade and metal endowment.

“Drilling at Kaiser [also at NMPP] remains on schedule for the release of an updated resource during the current quarter and this will contribute to the scoping study in the month or two after.”

Tomingley highlights

Tomingley delivered on its forecast production for the December quarter with the underground operations performing well.

Aside from production, gold sold for the quarter was 14,507 ounces at an average sale price of A$2,926 per ounce, generating revenue of A$42.4 million.

FY2024 guidance for Tomingley remains unchanged at 60,000 ounces to 65,000 ounces production at an AISC of $A1,750 to A$2,100 per ounce.

Tomingley production figures.

TGEP highlights

At TGEP, on the surface, the pad for the paste plant has been completed, with concreting to commence in the current quarter.

Surface works for the new flotation and fine grinding circuit will begin early in the current quarter.

Detailed drone-based magnetic and airborne gravity surveys were completed during the quarter and the data is being processed to assist in the definition of additional drill targets in the favourable volcanic stratigraphy south of San Antonio to Peak Hill.

Paste plant pad and earthworks.

Exploration highlights

The Boda updated mineral resource was based on approximately 145,000 metres of drilling using both 0.3 g/t and 0.4 g/t gold equivalent cut-offs deemed appropriate for potential open-cut mining or underground mining, respectively.

During the quarter, a substantial metallurgical test work program was completed on the Boda and Kaiser gold-copper prospects as well.

The program also established a viable flowsheet for processing Boda and Kaiser ore, comprising conventional crushing, grinding and flotation circuits to produce a saleable concentrate and leaching of the cleaner tail to produce gold dore.

The updated mineral resource estimation for Kaiser will be completed in the current quarter.

A scoping-level assessment of potential project economics is expected to be completed in the June quarter.

$ALK Alkane Resources boosts Boda resource 22% as NMPP surges toward world-class status https://t.co/DgKjt59v6W @AlkaneResources $ALKEF #ALK #ALKEF #ASX #ASXNews— Proactive Australia (@proactive_au) December 14, 2023

Read more on Proactive Investors AU