Alicanto Minerals Ltd (ASX:AQI) is raising A$3 million to support a major drilling program at its Falun Copper-Gold Project in Sweden.

The explorer has secured binding commitments to bring in the funds at 4 cents per share from new and existing institutional and sophisticated investors.

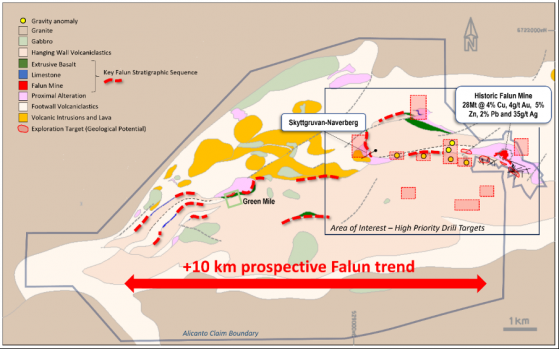

The upcoming diamond drill campaign will hone in on key targets around the historical Falun mine, as well as a highly prospective 3.5-kilometre trend that runs between Falun and high-grade mineralisation at the Skyttgruvan-Naverberg target.

Geophysics crews are on site completing electromagnetic and gravity surveys to support the campaign, which is expected to kick off sometime this quarter.

Back in its heyday, the Falun mine produced 28 million tonnes of ore at 4% copper, 4 g/t gold, 5% zinc, 2% lead and 35 g/t silver. Since its closure, however, the project has seen limited modern exploration or drilling efforts.

High-priority follow-up drill targets at Falun.

Drilling down at Falun

Alicanto managing director Rob Sennitt said the company’s recent exploration program had proved up several high-priority targets within its area of interest at the historical copper-gold camp.

“The proceeds from the placement will enable us to commit to a major diamond drill program with the flexibility to optimise the program to maximum effect,” he explained.

“We look forward to getting the drill program underway and confirming the significant opportunity that still exists at and around what was historically a world-class copper-gold mine.”

Alicanto has plenty of drill targets on the to-do list, but some of the best in class include:

- Falun’s near mine extensions;

- northern extensions to the SkyttgruvanNaverberg trend;

- gravity anomalies between Falun and SkyttgruvanNaverberg; and

- alteration and copper mineralisation at surface west-northwest of the historical Falun mine.

Defining Falun’s best-in-class drill targets.

Placement details

Alicanto plans to issue 75 million shares at 4 cents a pop to complete its A$3 million capital raise.

Investors are getting in at a 20% discount to the explorer’s 5-cent close price on August 2, as well as a 14% discount to the 15-day volume-weighted average price, which clocks in at 4.7 cents per share.

The vast majority of shares will vest under Alicanto’s existing placement capacity but 2.5 million shares earmarked for chairman Ray Shorrocks will need shareholder approval at this year’s November AGM.

Placement shares are expected to settle on August 10 before quotation the following day. Cannacord Genuity acted as the placement’s lead manager.

Read more on Proactive Investors AU