Aldoro Resources Ltd (ASX:ARN) plans to diamond drill at the Narndee Nickel and PGE (platinum group element) Project later this month following a successful fieldwork program.

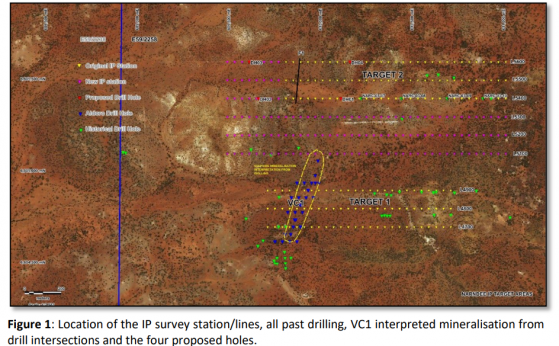

A high-powered induced polarisation (IP) survey across two targets, Target (NYSE:TGT) 1 and Target 2, has helped the company pick out priority drilling areas. The two targets are 500 metres apart.

Massive sulphide response

The survey defined a high-priority zone at Target 2, recording a signal consistent with a massive sulphide response in the basal contact between the peridotite and underlying mafic unit.

This target exhibits a very strong aeromagnetic PGE anomaly associated with VTEM and PGE geochemical anomalies as well as surface gossans.

The priority zone at Target 2 is at least 200 metres long and was present in three survey lines.

The company is now progressing infill lines between Targets 1 and 2 to verify continuity between them.

Contact anomaly over 200 metres

Historical reverse circulation (RC) drilling of the upper layer by Falconbridge in around 2003 intersected peridotite with up to 0.3% nickel and up to 0.26 g/t palladium.

The chargeability profile shows that these holes appear not to have drilled deep enough, or too far east to intersect the inferred mineralised contact zone.

IP responses are consistent along all three Target 2 profiles conducted to date, which suggests to Aldoro that the contact anomaly has strike extent over 200 metres north to south, and is open at both ends.

The Target 2 lines were extended some 250 metres to the west to cover the anomaly.

At Target 1, to the south, the contact anomaly is present but not as laterally extensive or well-formed as Target 2.

The area between Target 1 and Target 2 is being infilled to close off the anomaly to the south.

Drilling to start at T2

A diamond drill rig has been booked and drilling is expected to kick off in mid-November at Target 2’s DH01, where four holes are planned.

The survey picked up an inferred contact between peridotite (ultramafic) and an underlying mafic (basalt or gabbronorite) with an associated response consistent with that expected for massive sulphides.

At Target 1, the planned east-west survey lines cover the previous drilling at VC01 and an area to the east.

Nickel-copper mineralisation was intersected at VC01, with results of up to 2.9 metres at 0.92% nickel and 0.40% copper in one hole, at the base of the ultramafic cumulate, where this contact appears to dip to the east.

What’s next?

The IP surveying is expected to continue after the Target 1 to Target 2 infill lines are done, with gradient array IP planned for the broader Target 3 to the north and a block west of Targets 1 and 2.

The geologists think that the mineralisation may thicken to the east and have extended the three IP lines 1 kilometre to the east to test the mineralisation model.

The boundaries of the surveys are still in the planning stage.

Read more on Proactive Investors AU