By Sam Boughedda

Advanced Micro Devices, Inc. (NASDAQ:AMD) shares initially fell after the close Tuesday following its third-quarter earnings report, which saw it miss earnings and revenue expectations.

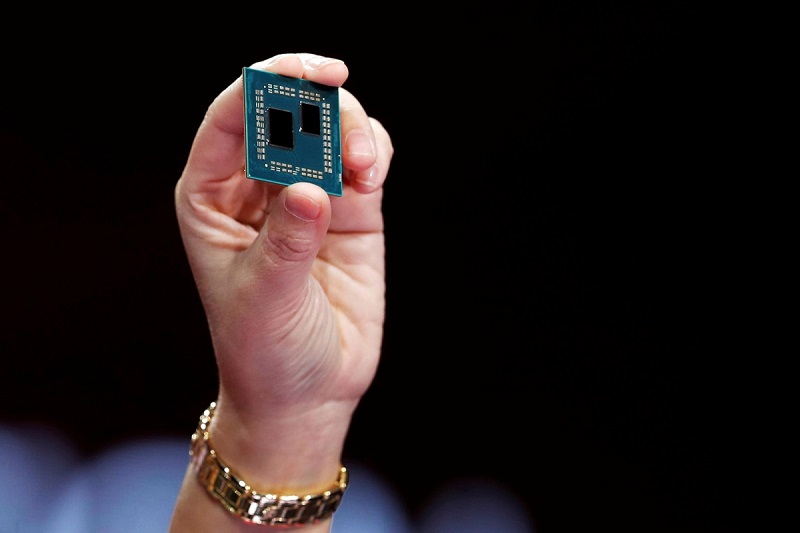

The semiconductor firm reported third-quarter earnings per share of $0.67, below the analyst consensus estimate of $0.68, with revenue for the quarter coming in at $5.6 billion versus the consensus estimate of $5.62 billion. The company's 29% year-over-year revenue increase was driven by growth across its Data Center, Gaming, and Embedded segments.

After initially declining after-hours, AMD shares are now up 2.65%.

The company previously reported preliminary results in which it lowered guidance for the quarter due to weaker PC demand and supply chain issues.

"Third quarter results came in below our expectations due to the softening PC market and substantial inventory reduction actions across the PC supply chain," said AMD Chair and CEO Dr. Lisa Su.

"Despite the challenging macro environment, we grew revenue 29% year-over-year driven by increased sales of our data center, embedded and game console products. We are confident that our leadership product portfolio, strong balance sheet, and ongoing growth opportunities in our data center and embedded businesses position us well to navigate the current market dynamics."

AMD sees fourth-quarter revenue between $5.2 billion and $5.8 billion, versus the consensus of $5.85 billion. For the full year, AMD expects revenue to be around $23.5 billion, plus or minus $300 million, representing an increase of approximately 43% year-over-year, led by growth in the Embedded and Data Center segments.