There’s a gigantic gas opportunity shaping up in Australia’s north and Empire Energy Group Ltd (ASX:EEG, OTC:EEGUF) MD Alex Underwood is in the thick of it.

The managing director has been at the helm for five years, transforming the company’s Australian portfolio into the largest acreage position in the NT’s Beetaloo Sub-basin.

Fast forward to today, mere weeks after the Northern Territory Government greenlit fracking in the Beetaloo, and Empire stands on the threshold of a sizeable development opportunity.

In this article:

- Back then …

- … And now

- Gas remains in the mix

- Community at the heart

- New chapter for the Beetaloo

Underwood spoke to Proactive about his personal commitment to responsible production and sheds light on the role gas will play in the green energy revolution.

Back then …

It’s one thing to take a high-performing stock and build on its success. But for Underwood, his leadership journey has meant taking Empire through a 180 transformation.

When Alex joined the company in 2018 it was in a pretty challenging position: its core asset was subject to a moratorium on fracking, which meant no activity could be carried out in the field.

Beyond the situation in the basin, Empire’s finances were also a pain point.

“We had US$38 million of debt and that was secured against US oil and gas production that was only generating about US$4 million a year,” Alex remembers.

“In the office, it was just me and Kylie, our financial controller, who were trying to keep everything going.”

Although things looked bleak, Alex says he was drawn to the challenge.

“I’ve certainly always been a risk taker — often to my mother's great dismay when I was a teenager,” Alex laughs.

Things soon turned around. Shortly after Alex became MD, the moratorium was lifted, paving the way for exploration in the basin.

He also steered the company through an exhaustive recapitalisation process, meaning it could get some money back into the Beetaloo.

Five years on and Empire is leveraged to develop its extensive holding into a low-carbon operation — one that can provide critical energy security amid the east coast’s energy crisis.

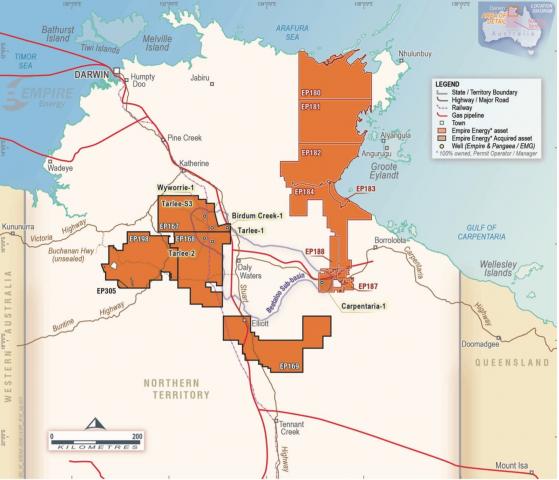

Empire’s holding in the Beetaloo Sub-basin.

… And now

In early May, the Northern Territory Government made an announcement that will open the doors to a full-scale onshore gas industry: it’s allowing fracking to go ahead in the Beetaloo Basin.

This is a major development and not just for companies in the region. Last year, the Australian Competition and Consumer Commission (ACCC) reported that an energy crisis on the country’s east coast — triggering widespread supply issues and price hikes — was likely to last through winter 2023.

The ACCC forecast a 70% increase in gas demand for electricity generation, while high international gas prices also hit consumers’ pockets.

This phenomenon underscores the need for reliable domestic gas supply and the Beetaloo’s sizeable gas bounty is well placed to meet demand.

With this in mind, Underwood says the company plans to build on four years of exploration to deliver much-needed supply.

“Beyond the domestic opportunity we hope to increase liquefied natural gas (LNG) exports, already the NT’s largest source of foreign income and a significant contributor to Federal Government revenues,” he stated in early May.

Gas remains in the mix

While the green energy revolution remains front of mind, it’s important to remember the role oil and gas companies will play in global decarbonisation efforts.

“In this increasingly carbon-constrained world, gas is going to be a critical transition fuel,” Underwood notes.

“Ultimately there's going to be a competitive advantage for those sources of gas that have very low CO2.”

That’s where Empire’s focus lies: on building a sustainable, low-carbon operation that supports modern energy requirements.

Earlier this year, the Federal Government introduced safeguard legislation, essentially giving effect to its commitments to reduce Australia's emissions by 43% by 2030 and then ultimately getting to net-zero by 2050.

The mechanism lays down the law on gas supply, paying specific attention to prospective operations in the sub-basin to facilitate cleaner, greener production.

“First of all, gas from the Beetaloo will need to be scope one net-zero from the commencement of production but there's another requirement that new fields that feed gas into existing LNG plants will also need to be net-zero,” Underwood explains.

“We've been working on this in the background for quite some time.”

From Alex’s perspective, gas will always play a role in our modern energy mix.

“The reality is that 82% of all energy usage globally is still hydrocarbon based,” he explains.

“It's very clear to me — and I think a lot of other people in the broader energy industry — that there simply will not be net-zero without an orderly transition from the old system to the new system,” he continues.

That’s ultimately because renewables face one key problem: intermittency. And while battery technology is evolving rapidly, their intensive mineral and infrastructure requirements mean they’re a long way off powering the grid.

Community at the heart

Beyond the traditional carbon credit system, Alex is considering ways the business could reduce its carbon footprint while supporting Northern Territory communities.

“As part of our efforts to be a good corporate citizen and help generate more economic activity, one option we’re looking at is taking the capital that we would otherwise invest [in carbon credits] and helping Northern Territory-based businesses to develop their own carbon farming opportunity.”

One option on the table is human-induced regeneration, which involves planting trees to act as carbon sinks.

“We've had conversations with some of the pastoralists on whose properties we operate to look at that,” Alex says.

Another initiative is savanna burning, which involves deliberate burning in the early dry season to reduce the emissions released in large wildfires.

“For thousands of years, traditional owners have been managing these areas by deliberately setting smaller fires to manage the risk of big fire outbreaks,” he explains.

“It actually results in less carbon release in aggregate because you're more carefully managing the land.”

Considering the resource spoils Australia is known for, Underwood is a big advocate for prospecting our natural wealth with care.

“I believe the key to building a social licence for our industry is to demonstrate the environmental credentials of our products,” he concludes.

Regardless of a workforce’s size, Alex says a responsible operation can have a ripple effect on the local community. Although it may only create a certain number of on-site jobs, the money and people it brings to local businesses can have an exponential effect.

One of the best examples of this kind of impact? For Alex, it’s a motel that’s close to his heart.

The Heartbreak Hotel, Cape Crawford. Source: Heartbreak Hotel.

“There's a roadhouse about 80 Ks down the road from us called the Heartbreak Hotel — a great name for a remote roadhouse,” he laughs.

“They do a great steak by the way, if anyone's in that part of the world. But our activities can result in that business alone — just one business — having a great time, because people are staying there, eating, having a beer after work.

“It's these sorts of opportunities — out in these remote areas where there's little other economic opportunity — where we can actually really make a difference to people's lives.”

Next chapter for Empire

One area where Underwood believes Australia’s energy industry needs to step up is in the way it communicates its role in society.

“There's a bit of a perception about oil and gas, where it's just all of these people in glass towers,” he explains.

“I've seen the way they do it in America — you've got states like Texas and Oklahoma and Kansas where the oil and gas industry is just part of people's daily lives.

“I remember visiting Kansas once and going out to look at one of our fields … you see the nodding donkey wells dotted all over the place and the landowners benefit from it.”

Down under, Underwood says energy companies should talk more about their decarbonisation and ESG initiatives — especially considering Australia’s natural resource endowment.

And with all eyes on the Beetaloo right now, operating with a social licence — and valuing the safety and sustainability of your team — is Alex’s number-one priority.

“This can be a dangerous industry if you don't do things the right way, and I'm very proud of our safety track record.

“I'm ultimately the person responsible for lots of people's safety, and that really requires you to act with integrity.”

With all this in mind, one big question remains: What does Alex see in store for the Beetaloo asset?

“As a company, we are in this for the long haul. We’re not just looking to drill a few wells, de-risk projects and then sell off to a bigger player,” he clarifies.

“We take great inspiration from some of the great Australian success stories … but I think what’s most important is bringing people on the journey.

“We've got all the pieces of the puzzle on the board as it were, and really what we're focused on is bringing them together for what could be a nation building project.”

Read more on Proactive Investors AU