Gold is in demand again.

Despite lacklustre returns for gold this year, demand for it has most certainly been on the rise.

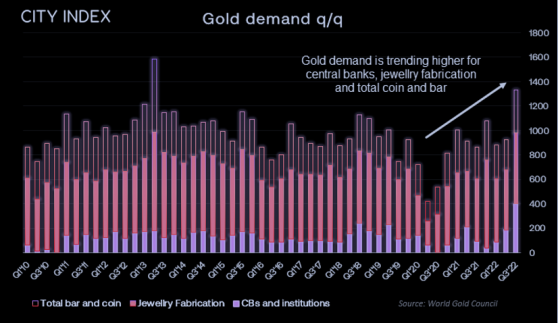

According to the World Gold Council (WCC), year-to-date demand is back to its pre-pandemic pace and at its highest level since 2016.

Jewellery and fabrication make up for more than half of gold demand, which rose to a 4-year high of 1,589 tonnes between Q1 to Q3. Furthermore, Q3 demand is back above its 5-year quarterly average for the first time since the pandemic.

Demand from China picked up by 58% q/q over the same period as lockdowns in Q2 were eased, whilst demand from India is currently up in excess of 17% y/y. The WGC is confident demand in India will be sustained in Q4 as ‘wedding season’ kicks off.

Coins and bars are the second largest source of demand and, up to the first three quarters, the annual rate has risen to a 9-year high. And with central banks favouring coins and bars for their reserves, they’ve played their part to support gold prices this year.

Soaring inflation has incentivised central banks to stockpile gold, sending demand this year to Q3 to more than twice seen in 2021. Moreover, their demand in Q3 is at a record.

According to an annual central bank survey from June, gold continues to be viewed favourably by CBs as a reserve asset. 61% of respondents said they expected to increase their reserves over the next six months with just 5% intending to decrease it.

And it would appear they have done just that with 31 tonnes of gold added to international reserves in October alone.

Gold can get high despite its own supply

Whilst demand is clearly rising, it is worth noting that supply has outpaced demand year to date.

Yet as gold supply is considered inelastic (not easily available) then the traditional supply and demand theory hits shaky ground.

Therefore, I’m more inclined to focus on the pickup in gold demand this year over supply, which at the minimum throws a pillar of support under gold prices as we head into 2023.

Interest rates, the Fed and inflation

A threat to gold’s outlook is that inflation doesn’t drift lower as quickly as hoped and the Fed’s terminal rate will be higher than the 5-5.25% currently estimated. This would likely be dollar bullish and weigh on gold prices in the process (amongst other markets).

Of course, if rates were to revert north and cause the hard landing central banks are not foreseeing, we suspect investors would simply head to cash and gold would lose its safe-haven appeal until much later in the recession. This seems like an outside chance and one that could still see central banks favouring gold.

In all likelihood, we suspect inflation will drift lower to the mid-single digits next year as outlined in Matt Weller’s Global Macro 2023 outlook report. This should provide further support to gold prices without it turning into an overheated rally, which a 5% plus Fed fund keep any runaway rally in check.

Market positioning

Large speculators have been net-long gold futures for the majority of time since the beginning of the 2002 bull run.

However, net-long exposure has been trending lower since March 2020 when central banks flooded markets with liquidity. Net-long exposure then fell to a 3.5 year low in October but the dynamics have since changed.

Gross shorts stalled around the 150-160k area from September and shorts are now being covered after the Fed signalled a slower trajectory of hikes.

Yet gross longs are also beginning to pick up – which is encouraging as open interest is currently at its lowest since December 2018. And that suggests there are plenty more bulls sat on the sidelines waiting to redeploy their capital.

Gold to hold above $1,600 in 2023?

We expect gold could hold above $1,600 this year but a break to a new record high seems debatable. The market produced a convincing triple bottom around 1,614 with a bullish divergence on the RSI, which is now above 50 to confirm positive momentum on the weekly chart. Yet take note how the of RSI peaks since 2019 are trending lower, hence the call for gold to hold below the 2,075 high in 2023.

A 74-week cycle also suggests the lows in September could be of importance and that gold could be set to rally in the first half of 2023 before pulling back.

The next major low is not projected to arrive until February 2024, hence the call for it to hold above $1,600 next year.

Of course, cycles need to be treated with caution as troughs can be off by weeks or months at a time, so this is to be used alongside regular analysis as opposed to viewing as a roadmap for future prices.

The annual range of gold prices over the past 40 years is 27.5%, so it is interesting to see this year’s range comes in at 28.2% and the median in at 26%. Using $1,600 as the 2023 low estimates a high of $2,016 using the median HL%. But given the backdrop of ‘higher for longer rates’ then we suspect volatility may be on the lower side this year and may not see gold break above $2,000.

Conclusion

Central banks, China and India are expected to continue providing support for gold in 2023. Yet with the Fed likely to go above 5% interest rates and hold them there, it should cap upside potential for gold.

We, therefore, expect a ‘below average’ high-to-low range next year. Cycles suggest gold may have printed an important low in September and enjoy buying pressure in the first half of 2023. Our estimate range for gold in 2023 is $1,600-$1,900.

- City Index senior market analyst Matt Simpson

Read more on Proactive Investors AU