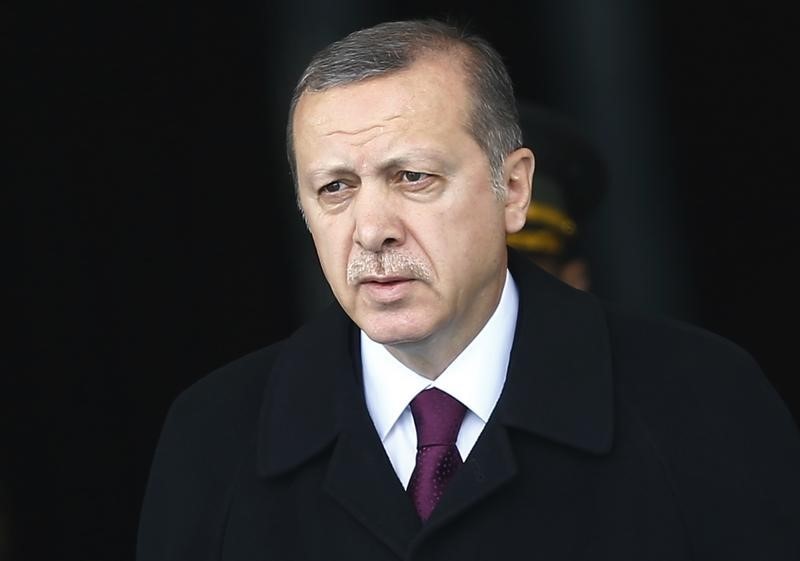

Investing.com - The recent re-election of Erdoğan as Turkey's president renewed concerns of a further fall in the lira if he continues with current economic policies. These firms believe that such strategies are unsustainable, given the country's over 40% inflation rate.

Erdoğan defeated his opponent Kemal Kılıçdaroğlu in a first-round vote, which led to an increase in costs for insuring Turkey’s debt against default. This outcome reversed investors' hopes that Kılıçdaroğlu would have implemented more conventional economic policies after taking office.

Rating agency Moody's Investors Service expressed its concern about the potential consequences of another term under President Erdoğan, stating it could result in "persistent very high inflation and severe currency pressures." The Turkish government has employed various unconventional methods to stabilize their $900 billion economy, including tight controls on foreign currency transfers and special savings accounts launched last year to shield depositors from fluctuations in the lira value.

Despite these measures slowing down the depreciation of Turkey’s currency, analysts argue that the lira remains overvalued due to prolonged efforts by central banks propping up its value. Over the past two years alone, it has fallen nearly 60% against US dollars.

Another issue adding fuel to this fire is Turkey’s record-breaking current account deficit of $24 billion during Q1 of this year. According to Fitch Ratings Senior Director Erich Arispe, financing this massive deficit will require billions more dollars – something achievable only through continued tapping into dwindling foreign currency reserves.

HSBC also highlighted Turkey's current account deficit as one of its main vulnerabilities and predicted the lira to fall even further, potentially reaching 24 or even 27 against the dollar by year-end. Additionally, Barclays (LON:BARC) analyst Ercan Erguzel estimates that Turkey's current account deficit will reach around $40 billion within a year and would need roughly $30 billion for financing.

Amid these concerns, it remains uncertain whether Erdoğan's economic policies can maintain stability in Turkey’s economy without significant repercussions on its currency value and investor confidence.