By Swati Pandey

CANBERRA, May 8 (Reuters) - The Australian government is expected to announce a major boost to infrastructure spending and measures to address housing unaffordability as it promises to speed up a return to surplus in its annual budget on Tuesday.

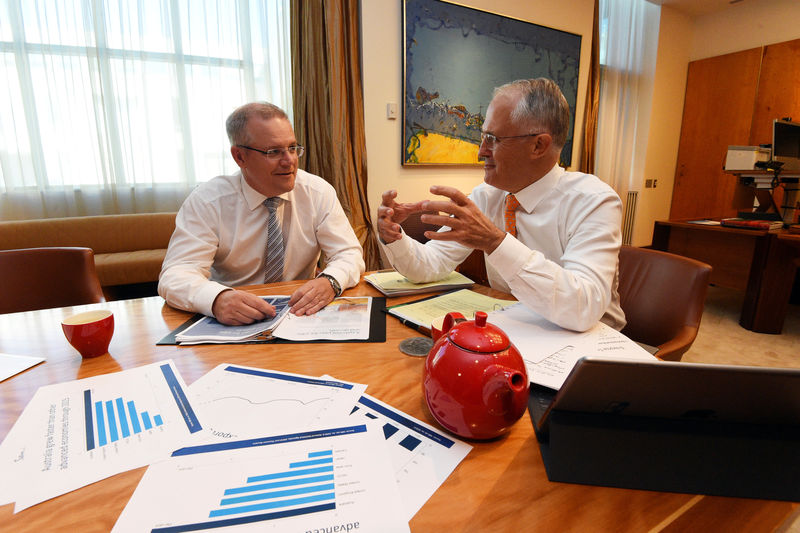

Australia's persistent budget deficit has led to lingering concerns about its prized Triple-A credit rating, and Treasurer Scott Morrison plans to differentiate between "good debt" and "bad debt" in this year's spending plan.

Broadly, Morrison is defining money borrowed to fund income-generating infrastructure, such as roads and railways as "good debt", while money borrowed to fund basic costs of annual services the government provides as "bad debt".

"There are some debt that you can acquire that can actually pay for itself over time when you invest it in things that boost productivity, that grow the economy, in particular that have an income stream," Morrison said.

Morrison has already announced the government will use "good debt" to finance a second international airport in Sydney. It has also agreed to a A$2.3 billion road and rail package and has hinted at funding an inland rail freight project linking Melbourne and Brisbane.

Not all economists are convinced by the new distinction.

"The big downside is that the differentiation does nothing on its own to wind back "bad debt" and that some of the projects may turn out to be white elephants that ultimately have to be written down in which case the debt will come back into the budget," said AMP chief economist Shane Oliver.

Morrison projected a shortfall of around A$36.5 billion for this financial year in his mid-year economic review in December, lower than 2016/17 forecast of A$37.1 billion.

Economists expect the number to show a further improvement of about A$10 billion in the budget, largely thanks to higher prices of iron ore - Australia's top export.

Morrison has also flagged a return to a budget surplus in 2020/21, ending 12 consecutive years in the red, but it will still need to get any major reforms through a hostile Senate where it has a wafer-thin majority.

It is widely expected that so-called 'zombie' savings measures - those that have been blocked by opposition parties in the Senate since 2014 and estimated at A$12.4 billion over the four years - will be removed.

The government is expected to attempt to appeal to voters with a package to address housing unaffordability, with economists speculating it will include measures such as allowing first-home buyers to save for a deposit out of pre-tax income.

Housing has become a sore political topic for the government with property prices in Australia's two biggest cities, Sydney and Melbourne, running red hot.

But economists say such measures will help only at the margin, given the government's reluctance to tweak a tax treatment on property massively favoured by the wealthy known as 'negative gearing.'

The budget comes as the latest Newspoll shows the ruling Liberal Party-led coalition government trailing the opposition Labor Party at 52 points to 48 points. The coalition has lagged Labor since July 2016.

"The middle political path the Treasurer needs to tread between the budget repair task and managing community expectations on service delivery suggests that the budget will likely contain few new major policy initiatives over what has already been announced," Citi economist Josh Williamsom said. (Editing By Jane Wardell & Shri Navaratnam)