By Purvi Agarwal

(Reuters) - Canada's main index inched up on Tuesday, led by gains in energy and materials stocks, while investors remained cautious ahead of the Bank of Canada's interest rate decision and economic data in the United States due later in the week.

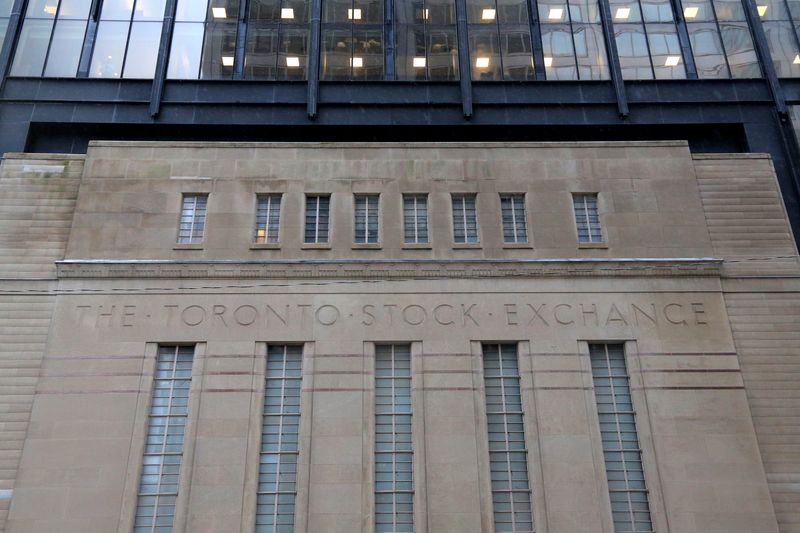

At 10:37 a.m. ET (15:37 GMT), the Toronto Stock Exchange's S&P/TSX composite index was up 14.17 points, or 0.07%, at 21,545.24.

Materials stocks gained 0.9% after spot gold prices hit a record high level. [GOL/]

Shares of gold miners like Alamos Gold and SSRM Mining rose 1.8% and 2.6%.

Energy shares also gained 0.6%, pulled up by a 3.0 % and 2.8% advance in gas companies Topaz Energy and Advantage Energy after their fourth-quarter results.

Gains were capped by a 2.2% decline in rate-sensitive technology stocks ahead of the Bank of Canada's decision on monetary policy on Wednesday, where traders widely expect the central bank to stay put on interest rates. However, they are pricing in about a 50% chance of a 25 basis points cut in June. [0#BOCWATCH]

"It would be shocking to the markets if they (BoC) cut tomorrow as opposed to hold. Central banks are going to be very methodical in terms of cutting interest rates, especially when inflation is still above their targets," said Macan Nia, co-chief investment strategist at Manulife Investment Management.

Across the border, U.S. Federal Reserve Chair Jerome Powell is due for congressional testimonies on Wednesday and Thursday. Investors are also tuned into the monthly U.S. labour market reports scheduled throughout the week.

"They will be paying very close attention to the theme of his (Powell) messaging, whether it is more hawkish or dovish. We anticipate that he's going to be walking a very fine line in terms of setting market expectations", Nia added.

Among other stocks, shares of lithium producer Lithium Americas (Argentina) Corp fell 1.5% after Ganfeng Lithium said it planned to buy a stake of at least 14.8% in a subsidiary of the company.