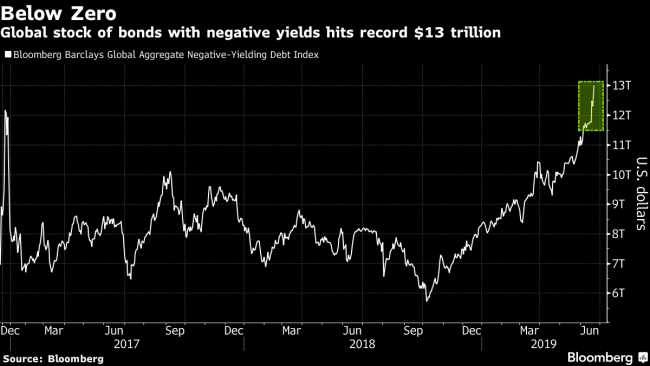

(Bloomberg) -- The universe of negative-yielding bonds grew about $1.2 trillion this week after dovish messages from central banks in Europe and the U.S., pushing the total past $13 trillion for the first time.

Joining the club of government debt with 10-year yields below zero this week were Austria, Sweden and France. Japanese and German rates plumbed fresh all-time lows amid a global bond rally that even got Wall Street pondering life with Treasuries yields under 2%.

“The message from the markets is that there are problems out there that central banks, not just the Fed, are now responding to,” Ed Hyman, Evercore ISI chairman, told Bloomberg TV.

In Europe, another notable milestone was reached this week. Yields on Danish debt due to mature 20 years from now dropped to a record low, leaving the entire curve within an inch of turning negative. Some 40% of global bonds are now yielding less than 1%, according to data compiled by Bloomberg.

It’s not just sovereign debt. In the investment-grade market, negative-yielding debt now comprises almost a quarter of the total. And as companies take advantage of low interest rates to borrow more, issuance has helped drive junk bonds outstanding to more than $1.23 trillion, more than double the level a decade ago.

Whether the universe of negative-yielding debt continues to expand depends in part on the policy of the European Central Bank under Mario Draghi’s successor and upcoming moves from the Bank of Japan, the two regions making up the overwhelming bulk of sub-zero yields. Countries to watch include Belgium, teetering on the brink with a 10-year rate of 0.08%. And Spain, at about 0.39%.

Bloomberg’s calculations of total global negative-rate bonds date to January2017; monthly tallies prior to that indicate that the stockpile is now at a record.