Investing.com - Here are the top five things you need to know in financial markets on Thursday, January 12

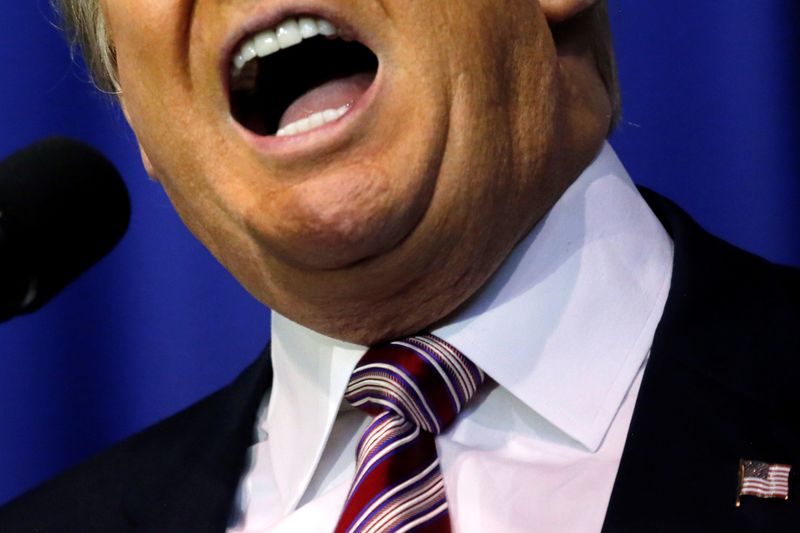

1. Dollar slumps after Trump press conference

The U.S dollar fell to one month lows against a currency basket on Thursday after Donald Trump failed to address economic and fiscal policies in his first formal news conference as U.S. president-elect.

Trump disappointed investors who had been hoping he would outline his proposed plans to boost the U.S. economy with infrastructure spending and tax reforms.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, hit lows of 101.00, the weakest level since December 14.

USD/JPY hit five-week lows of 113.75 and was last at 114.26, off 0.99% for the day.

2. Gold tops $1,200 for first time since November

Gold prices rallied to a seven-week high on Thursday, helped by the weaker U.S. dollar as President-elect Trump’s press conference rippled across markets.

Gold hit an intra-day high of $1,202.35 a troy ounce, a level not seen since November 23 and was last at $1,205.15.

Dollar weakness usually benefits gold, as it boosts the metal's appeal as an alternative asset and makes dollar-priced commodities cheaper for holders of other currencies.

3. European markets, U.S. futures lower

European markets were lower, despite gains in Asia and the U.S. overnight as healthcare stocks skidded after Trump criticized the pharmaceutical industry, saying it had been "getting away with murder" on pricing.

Wall Street futures pointed to a lower open for the major U.S. indexes, with the Dow futures down 45.5 points or 0.23%, the S&P 500 futures losing 7 points or 0.31%, and the tech-heavy Nasdaq 100 futures falling 14.1 points or 0.28%.

4. Oil firms up but gains checked

Oil prices were firmer as the weaker dollar lent support, but gains were held in check as global oversupply remained in focus after a report showing rising U.S. inventories.

Brent crude was trading up 59 cents, or 1.07% at $55.69 a barrel at 11.00 GMT, while U.S. crude was up 41 cents or 0.78% at $52.66.

The U.S. Energy Information Administration said Wednesday that crude stocks unexpectedly rose by 4.1 million barrels to 483.11 million barrels last week.

5. Fed Chair Yellen, jobless claims report on tap

Federal Reserve Chair Janet Yellen is due to host a town hall event at 19.00 ET. The event will discuss for teachers the role of the Federal Reserve and traders are not expecting much by way of comment on monetary policy to emerge.

The weekly report on U.S. initial jobless claims, which are expected to total 255,000, is due for release at 08.30 ET.