Investing.com - The U.S. Federal Reserve is done raising interest rates until at least the end of next year, according to economists in a Reuters poll who gave a 40% chance of at least one rate cut by end-2020.

The Fed left its federal funds rate on hold last month as expected, but its "dot plot" projections shifted and now suggest no hikes in 2019 compared with two in December.

While the Fed's projections show one rate hike next year, the latest Reuters poll of over 100 economists taken after the March 19-20 central bank meeting showed the fed funds rate will stay at the current range of 2.25% to 2.5% until at least end-2020.

A smaller sample of economists with an end-2021 view predicted no change by then either.

"The most dramatic development of the year to date has not been on either trade policy or politics. Rather, it is the Fed's full-throated embrace of a monetary stance more dovish than many market participants had been expecting," noted Ajay Rajadhyaksha, head of macro research at Barclays (LON:BARC).

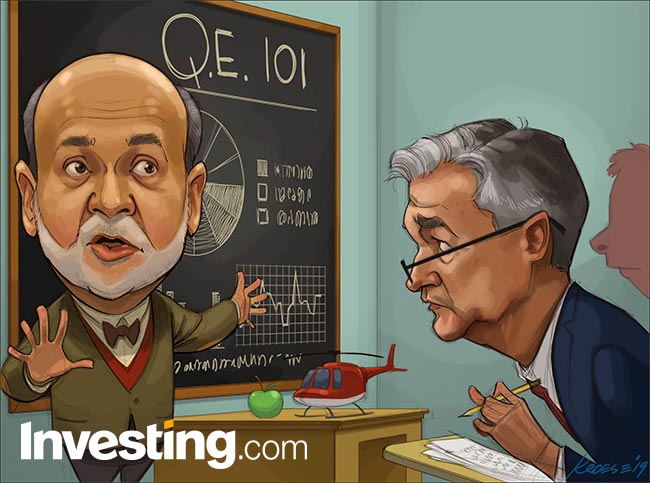

The U.S. central bank also indicated it intends to end the reduction of its massive $4.2 trillion balance sheet by September. The process began in October 2017 and followed three rounds of quantitative easing – a policy in which the Fed bought Treasurys and mortgage-backed securities in an effort to drive down interest rates.

According to some analysts, the change in tone is the first step in an inevitable march towards the fourth round of quantitative easing (QE4).

Former Fed Chair Ben Bernanke initiated QE in response to the 2008 Global Financial Crisis, creating $1.3 trillion from November 2008 to June 2010 and using the created money to buy financial assets from banks and from the government.

The process coincided with a massive run-up in stocks and part of the longest bull market in history.

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics

-- Reuters contributed to this report