(Bloomberg) -- Progress toward easing the steep tariffs China imposed on U.S. vehicle imports this year lifted carmaker stocks across the globe, as investors wagered on a thawing of tensions that have damaged the world’s biggest automotive market.

Daimler AG (DE:DAIGn), General Motors Co (NYSE:GM). and Tesla (NASDAQ:TSLA) Inc. were among the manufacturers that gained on Tuesday after Bloomberg News reported that a proposal to eliminate the 25 percent surcharge slapped onto U.S.-made cars this year has been submitted to China’s cabinet. The plan will be reviewed in coming days, people familiar with the matter said.

The levy forms the backbone of China’s response to a trade war instigated by President Donald Trump as he seeks to reset trade relations and spur manufacturing in the U.S. Car sales in China have fallen for six straight months after decades of almost uninterrupted growth, and while there are other factors, the tit-for-tat jabs between the world’s biggest economies have played a role.

The tension had escalated in recent days with the arrest of Huawei Technologies Co. Chief Financial Officer Meng Wanzhou in connection with sanctions violations. Trump claimed he won a concession during trade talks in Argentina; the proposal in the works helped to substantiate his claims.

The move by China would reduce tariffs on cars made in the U.S. to 15 percent from the current 40 percent, in line with what other countries pay, the people said. The step hasn’t been finalized and could change.

While reversing the retaliatory duty is a major climb-down by Beijing, it could re-focus the two sides toward implementing the trade-war truce agreed to earlier this month.

“Last week, events seemed to conspire to throw the truce into disarray, but the underlying incentives of both sides at the moment are to try to maintain that truce,” said Freya Beamish, chief Asia economist at Pantheon Macroeconomics Ltd. “Now we are seeing the possibility that China will come through with reductions of tariffs on U.S. autos, and that’s another good, concrete step.”

Top Chinese and American trade officials spoke by phone Tuesday morning Beijing time, signaling that dialog between the two nations on trade issues is at least continuing despite the ongoing tension over Huawei.

China’s Finance Ministry didn’t immediately respond to a faxed request for comment sent outside business hours.

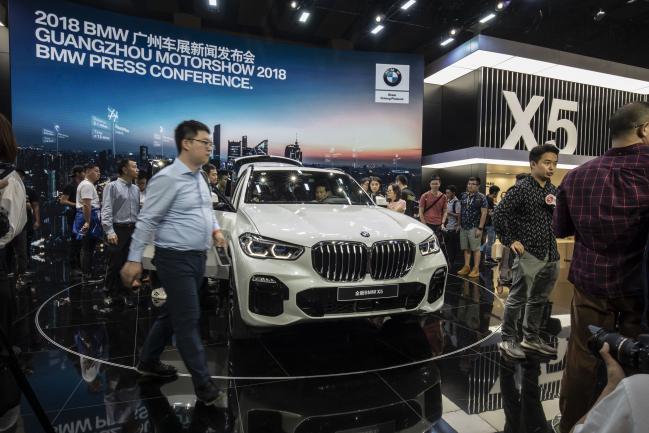

BMW AG, which exports sport utility vehicles from the U.S. to China, rose 1.8 percent to 71.38 euros in Frankfurt. The German luxury carmaker previously said the tariffs would cost the company 300 million euros ($340 million) this year alone.

Daimler, which said the tariffs were the key reason for a profit warning in June, gained 2.7 percent. Volkswagen (DE:VOWG_p) AG rallied 3.6 percent. GM was up about 1.5 percent as of mid-afternoon in New York, while Tesla added about 1 percent.

In July, China boosted the tariff on American-made cars as part of retaliatory measures against the U.S. Following a summit on trade in Buenos Aires earlier this month, Trump jolted global auto stocks by tweeting that China agreed to “reduce and remove” tariffs on imported U.S. models, something China did not confirm at the time.

Trade War

Trump’s tweet came shortly after he agreed with Xi to a truce in the trade war during a meeting at the Group of 20 summit in Argentina.

The discord has taken a toll on automakers that manufacture in the U.S., as tariffs forced the makers of Mercedes-Benz and BMW cars to raise prices in China. Car sales in the world’s second-biggest economy may post their first annual drop in at least two decades. That’s piled pressure on companies that have relied on the country for growth amid declining sales in the U.S.

The tariff reduction benefits Daimler and BMW more than U.S. automakers such as GM or Ford Motor (NYSE:F) Co. That’s because the German luxury brands dominate the top 10 list of vehicle imports into China.

Longer-term, China has a lot to gain from free trade in autos as Chinese manufacturers such as Guangzhou Automobile Group Co. and Geely Automobile Holdings Ltd. look to move overseas. The U.S. currently charges a 27.5 percent tax on imported cars from China.

China Imports

Of China’s $51 billion of vehicle imports in 2017, about $13.5 billion came from North America, including sales of models made there by non-U.S. manufacturers including BMW. China imported 280,208 vehicles, or 10 percent of total imported cars, from the U.S. last year, according to China’s Passenger Car Association.

U.S. exports of cars and light trucks to China were worth $9.5 billion in 2017 and have dropped off significantly since China imposed the retaliatory tariffs over the summer that gave exporters in Europe and Japan a significant advantage.

For Tesla, a tariff cut will provide a boon until the company sets up local production. The Palo Alto, California-based carmaker has been working with Shanghai’s government on establishing a factory to assemble cars in China.

Foreign carmakers have long pleaded for freer access to China’s auto market, while its own manufacturers are trying to expand abroad. In April, China announced a timetable to permit foreign companies to own more than 50 percent of local vehicle-making ventures.