* Employment +50,000 in Dec, matching forecasts

* Jobless falls to 6.6%, down from 6.8%, beating forecasts

* Economy has recovered majority of pandemic job losses

By Wayne Cole

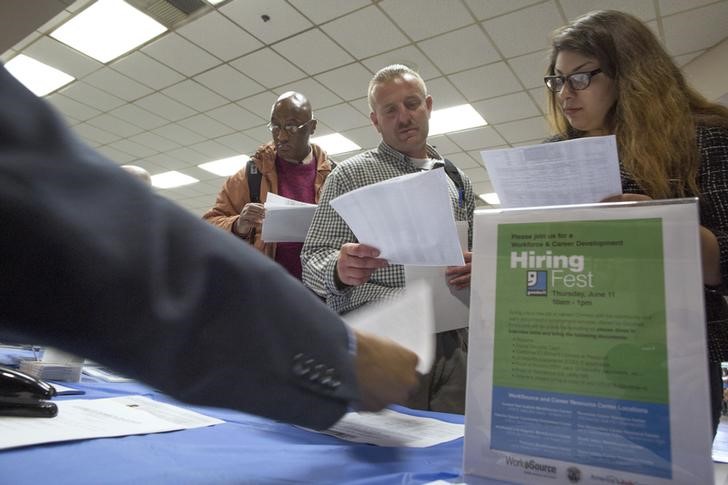

SYDNEY, Jan 21 (Reuters) - Australia boasted another solid rise in employment in December as strength in consumer spending and housing helped drive the jobless rate down to 6.6%, recovering most of the job losses suffered during the pandemic lockdown of 2020.

The Australian Bureau of Statistics (ABS) on Thursday reported 50,000 net new jobs were created in December, on top of a 90,000 gain the month before.

Employment has now rebounded by 784,500 since May, leaving it 87,600 short of the level seen in March before much of the economy was shut down.

The jobless rate was down from a July peak of 7.5% and beat forecasts of 6.7%, but still remains well above its pre-pandemic level of 5.2%.

"Job vacancies have continued to rise suggesting the labour demand from businesses remains high, so we expect employment to continue to recover toward pre-virus levels," said Ben Udy, Australia & New Zealand economist at Capital Economics.

"What's more, with the participation rate now at record highs, any gains in employment should reduce the unemployment rate."

Declaring unemployment a "national priority", the Reserve Bank of Australia (RBA) has slashed interest rates to near zero and launched a A$100 billion ($78 billion) bond-buying program to inundate the financial system with cash.

The tactic has clearly borne fruit in the housing market where record-low mortgage rates have sparked a boom in home prices and new building, with a big spillover into jobs and consumer spending.

Such has been the speed of recovery that markets are wondering whether the RBA will start tapering its stimulus by ending the bond program at the current cut-off date in April.

Most, however, suspect it will extend the plan if only to stop the local dollar from climbing ever higher as other major central banks keep expanding their balance sheets.

"We expect that the RBA will decide to extend the program for a further six months with another A$100 billion," said Westpac chief economist Bill Evans.

Evans now sees unemployment reaching 6% by the end of 2021, more than a year earlier than previously forecast, but emphasised it would take a rate under 5% to drive wages and inflation up to levels acceptable to the central bank.

($1 = 1.2895 Australian dollars)