* Xi visits coronavirus epicentre as new infections dip

* China's iron ore port stocks down 3.4% so far this year

* Brazil's Vale says iron ore mine near dam erodes further

* China's Valin Steel plans 21-day blast furnace shutdown

(Recasts, adds closing prices and chart)

By Enrico Dela Cruz

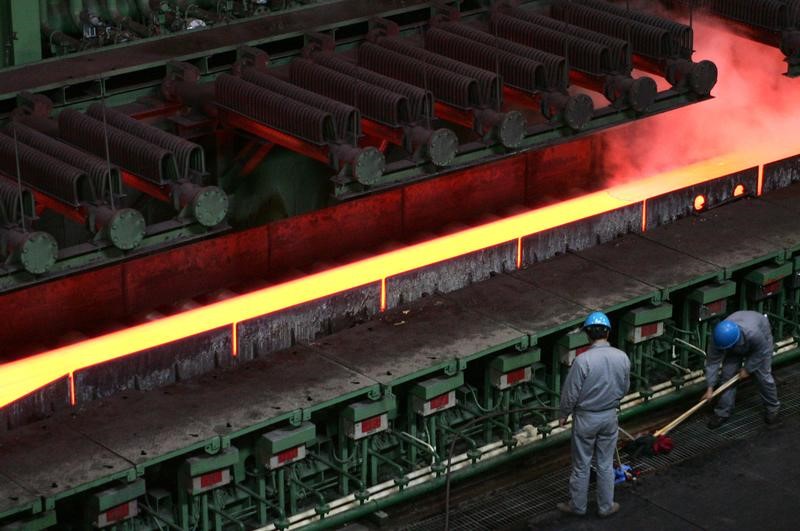

MANILA, March 10 (Reuters) - Iron ore futures in China rose sharply on Tuesday as a drop in new virus cases in the country raised hopes for an improvement in demand, while lower inventories also aided sentiment.

Iron ore on the Dalian Commodity Exchange DCIOcv1 ended up 4.9% at 662.50 yuan ($95.49) a tonne, after climbing as much as 5.5% during the afternoon session. Futures on the Singapore Exchange climbed as much as 3.9%.

New cases in China fell to 19 as of Monday from 40 a day earlier, with President Xi Jinping visiting Wuhan, the epicentre of the outbreak, a sign that Beijing believes its efforts to control the virus were working. iron ore stockpiles at China's ports continued to decline, down 3.4% so far this year at 126.25 million tonnes, as of March 6, data from SteelHome consultancy showed. SH-TOT-IRONINV

"Inventory is still at a low level (and) it has strong support for the price of iron ore," analysts at Sino-Steel Futures Co Ltd in Beijing said in a note.

Port stockpiles dropped as restocking by steel mills resumed and business activities picked up steam in China after being disrupted by the epidemic.

"As construction restarts ramp up, we are likely going to see more than 80% (of) major infrastructure projects in full swing by end of March," Singapore-based steel and iron ore data analytics company Tivlon Technologies wrote in a note.

FUNDAMENTALS

* Major iron ore supplier Vale SA VALE3.SA reported a further erosion in a mine embankment, which sparked worry about the mine's stability and its impact on a nearby tailings dam. A Vale tailings dam collapsed in early 2019, killing scores of people and prompting shutdowns of other facilities of the Brazilian miner, which had reduced iron ore supply and pushed prices to five-year peaks.

* Construction steel rebar on the Shanghai Futures Exchange SRBcv1 rose 2.3%, while hot-rolled coil SHHCcv1 climbed 1.4% and stainless steel SHSScv1 gained 1.8%.

* Coking coal DJMcv1 added 1.5% and coke DCJcv1 jumped 2.2%.

* Hunan Valin Steel Co Ltd 000932.SZ , the biggest steel producer in China's central province Hunan, plans a 21-day maintenance at a blast furnace this month, in an effort to ease pressure from high inventory. = 6.9378 yuan)

https://tmsnrt.rs/2VZLzAP

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>