* Steel, iron ore, coking coal and coke hit upside limit

* Steel and iron ore rise 6 pct; coke up 9 pct

* Weak steel demand suggests futures' gains would be fleeting (Updates prices)

By Manolo Serapio Jr

MANILA, Nov 22 (Reuters) - Prices of steel and its raw materials soared to hit their trade limits in China on Tuesday as investors returned to the market to pick up sold-off commodities, but a shaky demand outlook suggests the gains would again be fleeting.

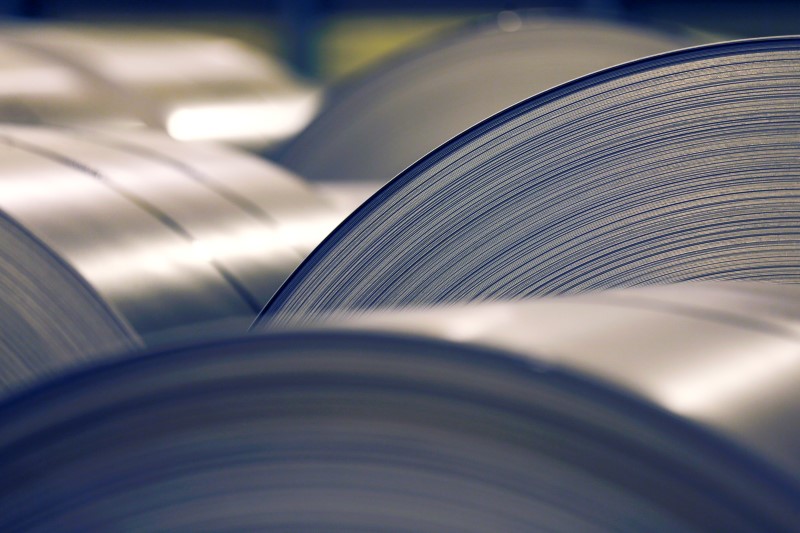

Chinese rebar steel and raw materials like coal and iron ore pulled back from this month's multi-year highs after exchanges in Shanghai, Dalian and Zhengzhou cracked down on speculative trading by raising transaction charges. steel rebar on the Shanghai Futures Exchange SRBcv1 jumped 6 percent to close at its exchange-set ceiling of 2,900 yuan ($421) a tonne.

Iron ore on the Dalian Commodity Exchange DCIOcv1 also surged 6 percent to its upside limit at 580.50 yuan.

"I think it's driven by speculative trading again," said Richard Lu, analyst at CRU consultancy in Beijing. "In terms of steel, we haven't seen any real support from the demand side."

"Winter is approaching and most of the construction in the northern part of China is already suspended because it's too cold, so steel demand is falling," said Lu.

Slower steel demand in China during winter, which usually lasts through February, may keep iron ore supply high at its ports.

Stockpiles of imported iron ore at 46 Chinese ports reached 110.58 million tonnes on Friday, up 2.83 million tonnes from the previous week, according to data tracked by industry consultancy SteelHome. SH-TOT-IRONINV

That was the most since September 2014. Inventory has risen 19 percent this year.

Among small- and medium-sized Chinese mills, iron ore stockpiles rose 8 percent on Nov. 9 from Oct. 26, according to Morgan Stanley (NYSE:MS).

But Tuesday's rebound in iron ore futures may spur a recovery in spot prices. Iron ore for delivery to China's Qingdao port .IO62-CNO=MB slid 3.4 percent to $70.34 a tonne on Monday, data from Metal Bulletin showed. The spot benchmark lost 8.8 percent last week, ending a five-week rally.

Other steelmaking commodities that surged on Tuesday were coke DCJcv1 which climbed 9 percent to end at its exchange-set limit of 2,183.50 yuan a tonne and coking coal DJMcv1 which closed up 8.4 percent at 1,598.50 yuan, just off the session high of 1,607.50 yuan.

($1 = 6.8903 Chinese yuan)