* ACCC will not oppose Asciano takeover

* Deal still needs FIRB approval

* Deal "not likely" to substantially lessen competition - ACCC

* Shares up 1 pct in firm Australian market (Adds context, comment from Qube, shares)

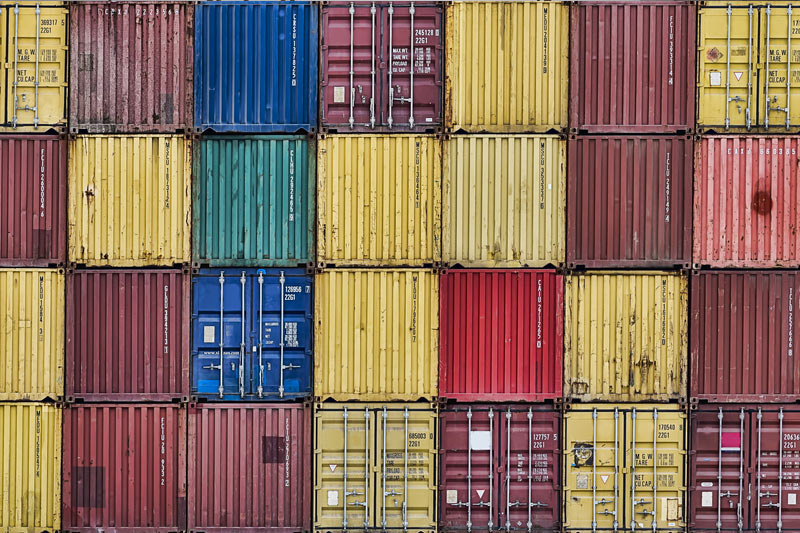

SYDNEY, July 21 (Reuters) - Australia's antitrust watchdog on Thursday gave the green light to a A$9.1 billion ($6.79 billion) buyout of rail freight giant Asciano Ltd AIO.AX by a global consortium led by Canada's Brookfield Asset Management Inc BAMa.TO .

The Australian Competition and Consumer Commission (ACCC) had been concerned the deal would give Asciano's new owners, which include Australian stevedoring company Qube Holdings Ltd QUB.AX , too much control of the freight market.

ACCC Chairman Rod Sims said the regulator had concluded there was "not likely to be a substantial lessening of competition in any market" after the deal was restructured to address officials' concerns.

The go-ahead will come as a relief for Asciano shareholders following a year-long takeover battle that began with Brookfield's initial solitary bid of $6.8 billion last July. The ACCC could have mounted a legal challenge, a move that would have hit the company's share price.

"The decision by the ACCC is clearly a major milestone in the process of acquiring these important businesses," Qube said in a statement.

The takeover must still be approved by Australia's Foreign Investment Review Board but analysts expect it to get the nod as the restructured deal keeps Asciano's strategically important ports out of Chinese hands. and Qube joined forces in February to make a joint offer for Asciano's port assets only, leaving the railways to China Investment Corp (CIC) CIC.UL and others. shareholders in June voted in favour of the buyout.

Asciano shares were up 0.8 percent on Thursday in a firm Australian market. They are up 4.3 percent year-to-date, in line with the benchmark S&P/ASX 200 .AXJO .

($1 = 1.3399 Australian dollars)