(Bloomberg) -- The market for lithium will remain tight through 2025 as producers struggle to ramp up production fast enough to meet demand for the mineral that’s essential in making batteries for electric-vehicles, Livent Corp. Chief Executive Paul Graves said.

“We think demand is going to grow almost five times larger in 2025 than it was in 2017,” Graves said in an interview Thursday in New York. "Our biggest challenge is producing enough to meet the demand -- there’s a much greater risk that this market is consistently in a deficit in the near future."

Investor interest for lithium has been wavering as prices tumble this year, amid speculation producers may flood the market with supply. That’s a reversal from the rally that tripled prices in the three years through 2017. Some companies are struggling to raise money for expansion, dimming the global supply outlook, Graves said. Some companies are also facing regulatory hurdles that could thwart efforts to boost output, he said said.

Shares of Livent, a spin off from chemical manufacturer FMC Corp (NYSE:FMC)., fell 4.2 percent to $16.28 a share at 2:53 p.m. Thursday, its first trading day on the New York Stock Exchange. Standard & Poor’s Index headed for its longest losing streak of Donald Trump’s presidency.

Production will trail consumption of lithium carbonate by 250,000 tons in 2025, said Graves, 47, who worked at Goldman Sachs Group Inc (NYSE:GS). for 12 years, including as co-head of natural resources in Asia. He served as CFO at FMC before joining Livent.

Livent’s estimates for demand of 1 million tons in lithium carbonate for 2025 compares with Bloomberg NEF’s forecast of 850,000 in its report in August.

Supply will outstrip demand in 2018 as two new mines start production and another one expands, BNEF analysts Logan Goldie-Scot and James Frith said. "Based on current announcements, the market will begin to tighten again by 2024, although there is sufficient time for miners to look at further capacity expansions," they said.

Extremely Difficult

Livent sold 20 million shares at $17 each, below the price range of $18 to $20 that the company had expected in its filing on October 1. The initial public offering raised $390 million, Graves said.

"Pricing an IPO in those market conditions is extremely difficult," Graves said. "We were asking people to step in and commit capital in a market that was down 800 points," he said, referring to the Dow Jones Industrial Average slumping Wednesday by the most in eight months. The gauge fell Thursday for a third straight session.

Its Chinese competitor, Jiangxi Ganfeng Lithium Co., fell more than 28 percent in its first trading day in Hong Kong, even after pricing the shares at the bottom of a target range.

"I think investors have decided to pause the investments around lithium and cobalt," Chris Berry, a New York-based energy-metals analyst and founder of research firm House Mountain Partners LLC., said by phone on Wednesday. "Macro-economic concerns are driving the sentiment right now."

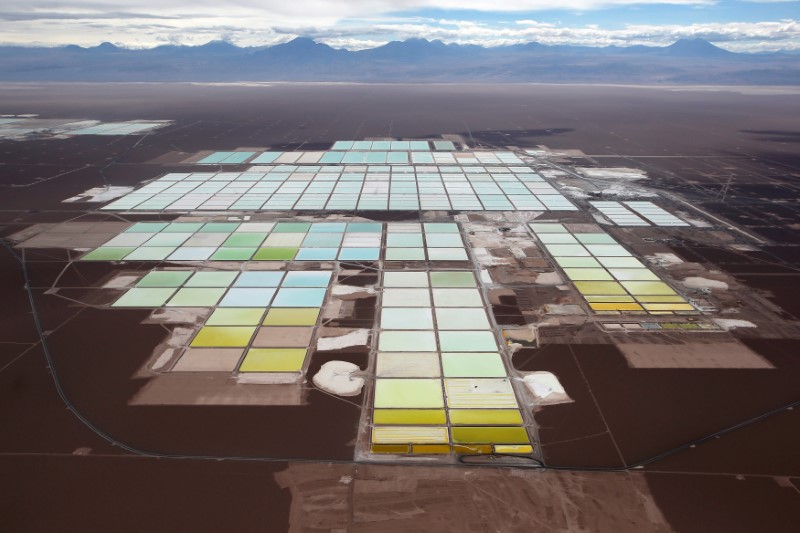

In South America, where FMC operates the Salar del Hombre Muerto mine in Argentina, lithium carbonate fell to $14,500 per ton in September, from a record high of $15,750 per ton in June, according to Benchmark Mineral Intelligence. The research firm’s gauge of prices across the main regions is down 8.2 percent this year, after climbing 208 percent in the three years ended Dec. 31.

"I have no doubts about the demand side and I have no doubts that there is a good deal of capital out there that’s looking to be deployed," Berry said. "But everyone’s skittish about China, tariffs, late-cycle economic growth and interest rates on the rise in the U.S."