* Dalian iron ore up as much as 2.2%

* Singapore iron ore futures jump 1.8%

* China iron ore port stocks up for 5th week

* China unveils interest rate reform

By Enrico Dela Cruz

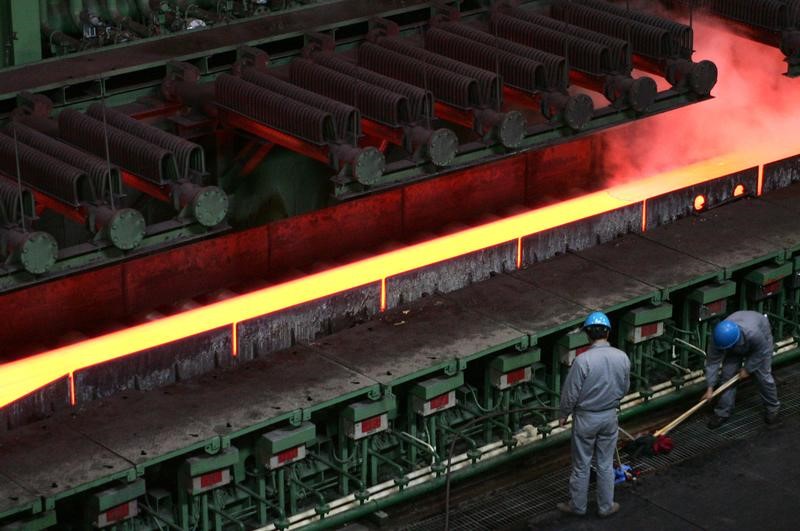

MANILA, Aug 19 (Reuters) - Dalian and Singapore iron ore futures rose on Monday, buoyed along with other Asian steel benchmarks as fresh moves by China's central bank to prop up its slowing economy lifted the overall mood in financial markets.

The most-traded iron ore contract DCIOcv1 on the Dalian Commodity Exchange, with January 2020 expiry, climbed as much as 2.2% to 636.50 yuan ($90.38) a tonne, rebounding from a recent slump.

The most-active September 2019 iron ore futures contract on the Singapore Exchange rose as much as 1.8% to $88.37 a tonne.

China's central bank unveiled a key interest rate reform on Saturday to help steer borrowing costs lower for companies and support a slowing economy that has been hurt by a trade war with the United States. reform is equivalent to making a loan rate cut of 45 basis points, according to ANZ Research's estimate.

"The decline in loan rates bodes well for China's credit demand and growth outlook in H2 2019 to offset the impact of the ongoing trade disputes," ANZ said in a note.

The reform comes as a slowing Chinese economy has clouded the outlook for demand for iron ore and other steelmaking ingredients in the world's top steel producer and consumer.

Dalian iron ore posted its fourth consecutive loss on a weekly basis on Friday, also pressured by rising stockpiles of seaborne supplies at ports across China.

FUNDAMENTALS

* The inventory of imported iron ore at Chinese ports was estimated at 123.15 million tonnes as of Aug. 16, climbing for a fifth week to its highest since the last week of May, based on the latest data from SteelHome consultancy. SH-TOT-IRONINV

* Benchmark spot 62% iron ore for delivery to China SH-CCN-IRNOR62 was steady at $91.50 a tonne on Friday, having rebounded from its lowest in more than four months, hit early last week.

* The construction steel rebar index SRBcv1 on the Shanghai Futures Exchange was up as much as 0.9% at 3,749 yuan a tonne.

* Hot-rolled coil SHHCcv1 , steel used in cars and home appliances, jumped as much as 0.5% to 3,742 yuan a tonne.

* Coking coal DJMcv1 gained as much as 1.0% to 1,344 yuan a tonne, while and coke DCJcv1 edged up 0.8% to 1,999 yuan.

* For the top stories metals and other news, click TOP/MTL or MET/L

($1 = 7.0427 yuan)