* Soybeans dip after climbing to highest sine July 2016

* Robust Chinese demand, development of COVID-19 vaccine support (Adds quote in paragraphs 4-5, details and reaction to U.S. report due later in the day)

By Naveen Thukral

SINGAPORE, Nov 10 (Reuters) - Chicago soybean futures slid on Tuesday, as the market took a breather after climbing to its highest in more than four years on the back of strong Chinese demand and successful data from a potential COVID-19 vaccine.

Asian share markets mostly shot higher, driven by regional airline, tourism and travel stocks as global investors applauded progress in the development of a coronavirus vaccine, which lifted confidence for economic recovery. MKTS/GLOB

Wheat fell for a third consecutive session while corn eased after closing marginally higher on Monday.

"The burst of optimism was generated by news that a COVID-19 vaccine is now closer than before," said Tobin Gorey, director of agricultural strategy at Commonwealth Bank of Australia.

"Early days, of course, but this breakthrough is truly a reason to become more optimistic. Soybean prices (on Monday) clearly gained in the wake of COVID 19 vaccine hopes. Also helping was more evidence of a post-election pickup in U.S. soybean sales to China."

The most-active soybean contract on the Chicago Board Of Trade Sv1 was down 0.1% at $11.09 a bushel, as of 0323 GMT, after firming 0.8% on Monday when prices hit a four-year peak of $11.18 a bushel.

Wheat Wv1 gave up 0.5% to $5.94-3/4 a bushel and corn Cv1 lost 0.2% to $4.06-3/4 a bushel.

The U.S. Department of Agriculture (USDA), in a daily reporting system for export sales, said on Monday that exporters sold 123,000 tonnes of U.S. soybeans to unknown destinations. in agricultural markets are adjusting positions before the USDA issues a monthly report later in the day, which is expected to trim estimates for domestic soybean and corn yields and inventories.

"The November supply and demand update from the U.S. Department of Agriculture is often relatively quiet compared with other months, but global corn trade is high on the market's watch list this time around with eyes on both China and the United States," Karen Braun, a market analyst for Reuters, wrote in a column. participants have long been waiting for recognition from the U.S. government that China plans to import more than 7 million tonnes of corn over the next year, especially since its U.S. purchases alone exceed that number."

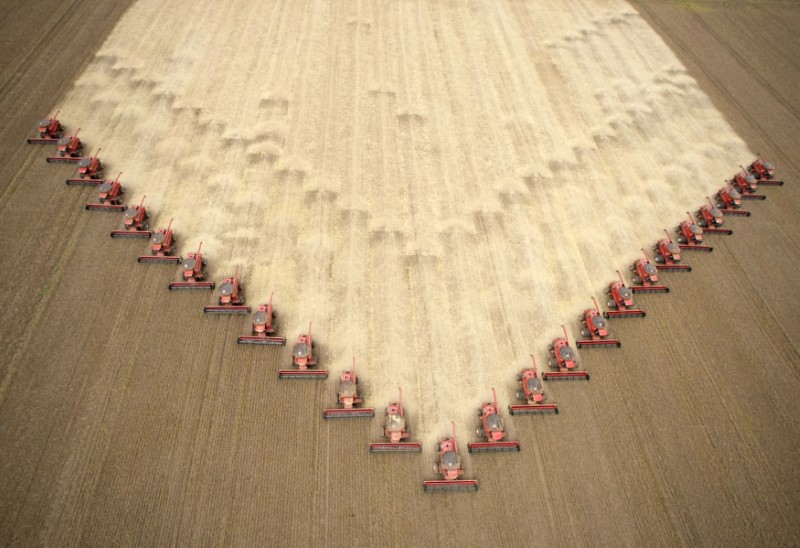

The USDA in a weekly report released after the market closed on Monday, said the U.S. soybean crop was 92% harvested and corn was 91% harvested, compared with expectations for 94% and 91%, respectively. agency rated 45% of the nation's winter wheat crop as "good" or "excellent", compared with expectations for 44%.

Commodity funds were net buyers of CBOT corn, soybean, soymeal and soyoil futures contracts on Monday and net sellers of CBOT wheat, traders said. COMFUND/CBT