By Paulina Duran

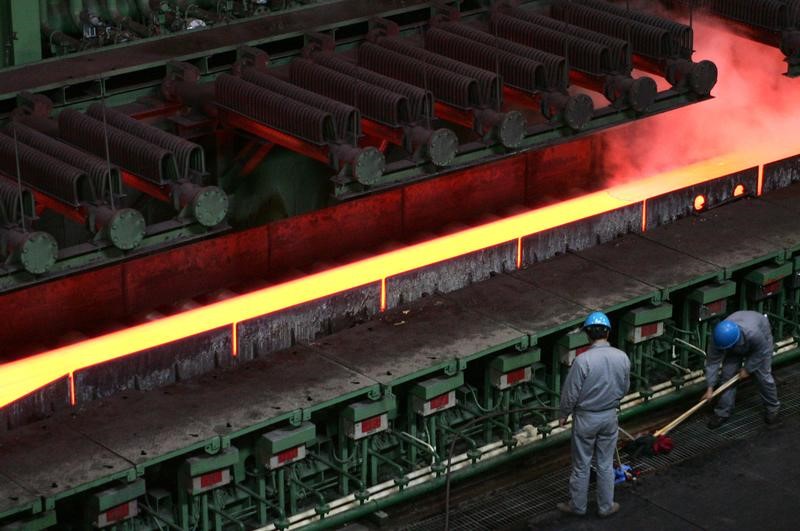

SYDNEY, April 18 (Reuters) - GFG Alliance, a privately held conglomerate, said on Thursday it plans to integrate most of the mining and engineering businesses under its Liberty House unit into a single global steel business with assets across the UK, Europe and Australia.

London-headquartered GFG, which is looking at possible stock market flotations for part of its business, said in a statement the consolidated business would include its UK steel and engineering assets, a steel plant and mines in Australia, and seven European plants it acquired from ArcelorMittal.

"This combination will form a global champion, with fully integrated capabilities, shipping iron ore and coking coal and semi-finished product from Australia to its manufacturing plants and mills globally," GFG Alliance executive chairman Sanjeev Gupta said in the statement.

The goal, Gupta said, was to become one of the largest fully integrated steel producers in the world.

GFG has spent billions in recent years buying troubled steel and aluminium plants and investing in renewable energy assets around the world, raising questions over funding for its rapid expansion. company said late last year it plans to list up to 40 percent of its manufacturing, distribution and recycling business in Australia in 2019. announcement follows the approval by the European Commission on Wednesday of the sale by ArcelorMittal MT.AS , the world's largest steel producer, of plants in several European countries to Liberty House.