By Dave Sherwood and Nicole Mordant

SANTIAGO/VANCOUVER, March 13 (Reuters) - Chile's government has asked antitrust regulators to block the sale of a 32 percent stake in Chilean lithium company SQM SQM.N SQM_pb.SN to a Chinese firm on the grounds it would give it an unfair advantage in the global race to secure resources to develop electric vehicles.

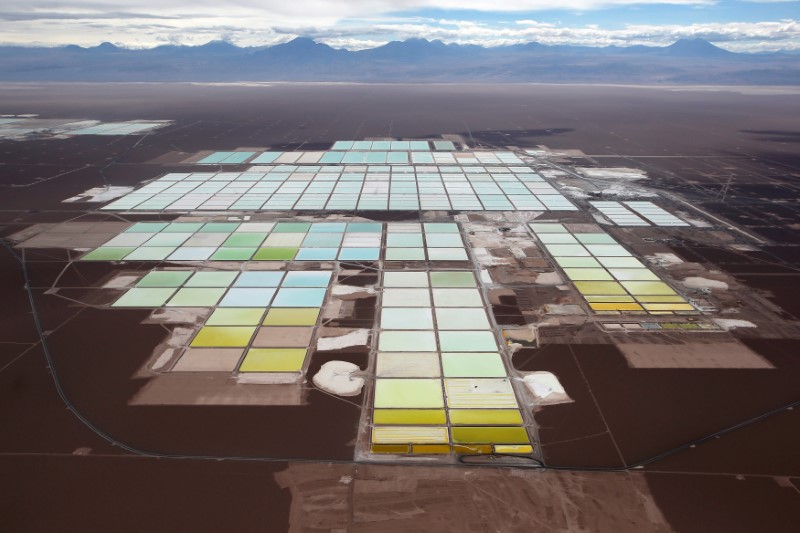

Chile development agency Corfo, which oversees SQM's lithium leases in the Salar de Atacama, claimed in a 37-page complaint filed on Friday that the purchase of a stake in SQM by "Tianqi Lithium, or any entity related to it directly or indirectly (including companies controlled by the government of China)" would "gravely distort market competition." WOULD CHILE WANT TO BLOCK A CHINESE BUYER?

It was unclear if Corfo's complaint, if upheld, would block all potential Chinese bidders for the stake. But it certainly seeks to block Tianqi Lithium 002466.SZ , one of China's top lithium producers.

SQM and Tianqi are "extremely close competitors ... and were one to acquire an interest in the other - even minority - it would have serious anti-competitive impacts on the market," Eduardo Bitran, the now former head of Corfo, wrote in the complaint.

Together, Tianqi and SQM, the world's second biggest lithium producer after U.S.-based Albemarle Corp ALB.N , would control 70 percent of the global lithium market, the document said.

A combined Tianqi-SQM would be in a strong bargaining position, given the companies' outsized control of the lithium supply, for everything from prices to royalty payments, a source close to SQM said.

Tianqi, through Talison Lithium which it controls, is also in a joint venture with Albemarle in Australia where they own the world's biggest lithium mine, Greenbushes.

"The natural obvious buyer (of the SQM stake) are the Chinese ... it does tend to make an industry that is already an oligopoly even stronger to the detriment of potential new entrants," said Chris Berry, an independent energy metals analyst based in New York.

WHAT IS FOR SALE?

An equity stake in SQM worth over $4 billion is in play.

The stake is being sold by Canadian fertilizer company Nutrien Ltd NTR.TO - formerly Potash Corp of Saskatchewan - which has to offload its 32 percent interest to meet regulatory requirements after its merger with a rival fertilizer company to create Nutrien. SQM is also a significant fertilizer producer.

Nutrien is likely reaching out to the new Chilean administration to gauge whether there will be any change in the status of Corfo's complaint, said Edward Jones analyst Dan Sherman, who covers Nutrien.

But the company would hesitate to take any steps that might prolong the uncertainty and drag out the sale process, since lithium is a hot commodity, he said.

"I think what they're more concerned about is doing this with reasonable speed. They're still going to get an incredible price for it," Sherman said.

Nutrien chief executive Chuck Magro said in February that he was aiming to sell the SQM stake by the end of 2018. spokesman Richard Downey declined to comment.

WHO ELSE COULD BE A BUYER?

As well as Tianqi, four other companies, all Chinese except for global miner Rio Tinto RIO.L RIO.AX , were also vying for the Nutrien stake, according to former Corfo head Bitran.

Rio Tinto declined to comment. Bloomberg reported in January that Rio had dropped out of the bidding after studying information in the data room, quoting unnamed people familiar with the matter. private equity firm GSR Capital was considering a bid for the stake, banking sources told Reuters last November. other Chinese firms previously seen as potential bidders - state-owned Sinochem Group SINOC.UL and Ningbo Shanshan 600884.SS - have both said that they were not participating. of the deep pockets of Chinese firms, another individual buyer may be hard for Chile to find. The block of equity may have to be sold to a number of institutional investors, the source close to SQM said.

WHAT HAPPENS NEXT?

Chilean antitrust regulator FNE will review the complaint. FNE investigations typically follow a three-part procedure: a six-month admissibility study, the investigation, and a final report and recommendation which can include taking the case before Chile's anti-trust tribunal.

FNE said the agency would not comment on the specifics of the case.

A new Chilean government was sworn in on Sunday, two days after the Corfo complaint was submitted. It is not yet known what position the new administration will take on the issue.

Bitran, an appointee of the previous center-left government, has left his post and his replacement has yet to be announced by the incoming conservative administration.