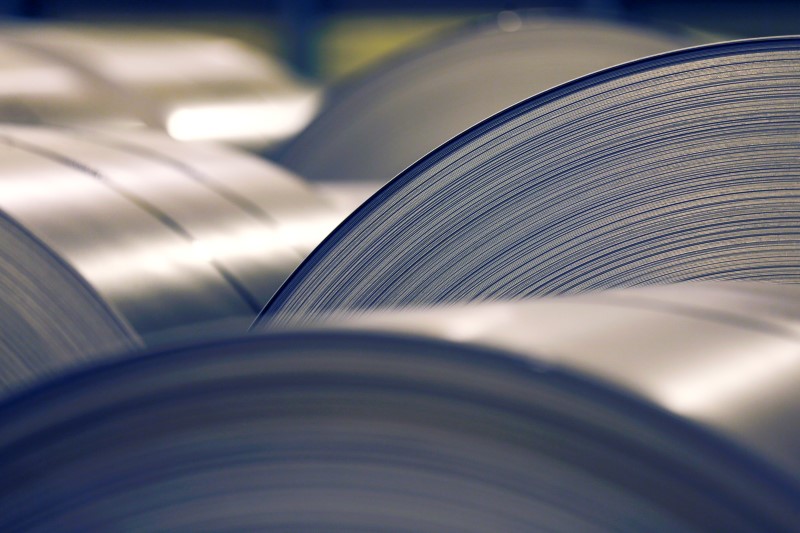

* Steel, iron ore on track for biggest monthly drop since May 2016

* Worries about glut offset robust China GDP data

* China produced record steel volume in March

BEIJING, April 17 (Reuters) - China's steel and iron ore prices extended losses on Monday as speculators continued to exit bullish bets after data revealed that mills in the world's top producer churned out a record tonnage of steel in March, stirring concerns about a growing glut.

The output data came as the government also said the world's second-largest economy grew at 6.9 percent in the first quarter, slightly faster than expectations. industrial production was completely beyond expectations and fixed asset investment was rock-solid, so that's where your steel has gone," said Dominic Schnider at UBS Wealth Management in Hong Kong.

However, rising inventories and expectations that demand would be slow as Beijing tries to cool its red-hot property market has hammered prices, snuffing out months-long rally.

Iron ore and steel are on track for their worst monthly performance since May last year.

Last week, trade data revealed that a relentless influx of imported iron ore continues to flood Chinese ports, where inventories SH-TOT-IRONINV have ballooned to more than 130 million tonnes.

Iron ore on the Dalian Commodity Exchange DCIOcv1 was down 3.3 percent at 493.5 yuan ($71.66) a tonne, as of 0344 GMT. Earlier in the session, prices hit 491 yuan, their lowest since Jan. 10.

The most-active rebar on the Shanghai Futures Exchange SRBcv1 slipped 1.35 percent to 2,911 yuan ($422.68) a tonne. It touched 2,879 yuan last Thursday, its weakest in more than two months.

With output rising each month for the past year and signs emerging that the frenzied housing market is overheating, analysts reckon Beijing will ramp up efforts to crack down on excess in its bloated steel sector. That could help boost prices.

"At some stage, there will be capacity cuts so taking that into consideration, the question is, if the economy continues to demand so much steel, then prices might be well supported or actually bounce back," said Schnider.

($1 = 6.8870 Chinese yuan)