- Brazillian financial giant XP is eyeing a jump in profits in the second quarter

- Retail continues to lead the company's revenues

- In this piece, we will delve deep to determine if the stock is worth buying at current levels

XP (NASDAQ:XP), a pioneer in promoting investments in Brazil, manages just under $200 billion in client assets. It was founded in 2001 and transitioned into a brokerage in 2006. Within a few years, its home broker became the most widely used platform on the Brazilian stock exchange.

However, the company diversified a long time ago and stopped focusing solely on investments. Gradually, it started acting as a bank, offering checking accounts, cards, insurance, and pensions, among other products.

Nonetheless, the company's flagship remains equities, established as the largest platform for buying and selling financial assets in Brazil, and the owner of well-known brands in the market like Rico and Clear.

Can the Company Maintain Momentum in Q3 2023?

With the earnings report approaching on November 13, there is an expectation for continued growth, solidifying its position as one of the major banks in the country.

The sector expects a positive wave In October, XP announced the end of its cryptocurrency exchange, Xtage. Although cryptocurrencies are down, overall investments are expected to continue to grow.

With key interest rates falling even further, the trend is for investors to shift from fixed income to variable, benefiting platforms focused on stocks.

It's worth noting that $576.5 million of the $738.1 million in gross revenue in the last quarter came from this, increasing expectations for the medium-term future. Equities remained stable even in a scenario of higher interest rates.

However, fixed income also contributed significantly to keeping XP's numbers positive. Revenue from this segment grew by 74% compared to the first quarter of 2023, thanks to the recovery in private credit.

New developments increase expectations In addition to expected growth in equities with a lower key interest rate and continued strong results in fixed income, cards, and funds, among other products, XP is also expanding its operations.

The company is launching a global account with an international debit card with no fees and an IOF of just 1.1%, similar to what some banks already do, targeting Brazilian audiences traveling abroad.

The fund platform grew by 9% in the second quarter and is approaching 2022's numbers. Additionally, XP Asset had interesting figures in the semester, attracting 213,000 new investors, while the general fund market lost 138,000.

To conclude XP's positive news, in September, the company paid dividends of $0.58 per share, representing a Dividend Yield of 2.33%.

Is XP Trading at an Attractive Valuation?

Using our InvestingPro tool, we've analyzed several aspects of XP to determine whether the company's future remains promising.

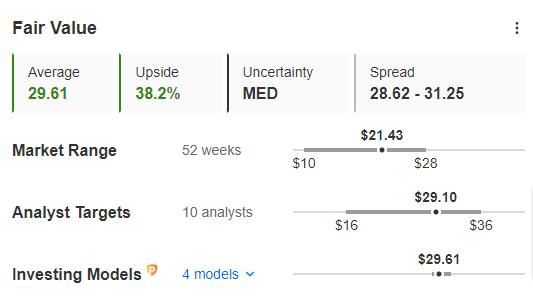

The stock closed Monday's session at $21.43. According to InvestingPro, XP's fair value is $29.61. In other words, there is a potential for a 38.2% medium-term appreciation.

Source: InvestingPro

The Price/Earnings ratio for the company currently stands at 16.4x, which is still within an acceptable range.

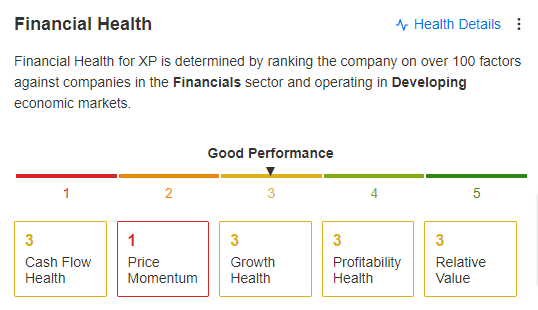

XP's Financial Health is rated at 2.55, with a C rating from InvestingPro. This value is close to the average and has been negatively affected recently by price drops, which lowered the rating in the Price Trend category (1) – the stock was worth almost $27 in August.

Source: InvestingPro

All other categories within the tool have a rating of 3. Notable highlights include Growth, which is marked by Free Cash Flow growth, both recently and in the average of the last three years.

XP's profitability metrics, including the current ROE and the two- and five-year averages, demonstrate strong performance. In terms of relative value, metrics like Price/Sales and Price/Book Value per Share are showing an upward trend.

Additionally, XP excels in cash flow, with notable margins for Free Cash Flow and Operating Cash Flow.

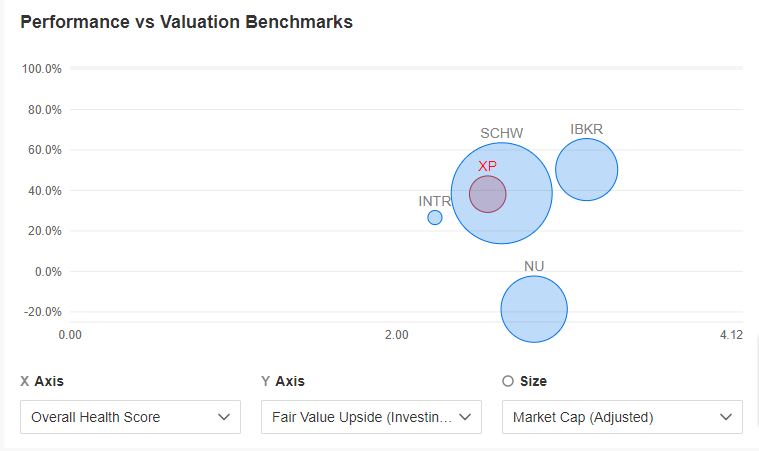

Source: InvestingPro

Finally, we compare XP with some competitors, although classification is somewhat challenging: Nu Holdings (NYSE:NU) and Inter (NASDAQ:INTR), Brazilian banks listed in the U.S., and Charles Schwab (NYSE:SCHW) and Interactive Brokers (NASDAQ:IBKR), American platforms that allow investments abroad directly from Brazil.

XP falls within the average. With the exception of Nubank (-18.6%), all have a positive fair value upside potential. Interactive Brokers is the only one on the list with a Financial Health rating of B (3.16), while the others also have a C rating at the moment.

Conclusion

If the positive figures are validated in the 3Q23 earnings report scheduled for November, XP would solidify its position as a compelling investment opportunity. The company has been channeling investments into innovations to sustain growth without being overly dependent on the investment platform.

Even amid high interest rates in Brazil, the platform has managed to deliver commendable performance. With the expectation of a decline in the key rate, 2024 could offer more favorable conditions for those who have been navigating turbulent waters.

***

Disclaimer: This article is for informational purposes only; it does not constitute an investment recommendation and is not intended to encourage the purchase of the mentioned stocks. Remember that every company should be analyzed from various perspectives, and investing in the stock market always involves risks.