It seems like every few weeks there's another headline about some cryptocurrency exchange being hacked. Just yesterday, news broke that Israel-based Bancor, a decentralized exchange service, lost $23.5 million in digital tokens including Ethereum, NPXS and its own BNT alt-currency, after it was hacked.

Last month the South Korea-based Conrail exchange was hacked, losing 30 percent of its digital currency inventory in the process—including NPXS, DENT and Tron tokens—worth approximately $40 million in losses. During the same month, Bithumb, another South Korean exchange was also hacked, losing $17 million in cryptocurrency including Bitcoin, Ethereum and Bitcoin Cash.

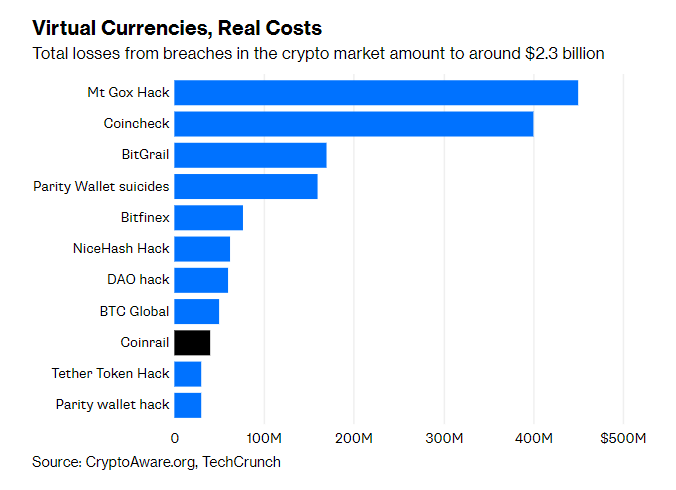

Though the 2014 Mt. Gox hack still holds the record for the biggest losses incurred by a crypto exchange, a whopping $460 million, CryptoAware stats indicate that year-to-date 2018 losses from crypto hacks and scams now total $1.7B and counting. The site also notes that there has been an average of at least one hack per month over the past year. As well, 2018 is on track to be the busiest year on record.

Lest all this discourage cryptocurrency investment, there are ways for investors to protect themselves. Taking note of a variety of red flags when choosing a cryptocurrency exchange, including liquidity, trading revenue, security safeguards and fees, is a good start. Here's what some specialists in the asset class recommend:

Growing Pains

The blockchain industry has been growing at breakneck speed, says Rob May, CEO of BotChain, and demand for tokens is far outpacing exchange growth. While the number of investors eager to capitalize on the tremendous potential of cryptocurrencies has ballooned, with many eager to partake of the asset class as quickly as possible, potential investors should not ignore the cautions they'd apply if they were getting into more traditional investments.

May cites industry growing pains as a particular caveat. Overeager investors who throw caution to the wind and dive recklessly into the market will be the most likely to feel those pains he says.

Key Questions to Ask

When considering an exchange, Roni Baibochaev, the founder of CryptoXchange says there are eight key questions to ask: how much is their trading revenue on a daily basis? Where is the exchange headquartered? Are they operating with a license? How fast is the KYC (know your client) process for clients? How responsive is the support? How secure is the exchange? What measures and steps are taken in order to secure clients deposits? He notes:

There are plenty of exchanges available today. Investing into one should be done with care and investors have to ask themselves all of these questions if they want their money to be in safe hands. It’s not enough to pick and choose a few factors to focus on.”

Peter Gal, co-founder of Bethereum agrees with Baibochaev:

“Investors should care about liquidity (ease of making a transaction) and security—for example is a 2FA [two factor authentication] option available, email verification or encryption or if the exchange keeps deposits in a cold storage; quality of response to customer claims, trading fees and user experience.”

Team Behind the Exchange

It's critical to understand who's behind the exchange, from management to other investors, if possible. Baibochaev believes that though there are a number of things to note, perhaps understanding who's managing the exchange is most important. In his view, not enough investors are paying attention to this key consideration.

Dror Medalion, co-founder of Bitjob says investors should check out the people in charge of the exchange, know their backgrounds, and understand if they are professionals with experience or merely scammers. Because there have been a variety of shady players involved in the cryptocurrency sector, a quick Google) check is a reasonable first step. Remember to see which VCs, if any, are behind the exchange as well.

Fees

For many investors, this is a deal breaker. Gianluca Giancola, the co-founder and head of UX and design at blockchain-powered loyalty ecosystem qiibee, warns that trading, transaction, and deposit fees can differ substantially from exchange to exchange, so consider costs carefully, especially if you're an individual who trades frequently.

At some exchanges fees can also be high if you opt to leave the exchange. Sebastian Serrano, founder and CEO at Ripio Credit Network says, "leaving fees and margins aside, investors should choose a cryptocurrency exchange as they would any other service that they would put their money (hence their trust) into—such as banks or digital wallets."

Exchange Security

Dror Medalion also points out that how your assets are handled should be considered:

“Another major factor is the local regulation of the coin. Poloniex for instance, was one of the leading trading platforms until the United States changed its policy about investing in cryptocurrencies. As investors we highly recommend you transfer your coins from the trading platform to your private wallet.

There is a common phrase that we like to go by, 'If you don't own your private key, you don't own your Bitcoins.' This means that no matter how much you think that your trading platform is secure, it can be hacked one day because most of the exchanges keep all their money in one wallet. That is why you as investor should hold your coins in a private wallet after you are done with trading to add that extra layer of security.”

Yo Kwon, CEO of Hosho acknowledges that crypto exchanges are still prone to hacks. Thus, even if they're diligent about security practices, there are additional potential risks at play including legal issues which could result in assets being frozen or blocked. Kwon advises:

“Educating yourself on how to properly store your own cryptocurrency safely and withdrawing capital from exchanges is at the moment the best course of action. We hope this will change in the future though, as greater regulation and security measures are implemented and enforced.”

There are currently over 200 active cryptocurrency exchanges says Nicolas Gilot, co-CEO of blockchain-powered gaming distribution platform Ultra, with new ones springing up nearly daily. The majority of these do not adhere to regulations or provide traders with any assurance in the event of a hack or bankruptcy.

“Unless you have good reason not to, try limiting your choice to one of the top 15 exchanges by volume. Apart from obvious factors such as availability of tokens you wish to trade, as well as transaction fees, beware that most large exchanges have geographical limitations (countries they are not allowed to operate in), so make sure the exchange you decide to go with is not restricted.

Before depositing any money or cryptocurrencies into the account, check your exit strategy: banks increasingly limit the ability to withdraw funds from cryptocurrency exchange accounts.”

Open source, decentralized exchanges are the safest way to avoid hacks, notes Jason Rosenstein, the co-founder of Portion. As well, centralized exchanges, where security vulnerabilities are more common, are antithetical to the cryptocurrency movement.

"The bottom line is you don't want to keep your crypto on an exchange," says Estefano Elhawary co-founder of Block Stocks.

"The rule of thumb: not your private keys, not your coins. Too many people either fall idle or get lazy with setting up proper storage, and it becomes a security risk. See recent events in South Korea, and what happened when Mt. Gox, the biggest exchange at the time imploded. As far as knowing which exchange to trade on, judging by market volume and history are good indicators.

But again, we'd strongly encourage any trader or investor to use safe storage and security practices with their crypto."

Disclaimer: The points listed above are for research purposes only and should not be considered investment advice nor a recommendation. Before choosing an exchange it is important to do your own due diligence.