With over 7 million active buy now, pay later accounts in Australia, the appetite for the form of credit continues to remain strong as Aussies look for a cost of living reprieve.

BNPL providers will be required to:

- Comply with Responsible Lending Obligations outlined by ASIC.

- Meet statutory dispute resolution and hardship requirements.

- Comply with statutory product disclosure and other information obligations.

- Abide by existing restrictions on unacceptable marketing.

- Meet a range of other minimum standards in relation to their conduct, and in relation to their products.

That said, BNPL in its current state consists of a hodgepode of regulated banks and platforms using regulatory arbitrage; almost any Australian is able to open an account without credit or income checks to determine suitability.

Research conducted by the Australian Financial Industry Association in 2022 revealed BNPL created an additional $2.7 billion in new revenue for merchants, through new customer acquisition, increased basket sizes and increased customer satisfaction and retention.

Despite this, a separate study conducted by the Good Shepherd in late 2022 revealed 73% of financial counselor clients have missed essential payments or cut back on essential items just to make BNPL repayments.

Under regulation, the Federal Government will amend the existing Credit Act, requiring BNPL providers to hold an Australian Credit Licence, or be a representative of a licensee.

FIS Banking and Payments Specialist Rob Tesoriero said BNPL providers are facing headwinds that are weighing on their performance, and in some cases their ability to continue operations.

“These headwinds are real and will largely define the next stage of BNPL’s evolution,” Mr Tesoriero told Savings.com.au.

“This includes upcoming new regulations that will put the sector under tighter scrutiny. Yet, from a consumer perspective, while the number of players in Australia has decreased, customer demand has remained steady.

“Inflation and increased cost of living can put a financial strain on consumers, leading to a preference for credit-based payment methods. While our forecast for BNPL growth is slowing, in no markets do we see demand for this form of credit decreasing.”

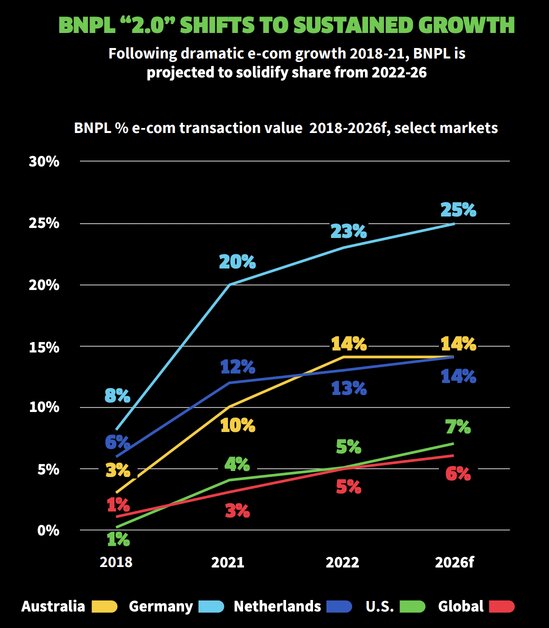

FIS 2023 Global Payments Report revealed BNPL services currently hold a 14% e-commerce market share, with that figure projected to remain steady through to 2026.

Source: FIS 2023 Global Payments Report

Mr Tesoriero said the next phase for BNPL – “BNPL 2.0” – is one where many of the hundreds of pure-play startups will likely consolidate into a fewer number of winners.

“BNPL will also enter into more mainstream regulatory frameworks that treat BNPL closer to traditional forms of credit,” he said.

This consolidation is already taking place throughout the first half of 2023, claiming the scalps of Affirm, LatitudePay and OpenPay.

FuPay and Humm have also closed BNPL to new customers, with the latter failing to meet regulatory target market determination (TMD) requirements.

What will regulation mean for banks offering BNPL products?

All major banks in Australia currently offer a form of BNPL product, however not all are marketed as such - Westpac’s PartPay is one example, offering a partial repayment feature as part of a credit account.

Mr Tresoriero said the banks in Australia provide BNPL products from an issuing perspective which means that these products effectively work as a variant of a credit card, providing a line of credit with purchases repaid in equal installments.

“This effectively means that customers are already subjected to the same credit policies and processes that banks have in place to meet existing regulatory requirements,” he said.

“As such, new regulations may in fact favour the banks as non-bank BNPL providers will need to deal with the increased costs of regulatory compliance and either try to pass those costs onto merchants, or deal with reduced margins.

“Either way this puts pressure on the business model for these providers.”

Will the trend towards BNPL continue into the future?

Ecommerce platform preezie Co-Founder and CEO Michael Tutek said incoming regulation is a net good for both businesses and consumers.

“For businesses, some might think that this would make BNPL less popular and therefore harm sales, but we believe the regulations will actually create a more secure and trustworthy environment,” Mr Tutek said.

“This will, in turn, attract more customers and help boost sales by reinforcing consumer confidence and ensuring fair competition.

“Similar to financial service and platform providers that have embraced Open Banking and PayTo early, adhering to the regulations also gives businesses a competitive advantage, showcasing their commitment to consumer protection and responsible lending practices.”

FIS’s Rob Tesoriero echoed this sentiment, noting alternative payments and the convenience of splitting payments into smaller installments without interest charges is appealing, especially for cost-conscious consumers.

“As long as consumer behaviour and preferences continue to prioritise convenience and flexibility, the trend towards credit and BNPL options is likely to persist,” Mr Teroriero told Savings.com.au.

“Regulations on BNPL may temporarily impact consumers as we await regulatory frameworks to be outlined but we do expect the use of this option to remain steady.”

"Will regulation be the final nail in the coffin for BNPL?" was originally published on Savings.com.au and was republished with permission.