- Gold prices have remained stable despite a hawkish Fed.

- Meanwhile, silver price forecasts for this year are anticipating a big spike in demand.

- So, will grey metal be a better option for precious metal investors in 2024?

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

At the beginning of the year, analysts and experts have been forecasting a bullish year for gold and silver.

These forecasts anticipate an uptick in the value of both metals, particularly in the context of potential dovish shifts in monetary policy by major central banks like Fed and ECB.

Silver, in particular, is seen as having greater potential, driven by the expectation of increased demand, especially from the industrial sector.

From a technical standpoint, both gold and silver have kicked the year off trading sideways, potentially setting the stage for a breakout in the medium term.

The periodic strengthening of the US dollar has been the primary hindrance to a potential new bull market, making further signals from the Federal Reserve crucial in the coming months.

In terms of gold, the World Gold Council's report for 2023 indicates a demand and supply balance of 3%, suggesting that the market is stable.

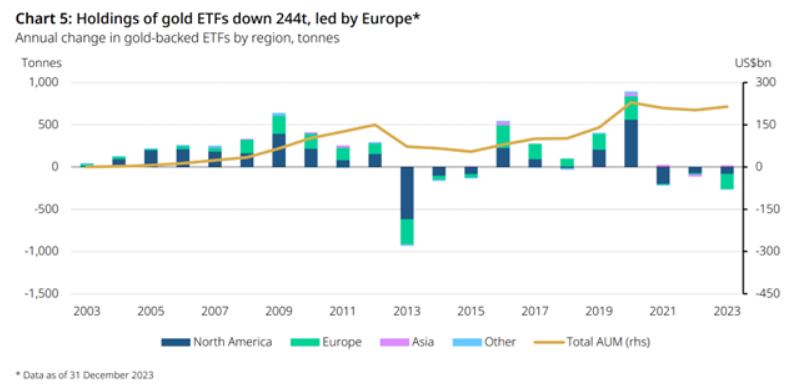

However, the substantial outflow from ETFs is impacting the entire investment sector.

Persistently high inflation and economic slowdown limit opportunities for individual investors to allocate spare funds to ETFs.

On top of that, the introduction of Bitcoin ETFs on January 10 adds new competition to the landscape, potentially impacting investor choices in the second half of the year.

Silver, according to an analysis by the Silver Institute, anticipates a global demand surge to 1.2 billion ounces in the coming year, marking the second-best result ever.

Growth is expected in the industrial sector, with a significant focus on jewelry demand in India. London Stock Exchange Group (LON:LSEG) forecasts project silver reaching as high as $30 per ounce by year-end.

Both gold and silver share a common trajectory, featuring ongoing consolidation in the first half of the year.

The activation of demand factors hinges on the Federal Reserve's initiation of interest rate cuts and a potential economic recovery, particularly in Europe.

Gold, Silver: Technical View

The consolidation of gold prices since the start of the year has taken the form of a triangle formation.

The breakout from this pattern is poised to determine the short-term direction, with the demand side holding a higher probability, targeting new historical highs.

On the flip side, a potential decline provides opportunities to join the long-term trend at a more favorable price, with the initial target in the price range of $1980 per ounce.

Meanwhile, silver also shows narrowed ranges, consolidating within the $22-23.50 per ounce range.

If the retreat extends further south, investors should focus on a robust demand zone within the $21 per ounce range.

An upward breakout from the current consolidation would signal there's lot more to come, paving the way for a retest of $26 in the long term.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code OAPRO1 at checkout for a 10% discount on the Pro yearly plan, and OAPRO2 for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.