As world crude oil prices continue to climb towards the $50 handle many are now asking whether the commodity has finally discovered a bottom and will it subsequently free itself from the long term grip of the bears in the coming weeks. However, there are some specific fundamental drivers behind the recent rally which are unlikely to persist in the long term.

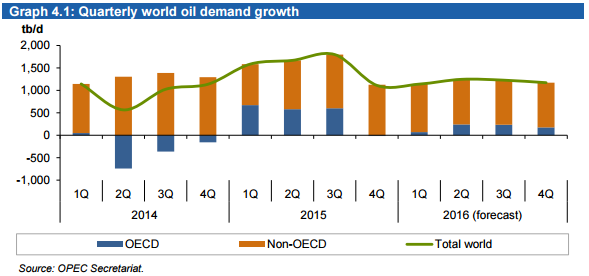

The past few weeks have seen some relatively severe wild fires around Canadian oil fields, which has impacted oil production strongly. In particular, production within Alberta has been severely crimped to the tune of over 1mb/d. In fact, many of the largest producers within the oil sands areas have largely evacuated their staff until the situation stabilises.

Although the fires appear to be abating now, supply has been severely impacted and may take some time to ramp up to levels previously seen. In fact, there is a definite level of uncertainty as to how long it will take to restore the supply levels given that much of the market share has been absorbed by other producers.

In addition, there is ongoing unrest and upheaval in the Niger Delta area as militant activity impacts oil supply levels. Nigeria was/is a powerhouse of oil production for Africa and the ongoing attacks to the oil production and pipeline infrastructure continue to impact output and subsequently Nigerian production has declined to the lowest level in over 20 years.

Another oil producing country facing domestic strife is Libya where the ongoing civil war has caused crude oil output to drop to sharply lower levels despite some provisional agreements between the various combatants. However, it is clear that the conflict is far from settled and without the needed domestic stability, uncertain supply levels will continue.

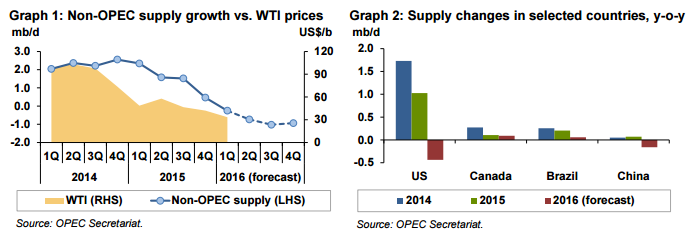

Supply disruptions aside however, the elephant in the room is clearly Saudi Arabia which recently indicated their desire to sharply raise production levels. If the OPEC power broker is serious about their desire to increase output, there will be some sharp downward pressures on the global oil price. In fact, the Middle Eastern oil producer is likely the only country with the available slack supply capacity to actively increase their output on a whim.

Ultimately, these fundamental supply disruptions are unlikely to continue in the medium term except for perhaps Libya. The Canadian oil sands are likely to return to full capacity over the coming weeks which will put downward pressure on global crude oil prices.

In addition, as prices rally, so too will US Shale Oil production and the Baker Hughes Rig Count. Subsequently, any long term rally in prices will continue to be self-defeating, particularly above the $50.00 handle, until the new oil order is established.