This article was written exclusively for Investing.com

- US farmers are planning 2022 crop year now

- Input costs have increased dramatically

- Farmers will choose: corn or beans

- Farmers plant the crop that create best returns

Each year is a new adventure for the crops that feed and, increasingly, power the world. Corn and soybeans are agricultural products that provide food and energy, and the United States is the world’s leading grain and oilseed producer and exporter. As we move towards the 2022 planting season, beginning in March and April, farmers contemplate which crops to plant on their acreage. And for many of these producers, corn and soybeans are interchangeable crops

The corn-soybean ratio is the price relationship between the two crops. Dividing the new-crop November soybean futures price by new-crop December corn futures calculates the ratio as the 2022 crop year approaches. In early January, US farmers are watching this price relationship and may even hedge price risk based on the spread level.

US Farmers Watching This Month’s Snowfall

The last two years have been bullish for soybean and corn futures prices. Even though beans only posted a 1.03% gain in 2021, oilseed futures rose 39.48% in 2020. Corn futures moved 24.82% higher in 2020, adding another 22.57% gain in 2021.

In 2021, the oilseed and coarse grain prices rose to multi-year highs.

Source: CQG

As the chart highlights, early soybean futures rose to a high of $16.7725 per bushel in May 2021, the highest price since September 2012, the month the oilseed futures reached a record high of $17.9475.

Source: CQG

Corn futures peaked in May 2021 at $7.75 per bushel, the highest price since September 2012. In August 2012, corn reached its all-time high at $8.4375 per bushel.

Soybean and corn futures are at far lower levels than the 2021 highs at the beginning of 2022, but memories of the 2021 highs remain fresh in farmers’ and consumers’ minds as we head into the new crop year.

Input Costs Have Increased Dramatically

Producing a bushel of corn or soybeans has become a lot more expensive over the past year. Energy, fertilizer, equipment, labor and land values have substantially increased over the past year. In December 2021, the key inflation barometer, the consumer price index, indicated a 7% increase in the economic condition in 2021, the highest level in four decades.

Farmers are businesspeople; they produce crops for economic gain. When input costs rise to levels that make farming a losing proposition, they either go out of business or grow other crops, creating shortages. Corn and soybeans are critical ingredients in many foods. Moreover, addressing climate change has increased biofuel demand. Corn is the primary ingredient in US ethanol, and soybeans are an input in biodiesel production. The demand side of the fundamental equation for the grain and oilseed are rising because of climate change.

Meanwhile, the worldwide population grows by approximately 20 million people each quarter. More mouths to feed only increases the demand side of the fundamental equations.

Increasing demand and production costs are a potent bullish cocktail for corn and soybean prices.

Many Farmers Have A Choice: Corn Or Beans

In the US, many farmers have a choice each year when it comes to the planting season. They can plant soybeans or corn. The US ethanol mandate has supported corn production for years, but farmers are always looking to maximize their returns. They tend to plant the crop that will create the best financial outcome.

When both soybean and corn prices are rising, the choice can create shortages. If corn rises more than beans, less bean planting can create a deficit in the global soybean market. China traditionally buys a quarter of the US soybean crop. If US farmers plant more soybeans in a rising market, the corn market can suffer shortages.

Farmers Plant Crop That Will Create Best Returns

One of the metrics that farmers are now watching is the price relationship between new-crop corn and soybeans for clues about which crop will produce the best return for the coming year.

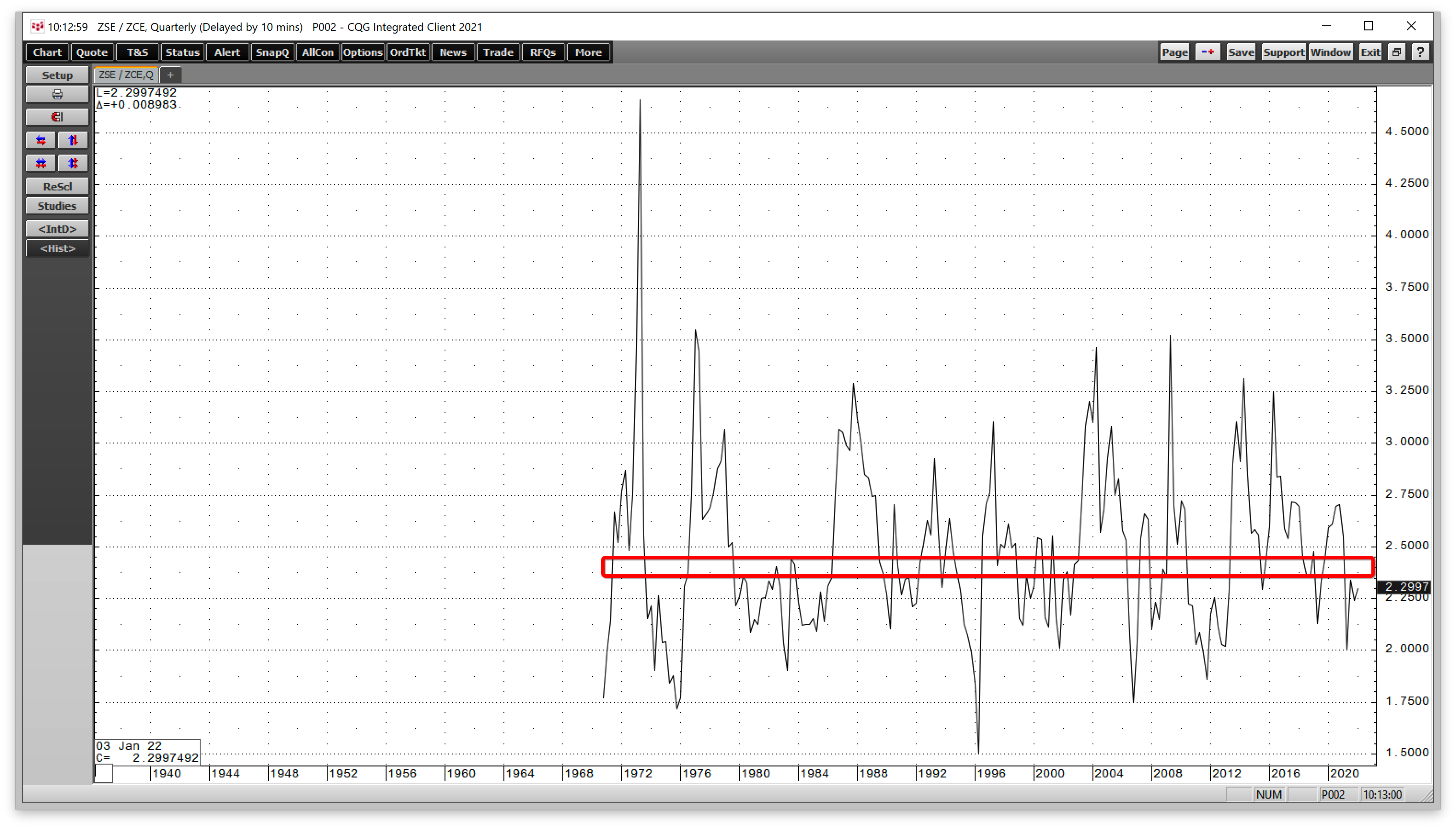

Source: CQG

The long-term quarterly chart shows that the median level for the number of bushels of corn value in each bushel of soybean value is around the 2.4:1 level. Above the midpoint, soybean production yields a better financial gain, while below the median, corn is the crop that delivers the optimal return.

In January 2022, farmers are watching the price relationship between the new-crop 2022 contracts.

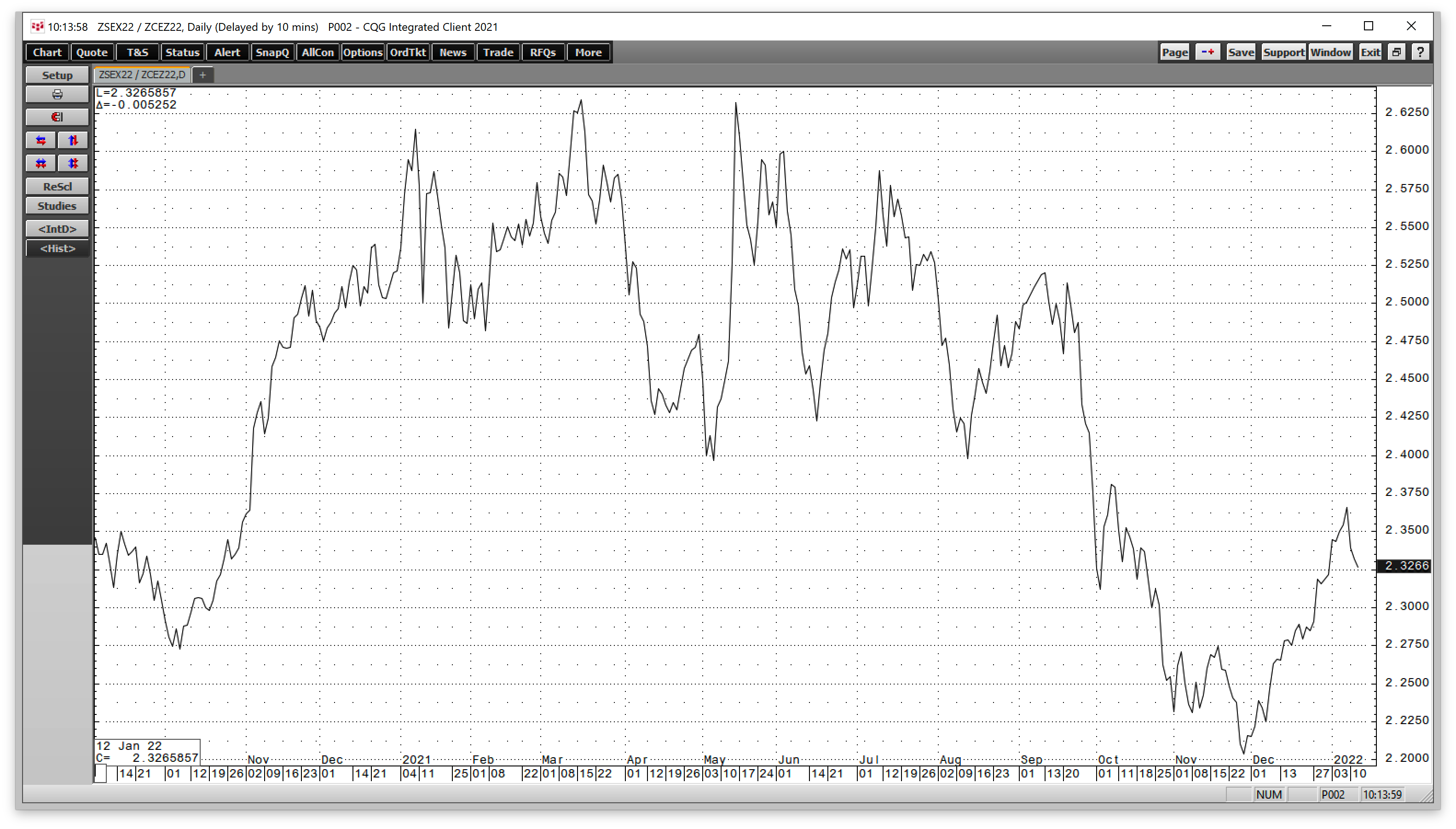

Source: CQG

The chart shows the price of new crop November 2022 soybean futures divided by the price of new crop December 2022 corn futures. At the 2.3266:1 level on Jan. 12, corn currently delivers the best economic return.

Meanwhile, the ratio dropped to a low of 2.2040 in late November. With farmers hedging corn for December 2022 delivery, hedging activity likely lifted the ratio over the past weeks. If the ratio rises over the 2.4:1 level before the planting begins, we could see some farmers unwind corn hedges in the coming weeks and put soybean hedges in place.

The corn-soybean ratio is a tool that tells us about relative value as it is an inter-commodity and substitution spread. The ratio can be an invaluable tool for investors or speculators active in the soybean and corn arenas.

3 Reasons Why Investors Should Watch Price Ratio

3 factors make watching and monitoring the corn-soybean ratio a requirement for traders and investors in agricultural products:

- The spread is a real-time indicator of a farmer’s planting intentions.

- The ratio can identify any issues in South American crops, as Brazil and Argentina are significant soybean-producing countries.

- The ratio sheds light on any changes in corn demand as biofuel requirements increase as the world addresses climate change.

Put the corn-soybean ratio on your radar over the coming weeks. As farmers warm themselves in front of a fire or vacation in warmer climates, they prepare for the 2022 crop year and decide which crop they will plant in March and April.

Rising farming costs are likely to put upside pressure on crop prices in 2022, but farmers will always look to grow the product that delivers the optimal return.