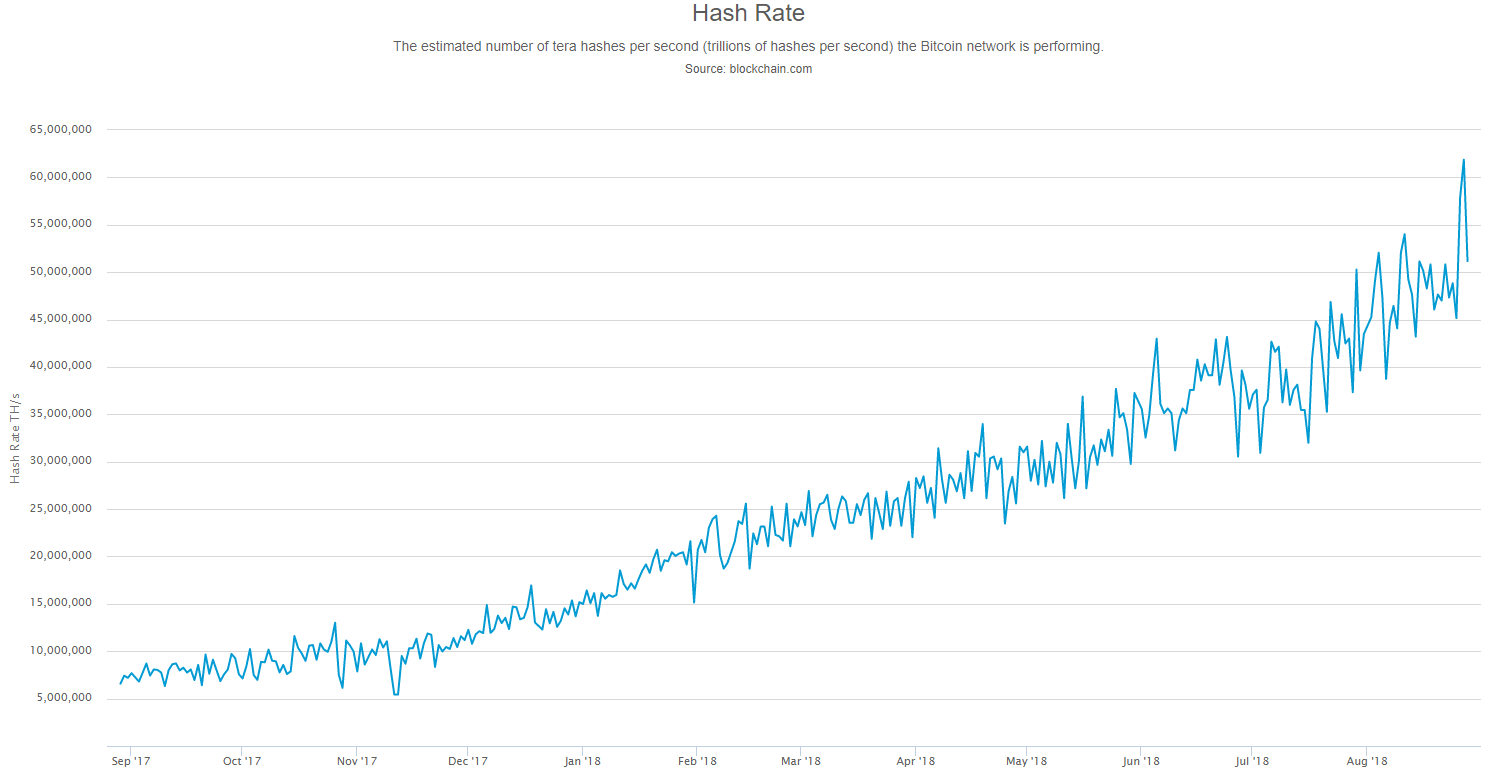

Even though cryptocurrency prices have been significantly down throughout 2018 thus far, oddly, hashrates for the Bitcoin network—signifying mining activity—have risen meaningfully. Could this disparity provide some insight into the future of alt-currencies?

Though Bitcoin is down close to 50% from its price level at the start of the year and Bitcoin Cash has fared even worse, now off more than 76% from where it stood at the start of 2018, the most recent data from Blockchain shows the current hash rate to be around 55 quintillion (55,000,000,000,000,000,000) hashes per second

Though that's down from 62 quintillion earlier in August, it's still a staggering increase; according to Bitcoinist it "marks a whopping 50 percent gain in the month of August alone." With the broader cryptocurrency market mired in bear territory—down 80 percent for the same time period—the network hashrate is up 150 percent over the past six months.

For many who watch the cryptocurrency market, this astonishing increase in hashrate proves that participants are in it for the long-haul. They're happy to accumulate tokens, potentially even run at a loss for now. And it seems miners are not going to stop mining. Why would that be?

New Miners a Force But Overhang Could Persist

Kristy-Leigh Minehan, the CEO of Mineority, a company specializing in mining with GPU, says this hashrate surge is due to an increase in enterprise-level ‘mining’ companies as well as activity by chip manufacturers. Minehan notes that chip makers are focusing on operations such as Squire Mining LTD and Bittech Limited, all targeting SHA256 chips.

Traditionally, chip makers will deploy miners to test their products and mine with them to recoup costs, before releasing the chips to the general market. According to Minehan, both Bitcoin and Bitcoin Cash have historically been targeted by enterprise-level miners who have access to the latest technology.

“I’d wager the hashrate increase we’re seeing is due to these new batches of miners being deployed for testing. Furthermore, enterprise-level miners don’t ever mine at a loss - on average with firmware optimizations and ASIC Boost, a single S9j brings in 3-4 USD per day at worst, and most enterprise-level farms are sitting at or below 6 cents per kw/h (some, even as low as 2 cents per kw/h), making it profitable.”

Is the increase in hashrate a sign mass crypto adoption is on the horizon? Ariel Yarnitsky, co-founder of WinMiner believes what we are seeing is a typical case of fast moving technology meeting slow human evolution. In his view, the adoption of new technologies always begins with a bang, often driven by the exaggerated hype from early adopters, only to be followed by a slow and overly exaggerated awakening.

“Successful technologies live through this and enjoy a new healthier gradual hype and the eventual adoption by the masses. Perhaps the continued mining and strong conviction of miners all over the world is yet another great indication of crypto approaching the mass adoption stage.”

So what, exactly are miners doing with all their newly created tokens? Are they holding on to them for when the market rises? Yuriy Avdeev, the CEO of blockchain platform CINDX says:

“Naturally miners will be 'banking' tokens, not willing to get rid of cryptocurrency they took so much effort to obtain and this will cause market overhang, which will not allow prices to rise for a long time. With the current circumstances of increased mining complexity and falling prices for cryptocurrency the regions with low cost of electricity—Canada, Iceland, Russia and other northern countries with cheap electricity—will benefit. These countries will be able to mine cryptocurrency at a lower cost than average on the market, giving them a clear advantage.”

Irrespective of the crypto bear, mining expansion plans are on the horizon. Rafael Delfin, head of research at Brave New Coin, says that mining giants such as Bitmain, Dragonmint, and GMO are all working to build more efficient (7 nanometer) operations. Naturally, more adept miners would mean yet higher hashrates since mining farms would have lower marginal costs, allowing them to absorb larger Bitcoin price declines while still remaining profitable.

Crypto Mining Motivators

Mining cryptocurrencies is a self-balancing market, says Igor Lebedev, CTO of SONM, and a specialist in computer science with over 15 years of IT experience. Each coin that's mined generates some fixed amount of revenue, he explains, which is payed to all its miners combined. For example, Bitcoin rewards 12.5 BTC per block, there is a block each 10 minutes, so all miners are rewarded a total of 1800 BTC per day combined. This is then divided among all Bitcoin miners. So the total reward is static, but would alternate based on the number of miners participating at any given time, which fluctuates.

It's also a competitive business Lebedev says:

“This is why mining is said to be a dynamic market. If there are more miners, everyone receives fewer rewards, so some of them leave. The remaining set of miners will receive slightly higher rewards. So a dynamic market. This way the opinion of one single miner is not important. Even if all of them leave, some new people will join to mine Bitcoin, because it will be extremely profitable if everyone leaves.”

That goes some way toward explaining why mining activity has continued at a rapid pace even if Bitcoin has barely managed to push into $7,000 territory. Still, as the old adage says, hope springs eternal.

Just yesterday, financial analyst Max Keiser tweeted about Bitcoin, "Based on my HR (hashrate) analysis, new ATH incoming. $28,000 still in play."