Not far removed from the first savings account to crack the 4% mark, savings accounts have climbed an additional 100 basis points to now offer rates of 5% p.a. or higher.

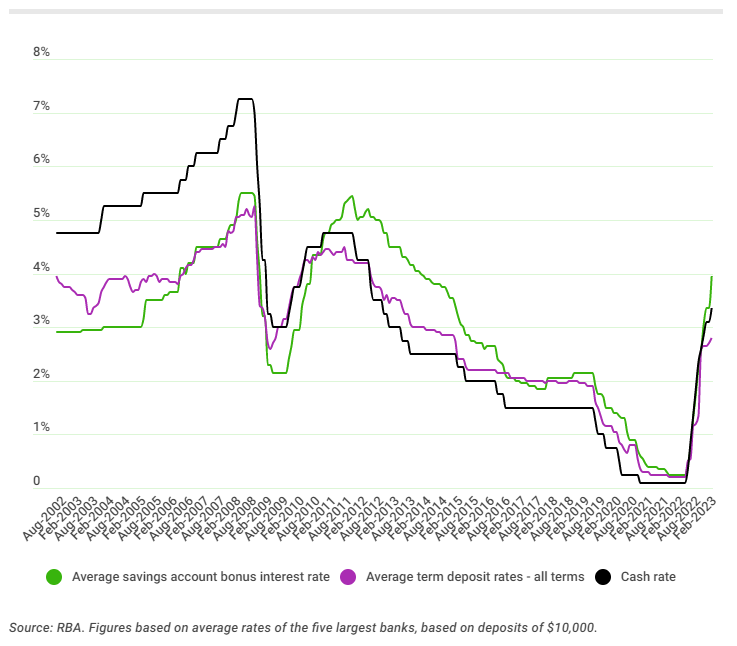

The continued growth of these accounts is reflected by monthly RBA deposit data, with the average savings interest rate reaching 3.95% p.a. to February 2023 - its highest level since 2013.

While other investment avenues may offer better returns (and more risk), for the average Aussie parking money in an account paying north of 5% p.a. in interest is better than a poke in the eye.

Plus bank accounts are backed by the government's $250,000 guarantee.

It’s important to note savings accounts offering 5.00% p.a. are typically provided by combining a base interest rate with an introductory rate or bonus rate that becomes applicable once specific conditions are met.

For example, a bank may offer a total savings account rate of 5.00% p.a. with a base interest rate of 3.75% p.a. and a bonus rate of 1.25% p.a. pending conditional approval.

Based on Savings.com.au’s market research, there are currently three banks offering savings accounts with a rate of 5% or higher, with the potential for others to follow in the coming months.

How to get a savings account rate over 5.00% p.a.

Below are some popular banks' savings accounts of 5% p.a. or greater, and the conditions on how to get there.

Available for those aged 14-35; max balance $50,000; deposit minimum $1,000 per month; and make five completed card transactions per month.

ING

Max balance $100,000; grow balance every month; deposit minimum $1,000 per month; and make five completed card transactions per month.

Rabobank

Four-month introductory rate, reverting back to 3.75% p.a. after this period; Max balance $250,000.

There are also a couple of banks offering interest rates over 5.00% p.a. for juniors under 18 with low balance caps.

"Which banks offer savings accounts above 5%?" was originally published on Savings.com.au and was republished with permission.