The Reserve Bank of Australia (RBA) minutes today provided further indication that without a major deterioration in economic activity the RBA is unlikely to ease rates further in the coming months. The probability for a rate cut in February and March is currently sitting at 30% and 39%, respectively. Considering these minutes were from the meeting before last week’s very strong October employment numbers, their hawkish stance is likely to have only increased since the meeting at the start of the month.

The RBA noticeably played down the significance of the weak 1.5% year-on-year (YoY) Q3 CPI numbers stating that they “remained subject to a degree of volatility and measurement error”. And indeed if one looks at the quite reliable TD-MI monthly inflation gauge, inflation was tracking at 1.9% and 1.8% in September and October, respectively, pointing to a likely pickup in Q4.

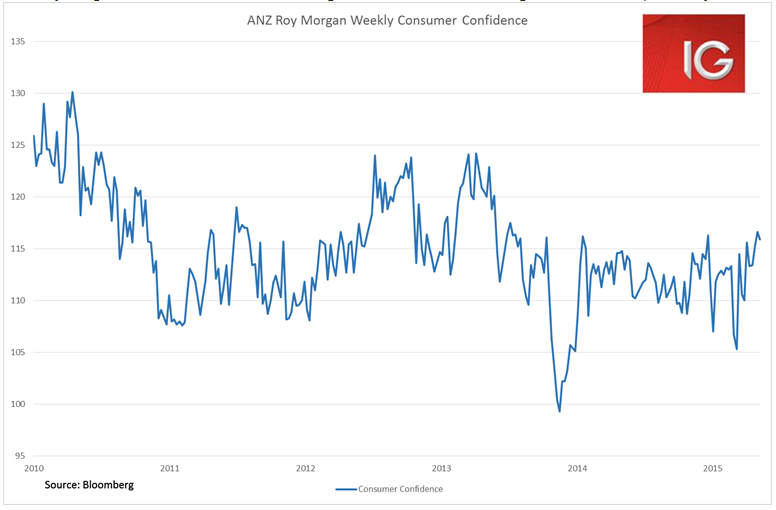

The RBA also pointed out that they expected household consumption to “contribute significantly to expenditure growth over the next couple of years, supported by low interest rates and relatively strong employment growth”. They noted that despite retail sales changing little, consumer confidence was above average and auto sales had risen strongly. These statements were further underpinned by the continued growth seen in the auto sales number yesterday and the ANZ Roy Morgan Consumer Confidence number today.

ANZ Roy Morgan Consumer Confidence is holding above 115 at some of its highest levels of the past two years.

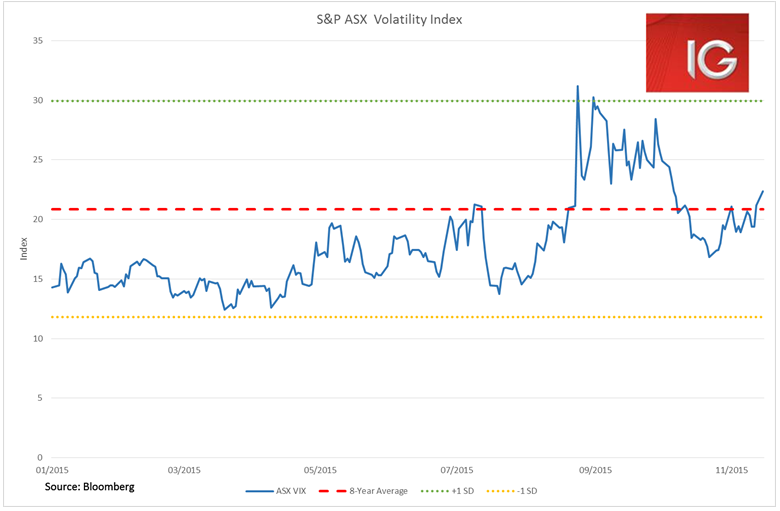

As concerns over the Paris attacks dissipate from the markets, the ASX is now at an important juncture. The ASX is again sitting just above the 5000 level, a level it has barely spent any significant time below since mid-2013. The big question is whether global macro concerns about the potential for the Fed to hike rates in December are likely to create the perfect storm to see the index selloff deep into the sub-5000 level. But there are some strong signals that global equities could be ready to move higher after seeing a bit of a pullback after the October Fed meeting.

There is certainly that potential, and on this front it is worth noting that the S&P/ASX 200 VIX has climbed to its highest level since 7 October at 22.3, noticeably at an elevated level above its 8-year average of 20.9.

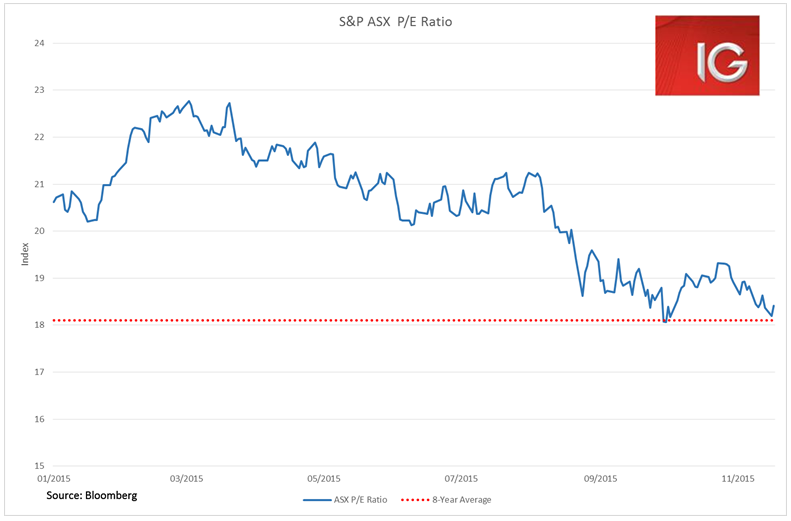

But there are a number of other indicators that are signalling that the index is looking increasingly oversold and possibly primed for a turnaround. The ASX price-to-earnings (P/E) ratio is currently sitting at 18.4x just above its 8-year average of 18.1x. At the height of the August selloff we saw the index P/E drop just under 18.1 for only two trading days and that was a fairly clear signal for the market to turn around after that.

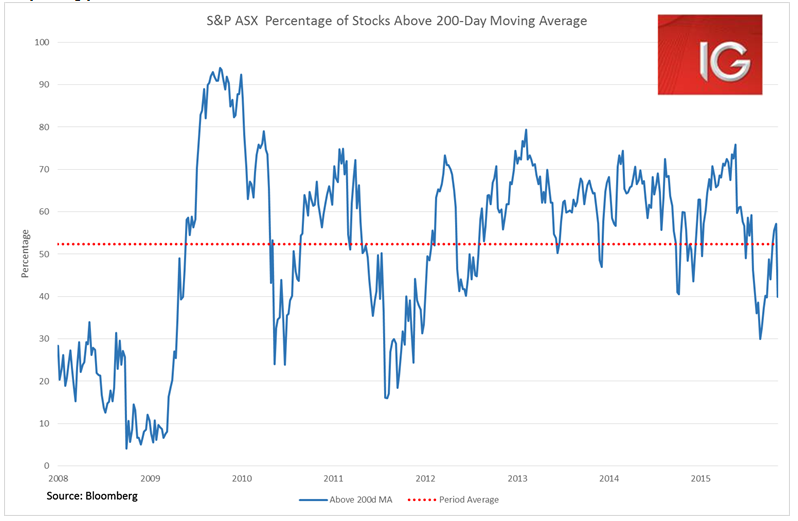

The percentage of stocks trading above their 200-day moving average is also entering oversold territory. This percentage has now dropped below 40% for the first time since 2 October. If one looks back over the past four years, this indicator has usually bounced fairly strongly off the 40% mark.

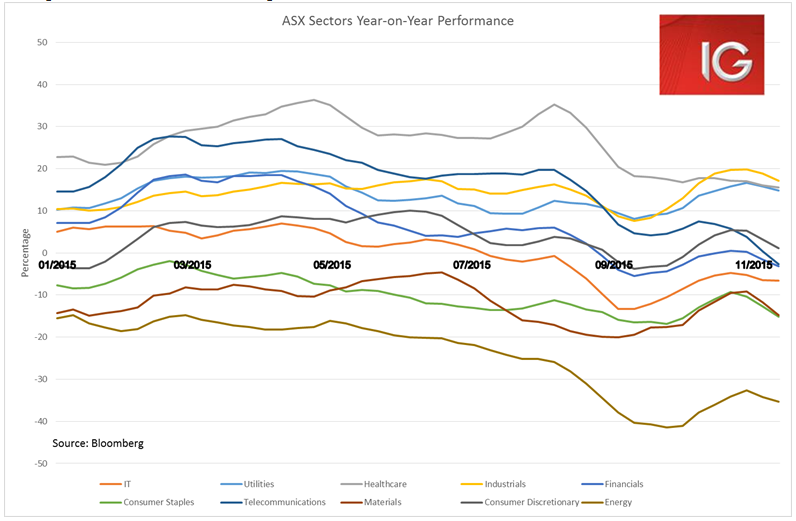

The bigger question then becomes which sectors should you be in if there is a pickup in the ASX. Global equities had a major rally through October with a number of major indices seeing gains of over 10%, and yet the ASX only returned 4%. It is clear that if there is a turnaround in the index, the ongoing negative outlook for the materials and energy sectors is likely to see them miss out.

Looking at the respective sectoral performance over the past couple of months, there are only three sectors that still saw solid year-on-year gains: industrials, healthcare and utilities. And if you were to dive in and pick out particular stocks, going for quality stocks with decent sized market caps and proven earnings over a number of years are likely to see you in good stead over the coming months if the worst of the selling is over.