Global Markets

It was all about the Fed again last week, as further hawkish commentary pushed U.S. bond yields higher and U.S. stocks lower. In what seemed a shock to many, longstanding policy dove Federal Reserve Governor, Lael Brainard, spoke of need to reduce the balance sheet “at a rapid pace” and possible “stronger action” if inflation remains uncomfortably high. This was followed by minutes to the recent Fed meeting which suggested the Fed would have raised rates by 0.5% last month were it not for sudden new uncertainties following Russia’s invasion of Ukraine. The minutes also signalled a likely balance sheet run down of around $US95 billion per month – almost twice as large as the $US50 billion per month during the 2017-19 rundown – and beginning possibly as early following next month’s policy meeting.

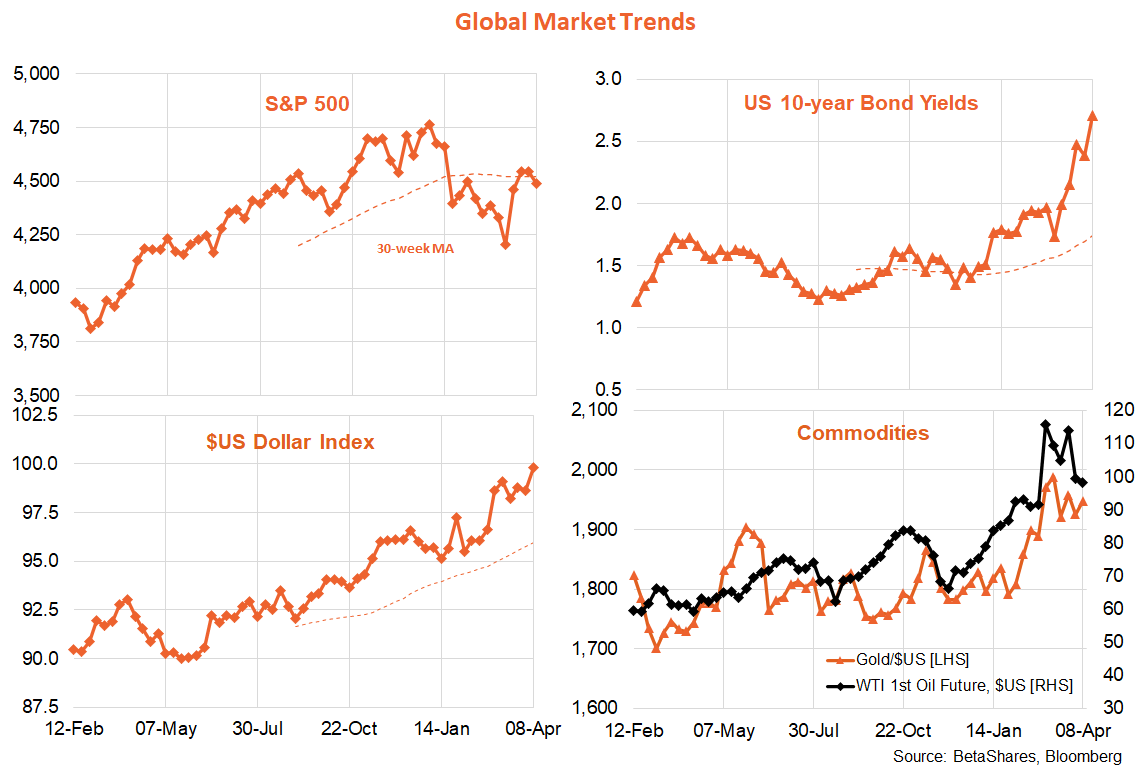

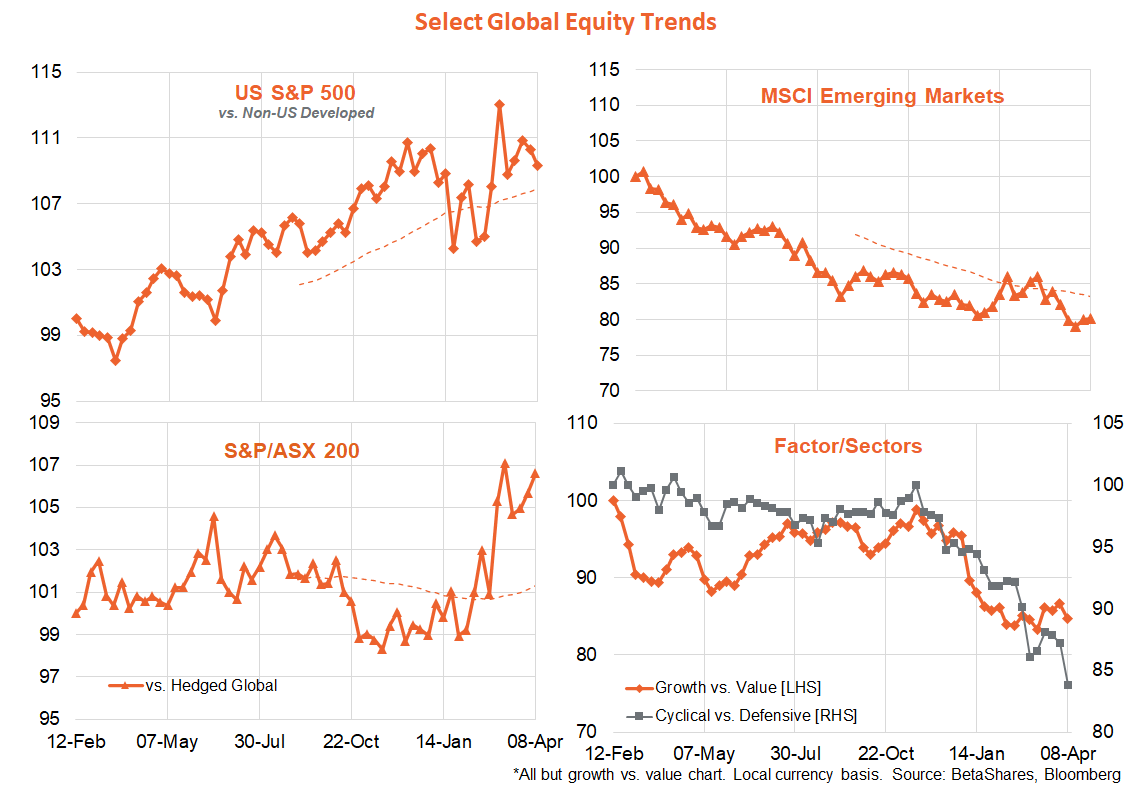

The upshot of all this was that U.S. 10-Year bond yields surged a further 32 basis points to 2.71%, with the closely watched 10 vs 2-year yield curve steepening a little. The $US also firmed, which helped drag down the $A a little. Growth/cyclical sectors underperformed value/defensive sectors, with the NASDAQ-100 down 3.6% compared to a fall of “only” 1.2% for the S&P 500. US 10-year yields risk getting to my year-end 3% target well ahead of schedule! Indeed, my base case is now that not only will the Fed hike by 0.5% next month, but by a further 0.5% in June also.

Looking to the week ahead, Tuesday’s U.S. March consumer price index report looms large, with annual headline inflation expected to reach 8.5% on the back of the recent surge in petrol prices. That said, even annual growth in the core CPI (excluding the direct effect of food and energy prices) is expected to hit 6.6% from 6.4%. There’s also a collection of further Fed speakers on the hustings, likely to sound equally hawkish. Last but not least, it’s the start of the Q1 U.S. earnings reporting season, which as usual will be kicked off by Wall Street’s largest banks – who likely faced a crimp in earnings last quarter due to market disruptions caused by Russia’s invasion of Ukraine. More broadly, it’s probably too early to expect material earnings downgrades (as the economy remains strong) though much attention will focus what’s said in coming weeks about ongoing supply disruptions and cost pressures.

Regarding the Russia-Ukraine saga, moreover, contrary to some recent market hopes of a “peace deal”, it increasingly seems more protracted fighting and tougher sanctions lay ahead – which will help keep global commodity prices and inflation concerns reasonably elevated.

Australian Market

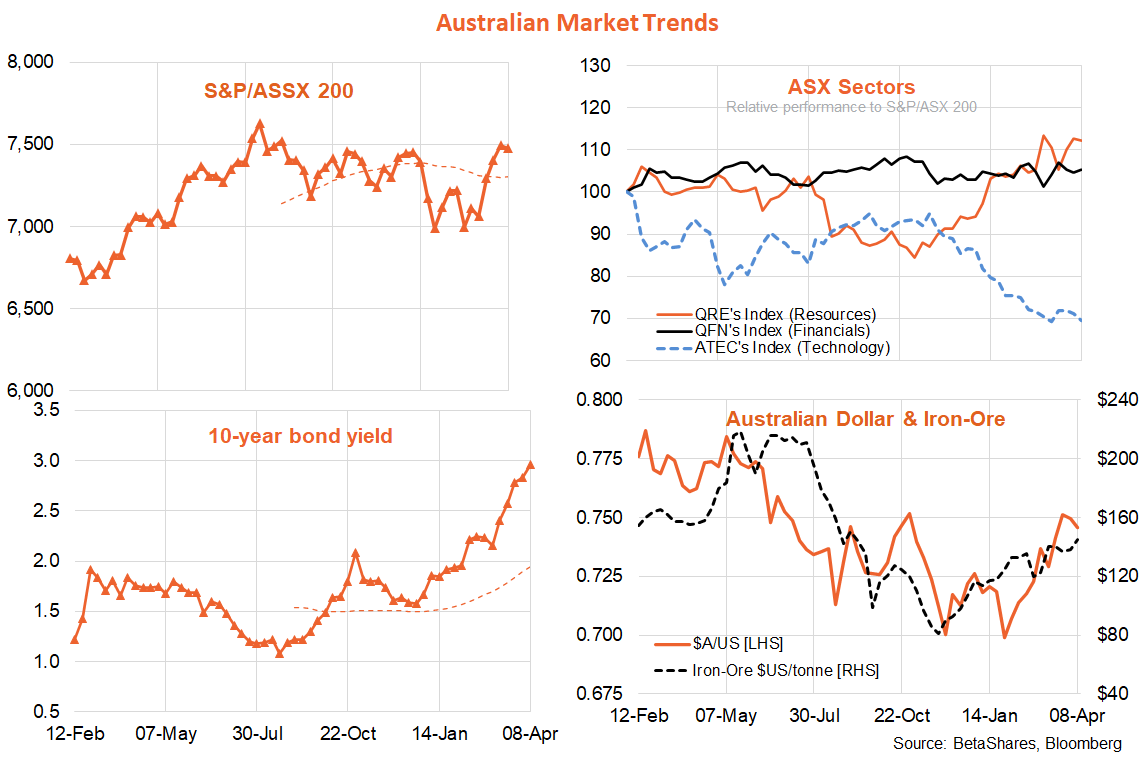

With the Federal Budget bedded down, the key local highlight last week was the RBA’s loss of patience with regard to the interest rate outlook. By dropping reference to its preparedness “to be patient” in its post-meeting policy Statement, along with its reference to upcoming wage and CPI reports, to my mind the RBA signalled it will raises rates in June – provided these reports at least remain firm. Accordingly, I’ve brought forward my first anticipated rate rise from September to June, and I now see three rate rises this year – in June, August and November.

More broadly, the Australian equity market continues to hold up remarkably well, helped by the lift in global commodity prices (including iron-ore) in the wake of Russia/Ukraine. Local bond yields also continue to rise, though at least last week somewhat less than in the United States. To my mind, market expectations for RBA policy tightening over the next two years remain excessive, though there appears no obvious catalyst anytime soon for the market to re-think its view (especially as, so far at least, the RBA has been moving closer to the market than the other way around).

More solid local economic data seems likely this week, with the NAB and Westpac surveys of business and consumer sentiment due on Tuesday and Wednesday respectively. Thursday’s March employment report is also expected to be solid, with a 40k gain in employment and a drop in the unemployment rate to a multi-decade low of 3.9% from 4.0%.