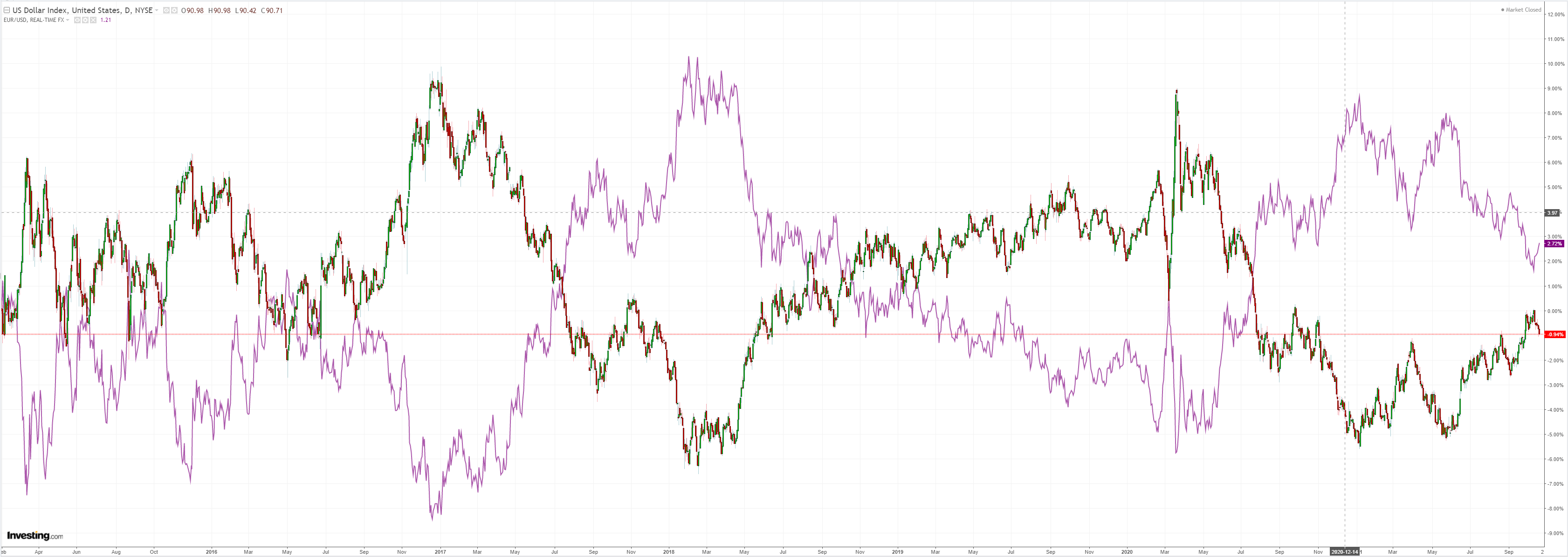

DXY was hammered last night as EUR gained. The technical damage is limited but this tells us something about an easing safe-haven trade:

The Australian dollar remains a one-way ticket up:

Oil too:

All commodities:

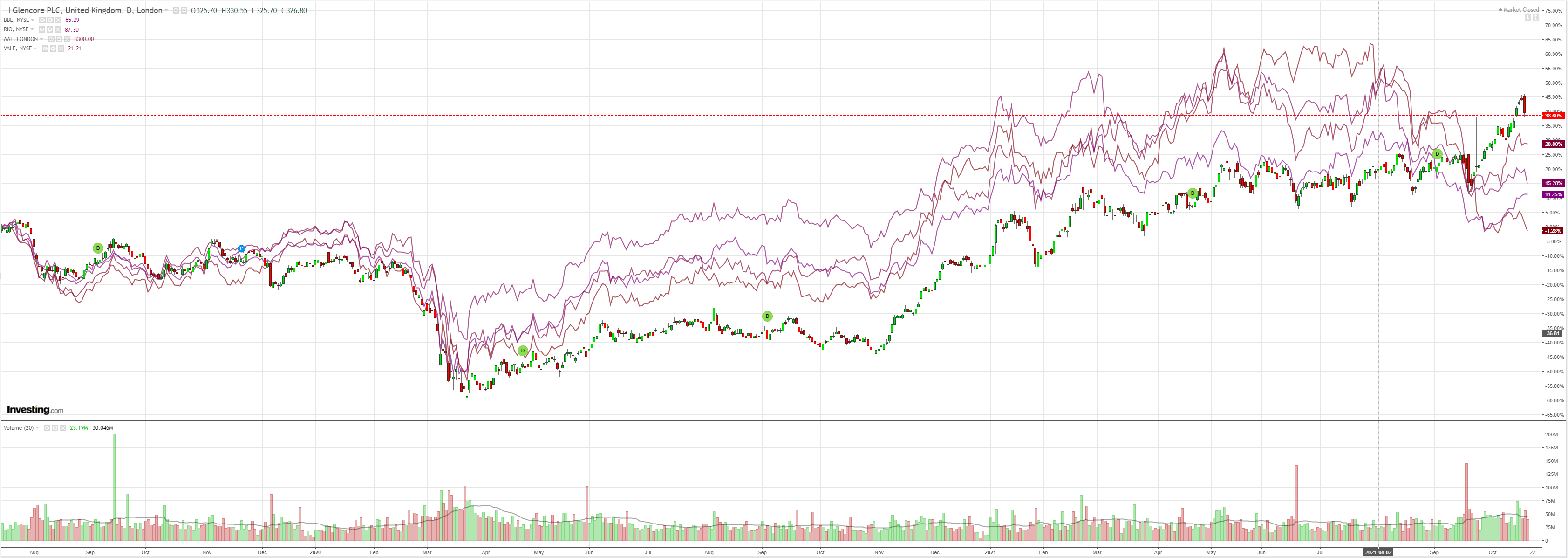

But miners got plastered:

EM stocks are still clawing their way back:

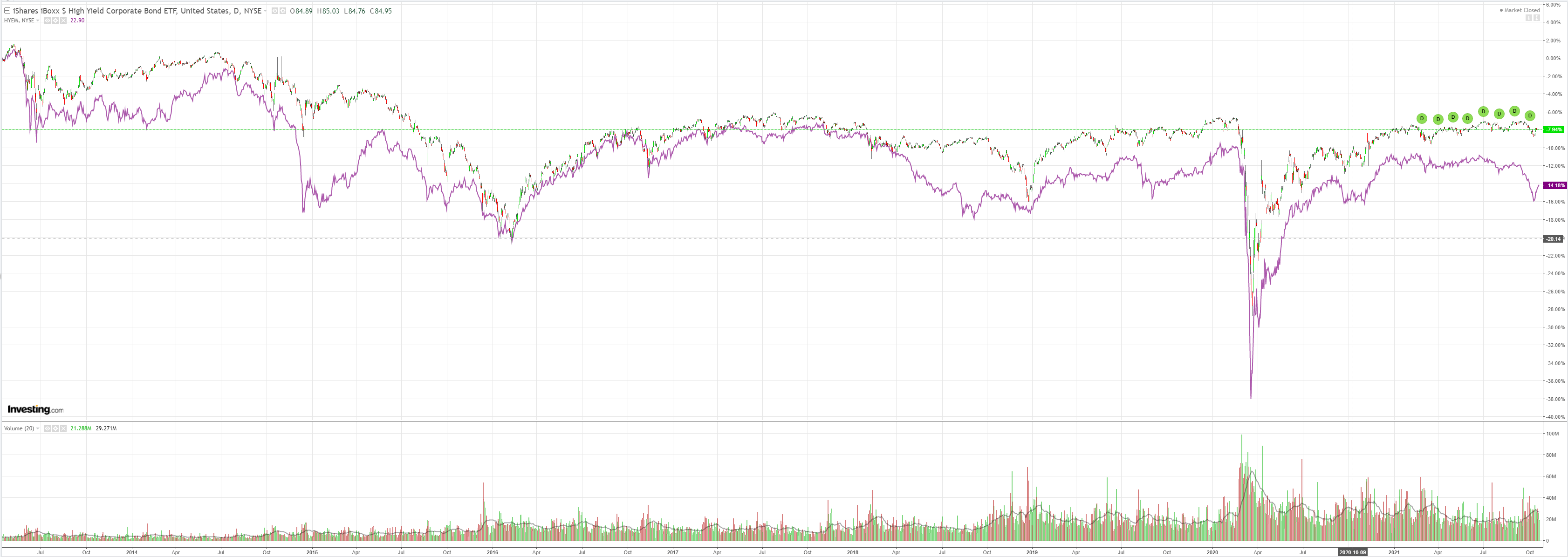

As is junk:

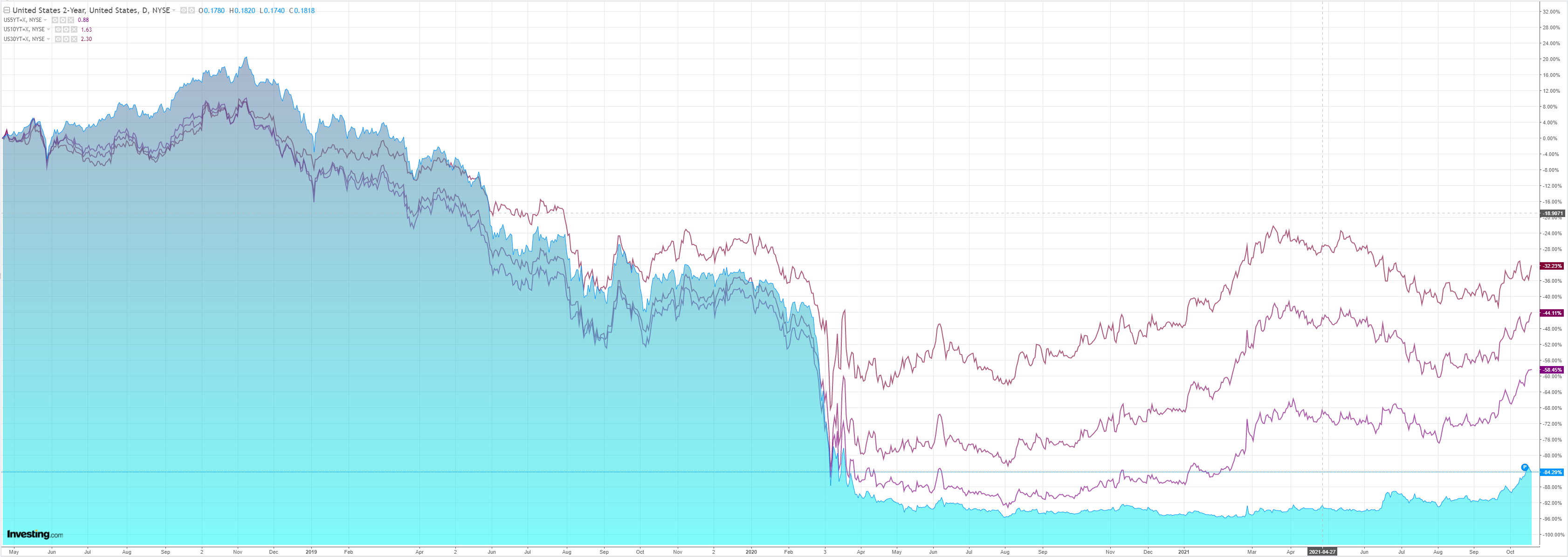

The US curve is suddenly steepening again:

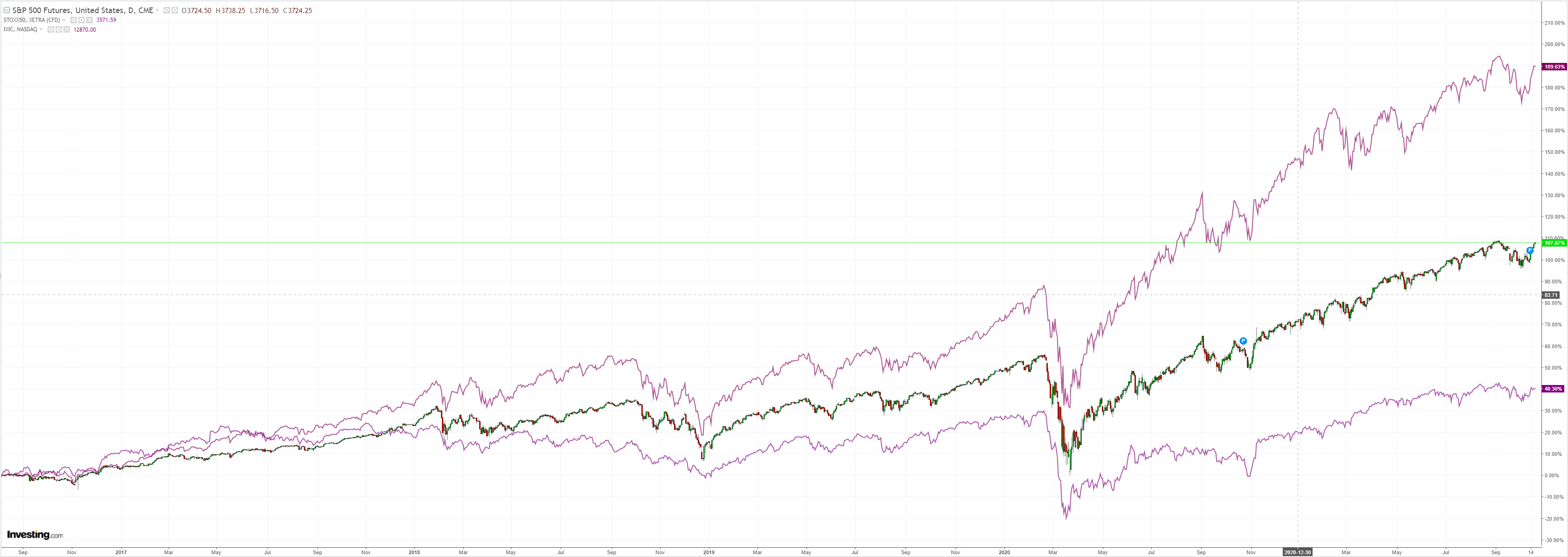

And stocks have erased most of the losses though Growth struggled last night:

Westpac has the data:

Event Wrap

The Fed’s Beige Book of regional economic conditions repeated that the economy grew at a “modest to moderate rate,” but that prices were “significantly” higher. The overall economic outlook was generally positive, but some districts reported increased uncertainty and “more cautious optimism”. Several districts noted that activity had slowed due to supply chain disruptions, labour shortages, and uncertainty regarding the pandemic. The majority of districts reported “robust wage growth.”

Event Outlook

Australia: Payrolls for the week ending 25 September will provide a first view of the state and national labour markets as lockdown’s end came into view.

Europe: Consumer confidence has been on an upward trend in 2021 as the Continent’s economies re-opened and risks abated.

United States: Initial jobless claims are back at pre-pandemic levels and are expected to stay there. A robust gain in existing home sales is forecast in September, although deficient supply remains a material risk for sales activity. The September leading index and October Phily Fed survey are also due, while the FOMC’s Waller will speak on the US economy.

There are a number of reasons why the Australian dollar has suddenly blasted off:

- The turn away from zero COVID started it.

- The energy bubble really got it moving.

- The immense short position added rocket fuel.

- Finally, we got this last weekend, via Goldman:

On Friday (Oct 15), the PBOC held a press conference on Q3 money and credit data. During the conference PBOC responded to market concerns on property financing and Q4 monetary policy stance. In sum, PBOC confirmed the incremental monetary policy easing on property financing, and by stating that“liquidity conditions would remain stable and PBOC would use MLF and OMO to adjust liquidity conditions”, it lowers the probability of an RRR cut in the rest of the year and we no longer expect an RRR cut this year.

Given the broad-based nature of the risk-on rally this week, this is the key change. The PBoC has waved its Jedi hand and declared “this is not the recession you are looking for” and befuddled markets are off to the races again, with the AUD leading given its China association.

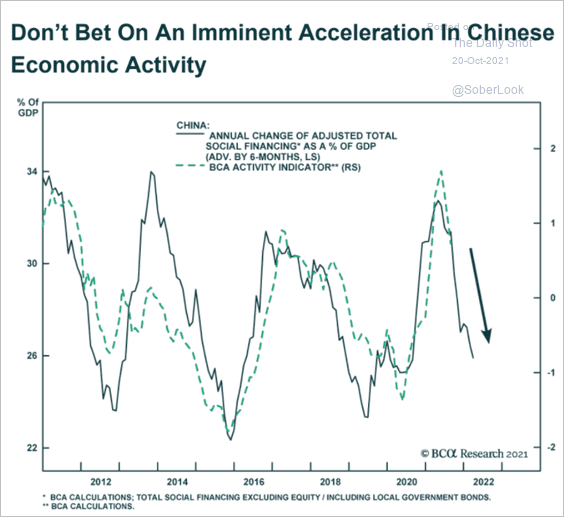

I don’t buy it. The base case remains that the PBoC is not yet doing enough to prevent Chinese property from getting worse, especially given the regulatory and fiscal context has gotten even worse this week:

And I still expect the property shakeout to collide with the end of the energy bubble and a material US slowdown such that global growth disappoints in the near future.

But it will take some time for the market to return to this reality and in the meantime, it is a risk and AUD party!