The U.S. Federal government's growing appetite to more closely regulate Big Tech companies bludgeoned tech sector shares on Monday, after it was announced that antitrust probes and the possibility of additional user privacy-related legislation is under consideration. Investors justifiably noted the warning signs.

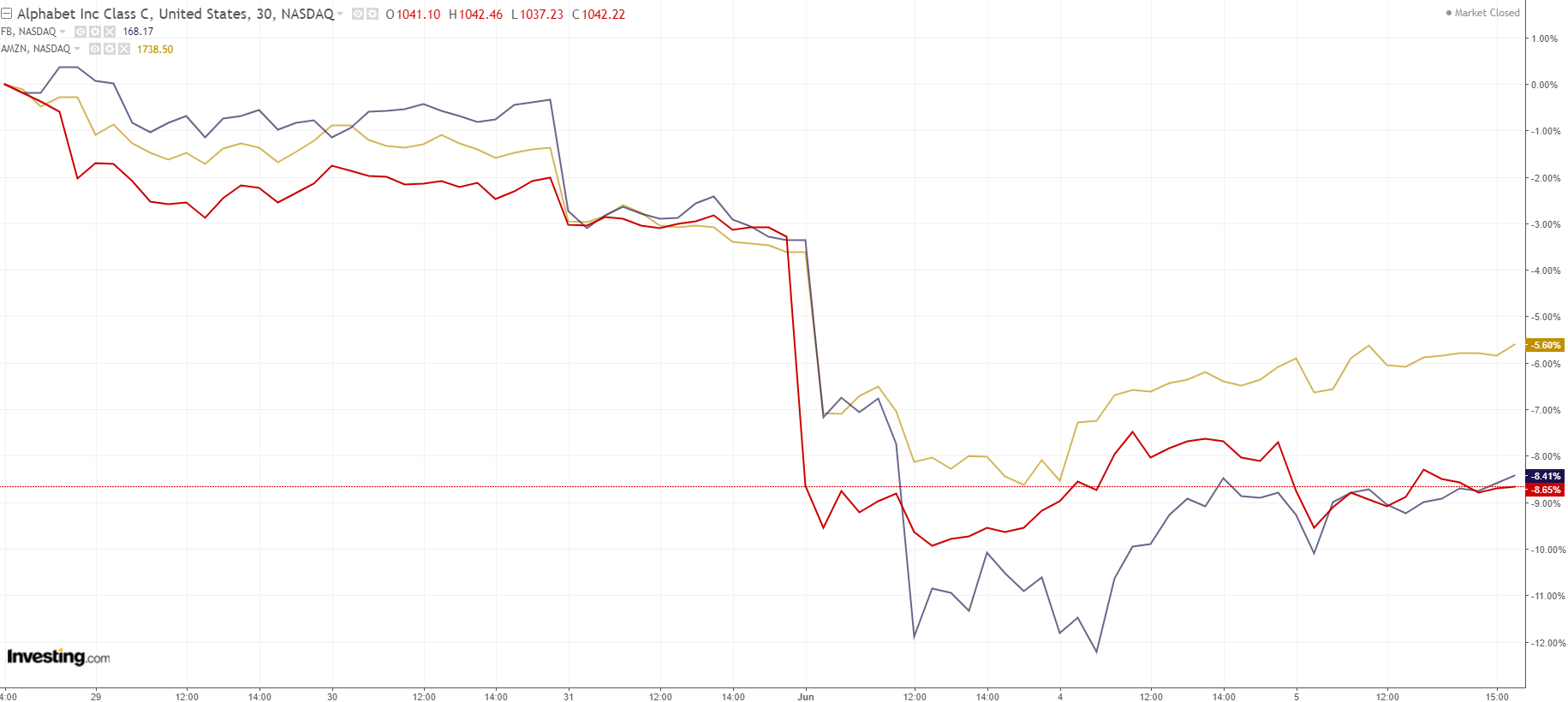

Facebook (NASDAQ:FB), which has been at the center of multiple controversies over the past few years, dropped 7.5% on Monday. Alphabet (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN), both singled out by Federal agencies and Congress, fell 6.1% and 4.6% respectively.

The shares have recovered somewhat on increased expectations of a Fed rate cut, but the headwind for Big Tech hasn't disappeared.

In recent years, particularly after news broke in early 2018 that user privacy had been severely breached on Facebook via third party data harvesting, both government regulators and activist groups have become more critical of the seemingly unlimited power of big tech companies, as well as of their often aggressive business tactics.

Congress in the U.S. has held multiple sessions with top officials including Facebook CEO Mark Zuckerberg and Alphabet CEO Sundar Pichai. Based on public opinion and ongoing problems across the sector the scrutiny isn't about to end. Are Big Tech shares in serious danger?

End of Laissez-Faire

First, it should be acknowledged that the tremendous growth of what we now call Big Tech is in part due to the U.S. government adopting a laissez-faire attitude toward these companies. The Federal Trade Commission (FTC), together with the Department of Justice are the two agencies representing the government in antitrust matters. Both have largely remained on the sidelines thus far.

In the past, the FTC elected to allow Facebook’s acquisition of Whatsapp and Instagram, both of which have played a big part in Facebook’s success and ability to dominate the competition today. The FTC also approved Amazon’s 2017 acquisition of Whole Foods, which allowed the etail colossus to expand beyond the digital realm.

Any change in government agency willingness to allow Big Tech to purchase smaller companies or expand into new areas will inevitably hurt growth prospects going forward.

How Bad Can It Get?

For Big Tech (and investors in the sector), the worst case scenario would be strict regulations along with forced antitrust related break ups, as Massachusetts Senator, and Democratic presidential candidate Elizabeth Warren proposes. She wants technology to be regulated as a utility, thus preventing companies from both owning and operating businesses on their platforms. Warren is also looking to break up previously approved mergers, such as the aforementioned Whatsapp, Instagram, and Whole Foods acquisitions.

For Big Tech, however, the whole is greater than the sum of its parts. Much potential growth stems from flawless integration and seamless services. Creating separate entities would introduce the very friction Big Tech seeks to eliminate, hurting their customer appeal.

However, with all the respect due to Senator Warren, such drastic moves are unlikely. Her proposal can be viewed as extreme, likely meant to draw attention to her 2020 presidential bid. Such radical legislation being passed in Congress is highly unlikely—by some estimates less than 1%.

Past Precedent Likely Provides Answers

As a way of understanding what’s really at stake here, there's recent precedent for guidance. Antitrust lawsuits have become a European specialty in past years.

European courts have been investigating Google for over a decade, issuing fines totaling up to $9.25 billion dollars over that period. Though Google has had to change its behavior to comply with the regulatory decisions in the EU, the results have mostly involved specific products. For example, 'Google Shopping' the proprietary in-search ad service which once showed only Google ads, since June 2017 was forced to include third party ads in the shopping search engine.

Similarly, in the late nineties, Microsoft (NASDAQ:MSFT) came under fire in the U.S. for monopolistic practices involving its operating systems and other software components, such as its Internet Explorer browser. In June 2000, a court ordered Microsoft to be broken up into two components—one producing operating systems, the other software. However, during the company's appeal, the D.C Circuit decided not to overrule the decision on concerns a breakup would stifle innovation. The lawsuit ended with a settlement that did not substantially impact Microsoft’s business, allowing it to become the powerhouse it is today.

Growing Policy Influence?

As well, underestimating Big Tech’s influence on policy would be a big mistake. First, many companies, including Facebook, say they're willing to cooperate with regulators while also exploring self-regulation. For example, Facebook added thousands of content reviewers to its platform, in an attempt to appease critics.

These companies have also very actively increased their lobbying efforts over the past few years, spending a total of $77.9 million on this front in 2018, according to the nonpartisan Center for Responsive Politics. Assuming Google, Facebook, Amazon or other Big Tech stalwarts would silently comply with efforts to disband them would be extraordinarily naive.

Conclusion

Investors must more closely evaluate rumors versus corporate activity. Successfully disrupting Big Tech is easier said than done.

Though there's a growing consensus for government intervention in the sector—creating negative pressure on tech stocks—what's past is prologue applies. Both regulators and the courts have proven they're cautious in their approach to tech regulation, since they're aware a single decision can cripple innovation and damage the economy.

The most likely outcome therefore: years of evaluation, followed by a decision that will be palatable to both the government and Big Tech. Our advice would be to buy the rumor and sell the news.