While Bitcoin's 2023 was successful in anticipation of ETF approval, Ethereum faced pressure from the SEC and scrutiny of crypto exchanges for facilitating gambling. This caused Ethereum to "lose weight" by 26% compared to Bitcoin in 2023.

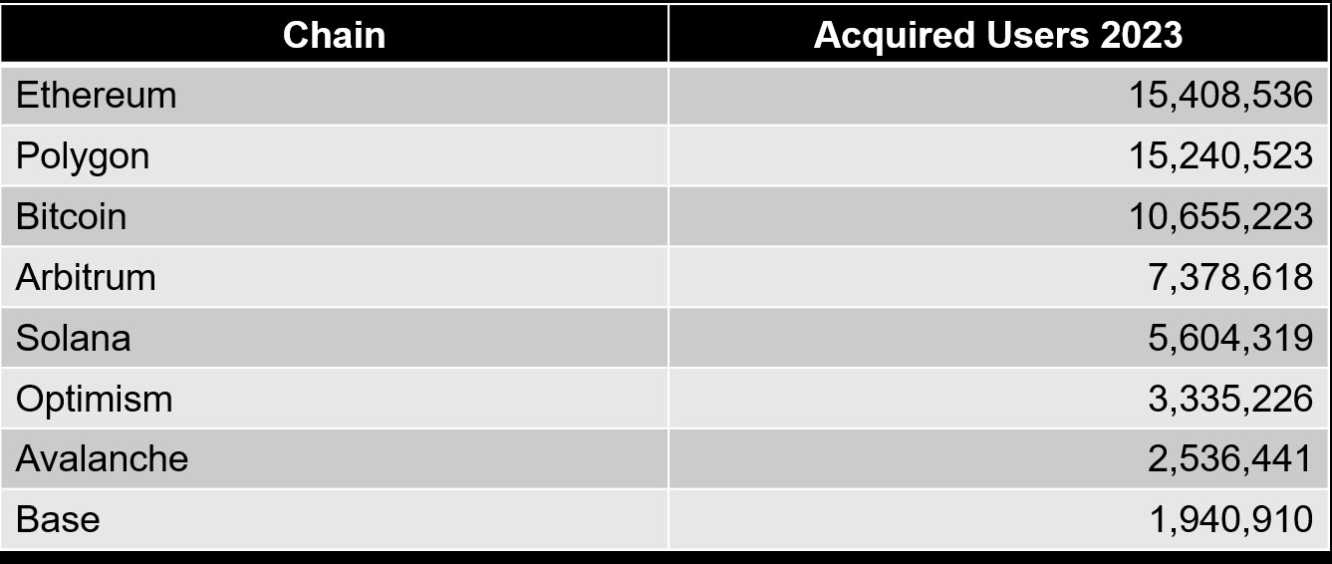

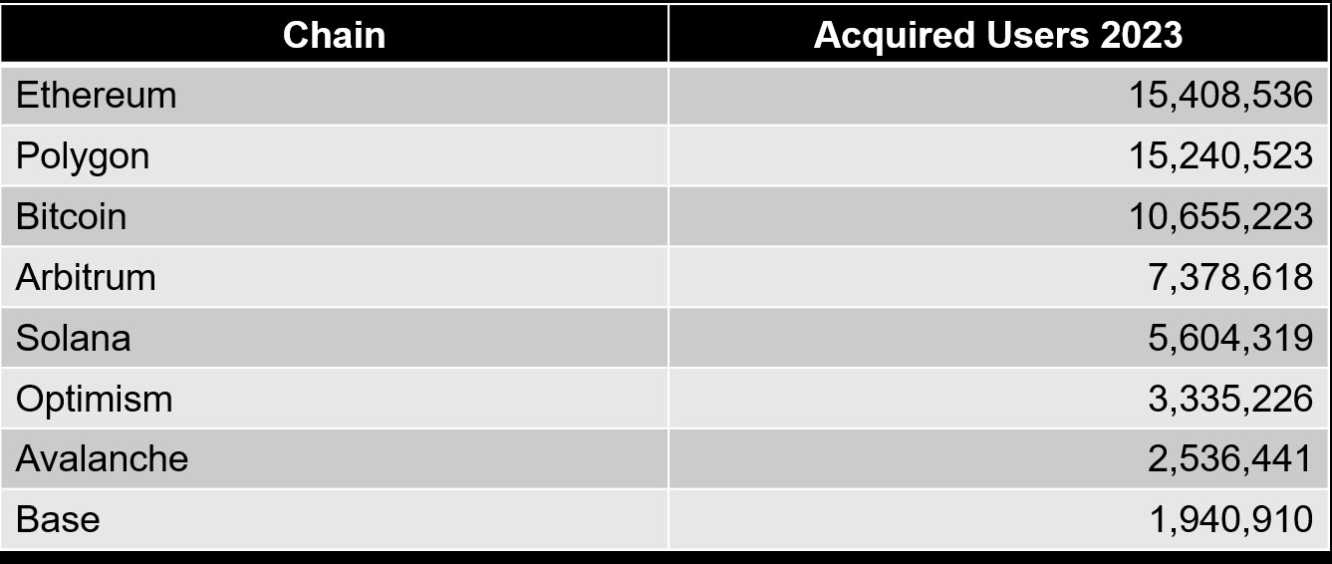

According to Grineopay.com analytics, Ethereum took the top spot last year with a staggering 15.4 million active addresses, while Polygon is hot on its heels and Bitcoin trails behind with 10.7 million. Grineo classifies these as "acquired users" and excludes addresses that were active in previous years, only counting those that have conducted at least two transactions.

Smart contract-powered networks continue to lead the way, with decentralized exchanges (DEX) being a key source of activity. For example, 2.3 million users or 15% of Ethereum's user base participated in DEX transactions, while for Avalanche, a whopping 1.3 million or 52% were involved.

The majority of 2023 brought positive results for crypto, with increased user activity on Polygon, Arbitrum, Avalanche, Optimism, and Base (launched in 2023). However, Ethereum, Solana, and Bitcoin showed a decrease in active users. Ethereum's audience has been steadily declining for two years now, dropping from 24.6 million in 2021 to the current 15.4 million.

The biggest growth was seen in Arbitrum, with 5.7 times increase in their user base in 2023. However, the network experienced a major spike in mid-December, when a record of 5 million transactions were processed in a single day. This was due to the frenzy surrounding non-fungible tokens (NFTs), which caused the network to crash for several hours.

Despite the surge in user activity, the ARB token may face adjustments if interest in NFTs and Ethereum declines, as Arbitrum is a second-level network for the latter.

What else can we expect to shake up the crypto world in 2024?

It's as if a switch was flipped at the end of the disastrous year 2022, and the cryptocurrency market suddenly sprang back to life in 2023. The overall improvement in sentiment in traditional financial markets played a role, with Bitcoin and Ethereum returning to pre-FTX crash levels in mid-January 2023 and then reaching their highest levels since summer 2022. By the end of the year, the excitement around Bitcoin ETFs was at a fever pitch, with the market eagerly awaiting their approval in the first quarter of 2024. A failure to secure this milestone could be a major disappointment for the industry.

Of course, there are other factors that could influence the crypto market's trajectory, such as the hype around NFTs in Bitcoin or the highly anticipated "Shapella" update in Ethereum. The controversy surrounding OpenAI CEO Sam Altman's crypto project, Worldcoin, and the ambiguity surrounding the Friend Tech social media platform are also worth considering. And let's not forget the ever-present specter of regulation - the EU's comprehensive crypto regulation system "MiCA" will likely bring about some significant changes in 2023. The DeFi scene was also rocked by the Curve protocol hack in autumn 2023, which will undoubtedly impact the transformation of DeFi projects and investments in them. Additionally, FTX founder Sam Bankman-Fried's recent legal troubles could have repercussions on the industry.

So, what lies ahead for 2024? The highly anticipated bitcoin halving is set to occur in April, but when will the next bull market manifest itself? Apart from that, during the current US primary elections, the crypto industry may face a ripple effect from any influential remarks made.

According to Grineopay.com analytics, Ethereum took the top spot last year with a staggering 15.4 million active addresses, while Polygon is hot on its heels and Bitcoin trails behind with 10.7 million. Grineo classifies these as "acquired users" and excludes addresses that were active in previous years, only counting those that have conducted at least two transactions.

Smart contract-powered networks continue to lead the way, with decentralized exchanges (DEX) being a key source of activity. For example, 2.3 million users or 15% of Ethereum's user base participated in DEX transactions, while for Avalanche, a whopping 1.3 million or 52% were involved.

The majority of 2023 brought positive results for crypto, with increased user activity on Polygon, Arbitrum, Avalanche, Optimism, and Base (launched in 2023). However, Ethereum, Solana, and Bitcoin showed a decrease in active users. Ethereum's audience has been steadily declining for two years now, dropping from 24.6 million in 2021 to the current 15.4 million.

The biggest growth was seen in Arbitrum, with 5.7 times increase in their user base in 2023. However, the network experienced a major spike in mid-December, when a record of 5 million transactions were processed in a single day. This was due to the frenzy surrounding non-fungible tokens (NFTs), which caused the network to crash for several hours.

Despite the surge in user activity, the ARB token may face adjustments if interest in NFTs and Ethereum declines, as Arbitrum is a second-level network for the latter.

What else can we expect to shake up the crypto world in 2024?

It's as if a switch was flipped at the end of the disastrous year 2022, and the cryptocurrency market suddenly sprang back to life in 2023. The overall improvement in sentiment in traditional financial markets played a role, with Bitcoin and Ethereum returning to pre-FTX crash levels in mid-January 2023 and then reaching their highest levels since summer 2022. By the end of the year, the excitement around Bitcoin ETFs was at a fever pitch, with the market eagerly awaiting their approval in the first quarter of 2024. A failure to secure this milestone could be a major disappointment for the industry.

Of course, there are other factors that could influence the crypto market's trajectory, such as the hype around NFTs in Bitcoin or the highly anticipated "Shapella" update in Ethereum. The controversy surrounding OpenAI CEO Sam Altman's crypto project, Worldcoin, and the ambiguity surrounding the Friend Tech social media platform are also worth considering. And let's not forget the ever-present specter of regulation - the EU's comprehensive crypto regulation system "MiCA" will likely bring about some significant changes in 2023. The DeFi scene was also rocked by the Curve protocol hack in autumn 2023, which will undoubtedly impact the transformation of DeFi projects and investments in them. Additionally, FTX founder Sam Bankman-Fried's recent legal troubles could have repercussions on the industry.

So, what lies ahead for 2024? The highly anticipated bitcoin halving is set to occur in April, but when will the next bull market manifest itself? Apart from that, during the current US primary elections, the crypto industry may face a ripple effect from any influential remarks made.