- CPI report was a positive surprise, but Median CPI rose at a 6.3%

- Surprise caused by large moves in small ‘tail’ items rather than a broad lessening of pressures

- More stories about how great wage and price controls are raising concerns

Last week, the stock market celebrated the soft CPI print, which surprised long-suffering forecasters on the downside for a change with a flat month-on-month (mom) print on the headline figure and only +0.3% on core CPI. Nostalgia requires me to note that we used to think of a 0.3% core print as a rare outlier on the high side: from 2008 through 2009, there were exactly six such prints and not a single one higher than that. Now, we consider this a major triumph and the stock market loved it.

There is a little clue in the fact that the bond market did not seem to regard it with such enthusiasm, with yields ending the week about where they started it. There is another clue in the fact that Median CPI rose 0.525% mom, which is still a 6.3% annual rate.

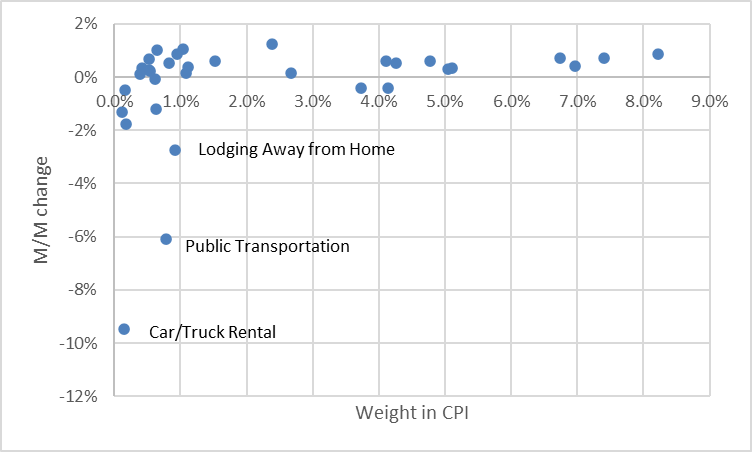

There are two ways that a weighted average can decline. One way is that some little parts of the average can move lower by a lot, leaving the rest of the distribution unchanged but lowering the average mechanically since a small category with a large move is mathematically as important as a large category moving a little. The other way is that most categories can shift together to a lower level.

One of the ways you diagnose such a thing is to look at the difference between the average (such as core CPI) and the median. In the second sort of movement I mentioned, average and median would both move similarly. In the first, the average would move but not the median. And that is just what happened. So within three or four minutes, we were pretty confident that the CPI miss was not quite the watershed event that we had been hoping for (these things generally take equity guys a little longer; they’ll figure it out by this Tuesday or so).

The chart illustrates the point. It shows (for core categories only, so no food nor energy) the weights of various categories on the x-axis, and the 1-month percentage change for July on the y-axis. You can see that most categories still rose on the month—in fact, about 60% of the weight in the CPI basket rose more than 0.5%, down from 70% last month (but prior to 2020, that number was about 20% most months). But a few small categories showed very large negative changes and that brought the whole number down.

The good news is that these are the sorts of categories that would be considered “transitory”…and finally are. The bad news is that these are not very emblematic of the overall pressure on prices, which remains quite high (as median CPI illustrates).

All of which is to say that I can understand why the U.S. President would want to crow about prices being unchanged on the month…but if I were him I wouldn’t parachute in with a big sign saying “Mission Accomplished” just yet.

Taking a Step Back…

I noticed something last week that made me very nervous. There was an article in the Washington Post on August 9 entitled “The way to fight inflation without rising interest rates and a recession” with the helpful subtitle “History shows targeted price caps work when accompanied by a public campaign.” It was about wage and price controls, and extolling the beauty and power of such policies.

Normally, I would ignore such hysterically ignorant writings—we all know, through lessons learned in very painful ways, that price controls do not work in theory nor in practice. However…

This followed an article back in January in the New York Times: “Price Controls Set Off Heated Debate as History Gets a Second Look.” I remembered that, because I laughed it off at the time. Once is just a ridiculous editor trying to fill column inches with provocative nonsense. Twice…starts to look like trial balloons.

If you do a quick internet search, you’ll also find that Rep. Jamaal Bowman (D-NY) recently introduced a bill that would create a Congressional task force analogous to the wage and price boards of yesteryear. This task force would have subpoena power to examine corporate earnings in housing, health care, energy, and transportation. Rep. Bowman quelled concerns about this bill by saying

“This is not about controlling prices across the entire economy. It’s really looking at where price-gouging is happening, where supply chain shortages are happening.”

This is brought to you by the same people who brought you Modern Monetary Theory, which was the driving philosophy behind the massive government spending that contributed mightily to the inflation we have now—the inflation that leads to them wanting wage and price controls.

I sure hope I am worrying for no reason at all. But I fear that we are going to see something like this tried, because when inflation fails to go down very far or very fast, there will be a perceived need to “do something.” And doing that something might lead to the old WWII standby, “bean loaf.”

Source: Library of Congress via https://dustyoldthing.com/share-the-meat-ration-recipes/

Disclosure: My company and/or funds and accounts we manage have positions in inflation-indexed bonds and various commodity and financial futures products and ETFs, that may be mentioned from time to time in this column.