DXY was smashed last night by the RBA!

AUD was weak anyway:

How long before oil snuffs the rally?

And metals:

Big miners (NYSE:RIO) dead cat:

EM (NYSE:EEM) gapped into the ceiling:

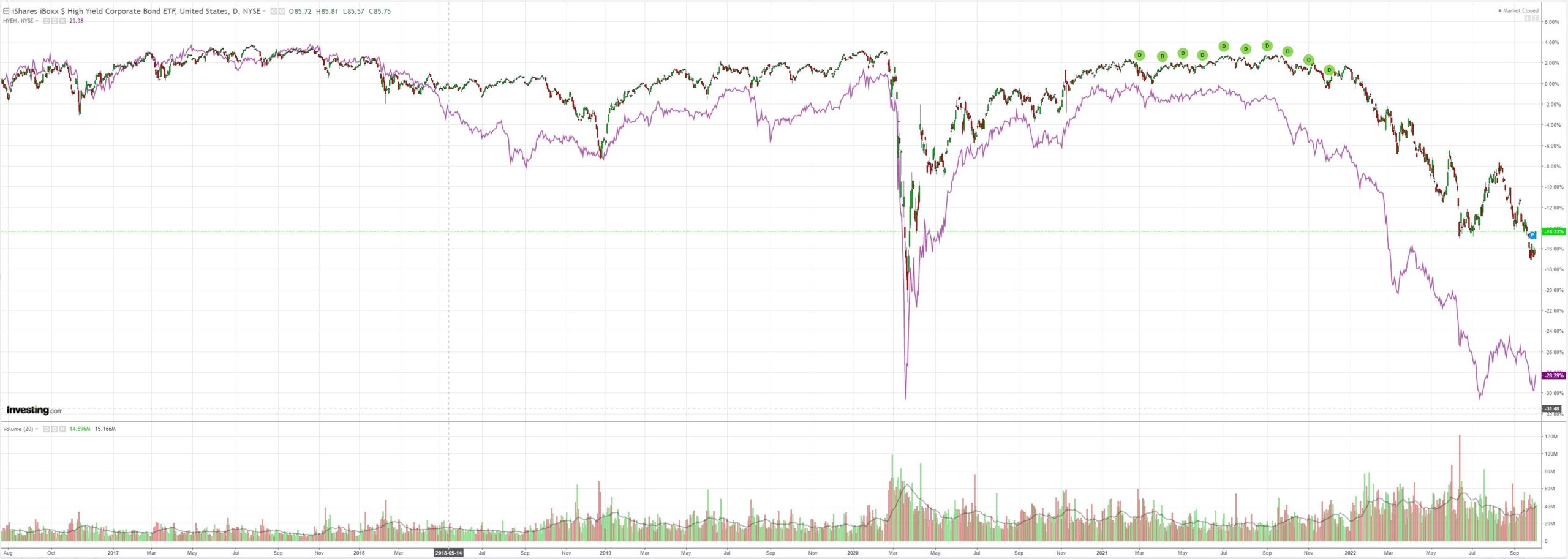

Junk (NYSE:HYG) too:

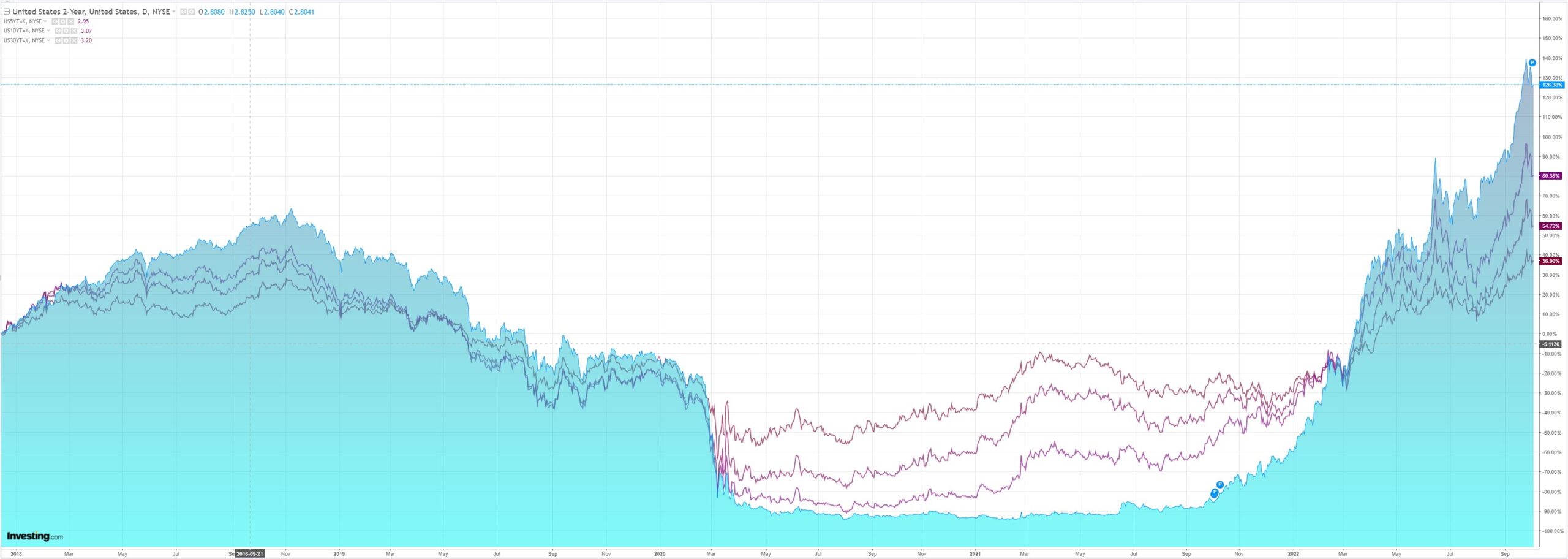

Ominously, yields rose:

Stocks snapped back:

The RBA has rarely had such an impact on global markets. But they were a coiled spring and it triggered the mechanism.

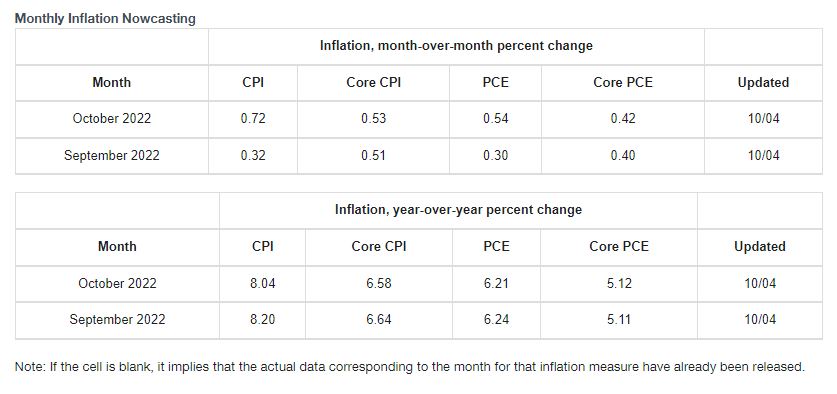

For me, this is still not the end of the selling in either AUD or broader markets. The Fed inflation nowcast is had actually been climbing for the past two months and needs more economic weakness to knocked down further from its monthly 40bps range:

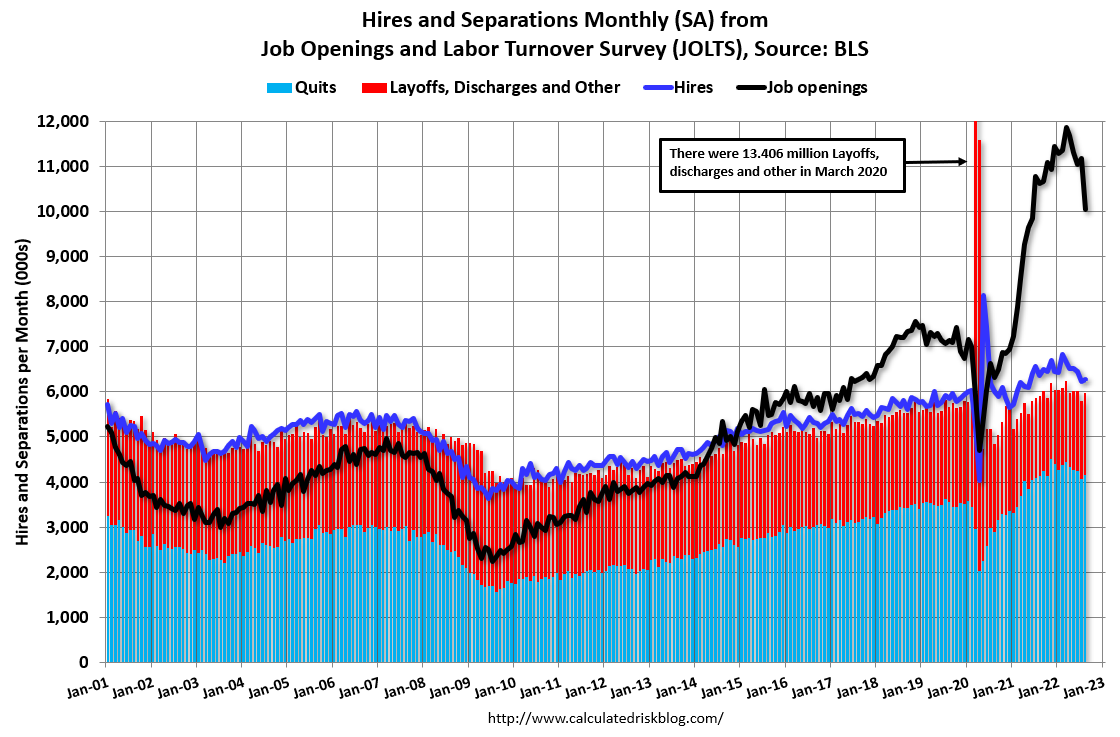

The fall in US job openings last night is helpful but not decisive. The Fed will want to see them back in the 6-7k range:

The Fed still hikes until something breaks.