This will be a pivotal week for the markets, with CPI on Tuesday, the June FOMC meeting on Wednesday, the ECB on Thursday, and the BOJ and US options expiring on Friday.

Markets aren’t sold on the Fed raising rates in June and see a 31% chance for a hike this week but a near 86% chance for a hike by the July meeting. It indicates that markets view the latest economic data as supportive of ongoing rate hikes, mostly due to the tight labor market, strong wage growth, and sticky inflation readings.

While headline CPI remains a focus, at this point, the underlying core CPI matters more, and that is expected to only fall to 5.2% in May, down from 5.5% in April. Core CPI is still way too high, way above the Fed’s target, and inconsistent with a 2% inflation rate.

I do not view this June meeting as critical from a rate hiking perspective; although a hot CPI report could sway the Fed to hike in June, the more important component will be what the Fed signals for the balance of the year through the dot plot.

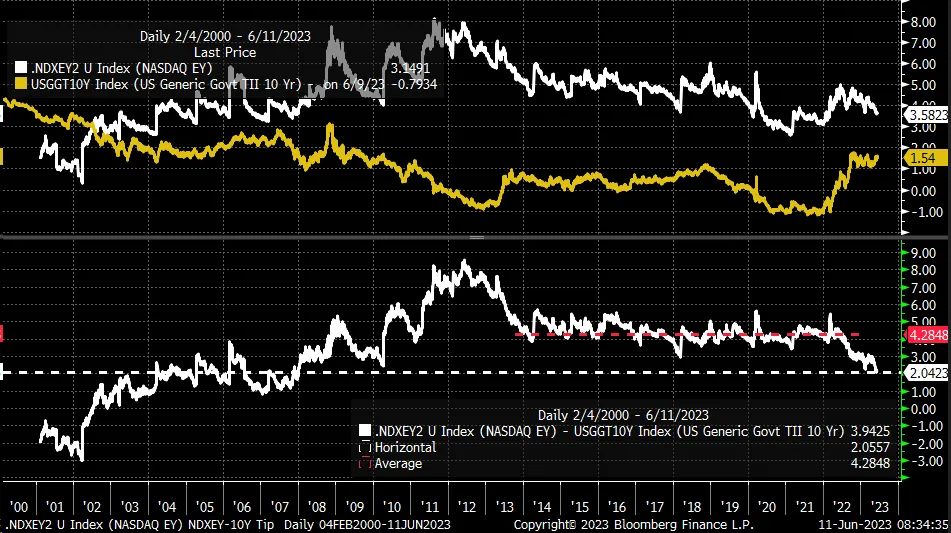

While the bond and the US dollar markets have been re-pricing the risk of the Fed pushing rates higher, the equity market has largely ignored the risk and focused on the prospects of the Fed cutting rates. This has pushed the Nasdaq 100 versus the 10-yr TIP spread to the lowest level in a couple of decades, with an earnings yield now just 2.04% above the 10-Year real yield. That is the narrowest spread since 2008 and is a new cycle low.

Perhaps the hype is cooling off and showing signs this market is about finished with this extreme. The Nasdaq 100 formed a 2b top on Friday after reaching a new intra-day high but finishing below the previous closing highs.

Additionally, the weekly Nasdaq 100 chart put in a nice reversal candle, and the index closed lower for the week and remains over-bought on the RSI and Bollinger Bands.

The S&P 500 is at a potential inflection point from a cycle standpoint.

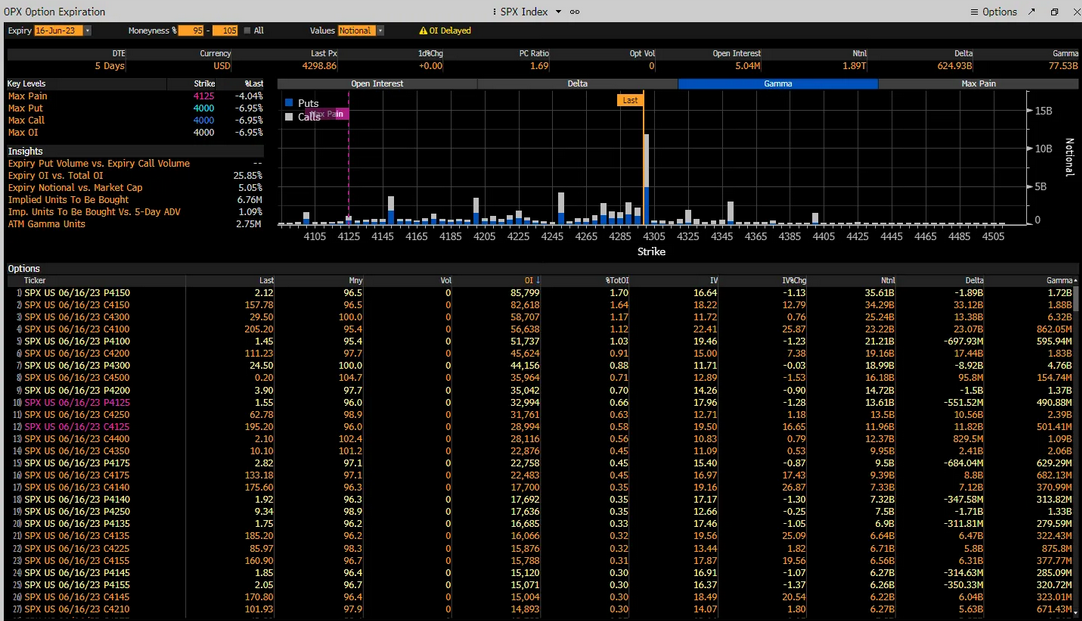

Additionally, the call wall for the S&P 500 is at 4,300. Because the index is in positive gamma, market makers will likely be sellers of the index as it goes higher, which will keep a lid on the S&P 500 rising until we get past Friday’s options expiration.

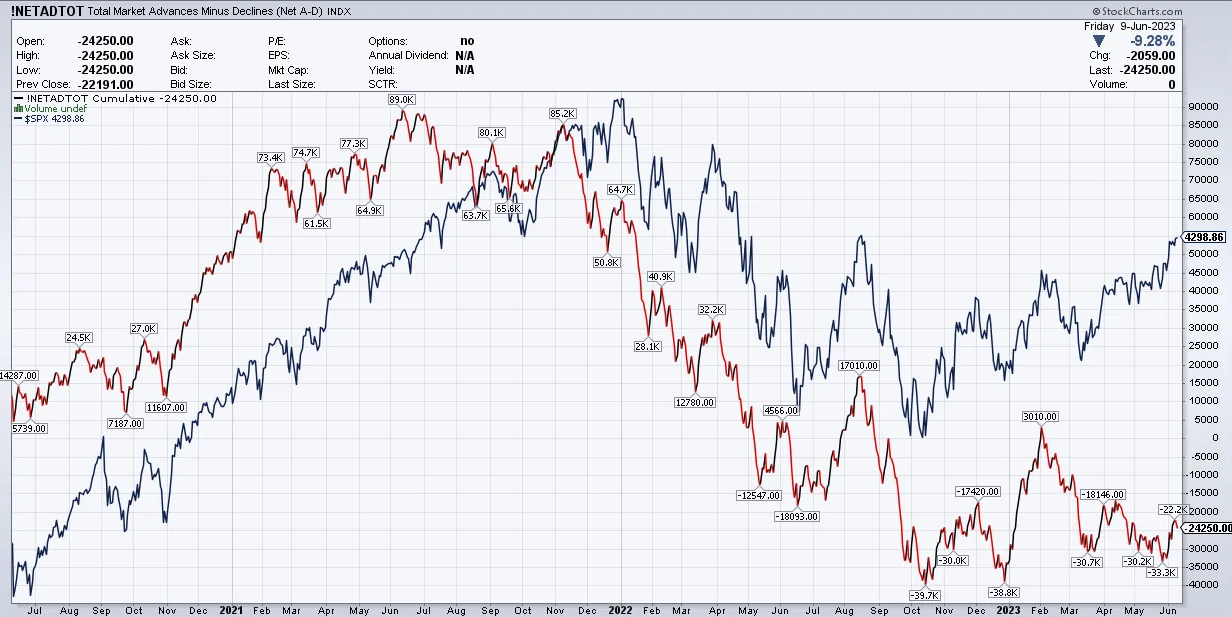

Additionally, the rally in the market remains weak, and the breadth remains narrow and unsupportive of a long-term sustainable rally. The advance-decline line for the entire stock market has been steadily declining since February, marking a very large divergence from the stock market’s direction.

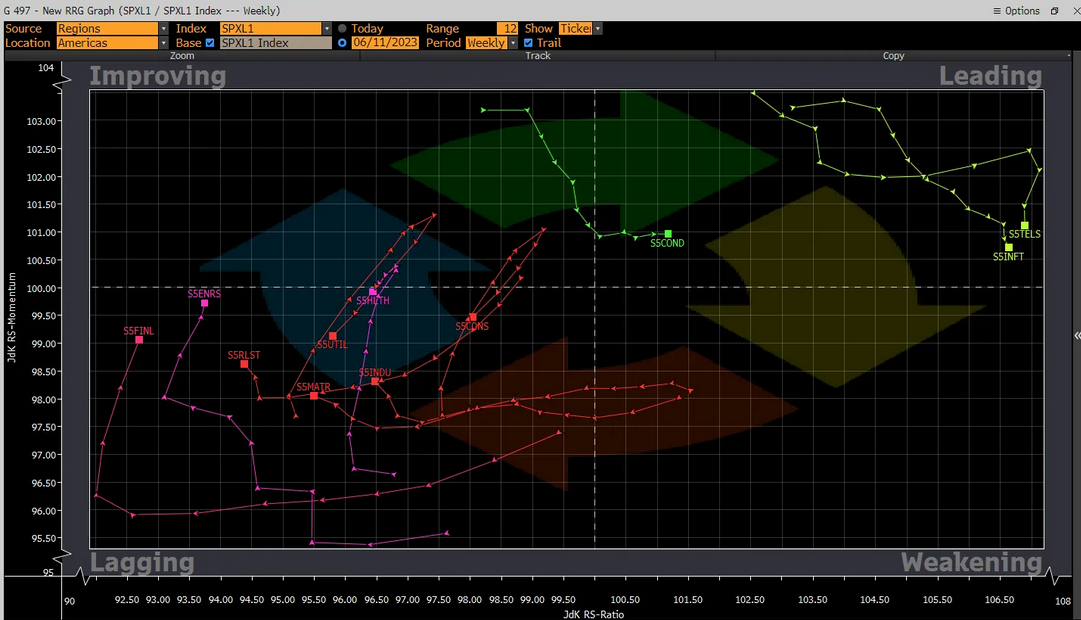

Over the last 12 weeks, the rally has been contained to 3 sectors, Technology, Communications, and Discretionaries. All three are heavily weighted to just 2 to 3 names that outweigh the sector and drive the returns.

This is a market on an index level that is overvalued and is trading higher with a narrow breadth while the overall advance-decline line is steadily declining.

This week’s Free YouTube Video: