The latest GDP data for the US economy presented a positive surprise, as it increased by 2.4% instead of the expected 1.8%. This suggests that the economy is improving and may not face a recession, contrary to what some banks were predicting for 2023.

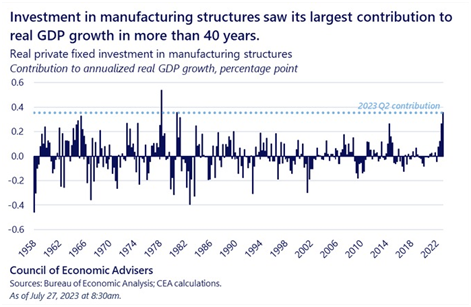

The growth was mainly driven by consumer spending and private investment, particularly in the manufacturing sector. This is excellent news, as it shows that businesses are confident about the economy's future and are expanding their production capabilities accordingly.

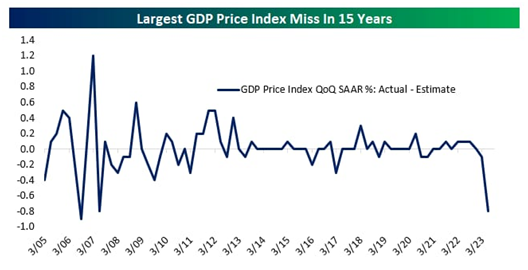

The latest data shows a quarterly inflation rate of 2.6% for consumption, which is a significant improvement from the 4.1% rate in the previous quarter. This indicates that the economy is growing at a healthy pace and prices are beginning to fall within the Fed's desired 2%-3% range.

When it comes to investing, there are two important things to consider. Firstly, consumers will be a major driving force for growth, so stocks in industries focused on consumer spending will likely perform well. Currently, experiences such as dining out, online shopping, and travel are thriving, so these industries may see strong earnings.

Secondly, with a strong economy comes a higher risk of inflation, which means that the Federal Reserve cannot be too accommodating in the coming months. This may not be a favorable environment for companies with high price-earnings ratios focused on growth. If the market continues to rally, it may be driven by the value components rather than the growth components.