- UiPath stock has undergone an impressive rally

- But is it based on sound fundamentals or just pure speculation?

- Let's dig deeper into the company's financials and find out

Thanks to the AI hype, UiPath (NYSE:PATH) surged 52% this year so far. And in a record-breaking week, it broke above the $17.60 resistance level formed last year.

But do the stock's fundamentals support such a rally, or was it merely fueled by the AI frenzy and speculation?

Let's try and find out using InvestingPro. You can analyze stocks of your choice yourself, sign up and start your free trial today!

What Does the Company Do?

UiPath provides an end-to-end automation platform offering a range of robotic process automation (RPA) solutions, primarily in the United States, Romania, and Japan. The company offers a suite of interconnected software to build, manage, execute, engage, measure, and govern automation within the organization.

Its platform combines artificial intelligence with desktop logging, back-end extraction of human activity and system logs, and intuitive visualization tools that allow users to discover, analyze, and identify processes to be automated in a centralized portal; offers low-code development environments that allow users in an organization to create attended and unattended automation without any prior coding knowledge.

It also offers centralized tools designed to manage, test, and deploy automations and ML models across the enterprise; enables customers to manage long-running processes that orchestrate work between robots and humans; enables users to monitor, measure, and predict the performance of automation in the enterprise; and helps enterprises ensure compliance with corporate standards.

In addition, the company provides maintenance and support for its software and professional services, such as training and implementation, to facilitate the adoption of its platform. The company operates in the banking, healthcare, financial services, and government sectors. UiPath Inc. was founded in 2005 and is headquartered in New York, New York.

Fundamentals at a Glance

To begin, we can access the financial statement history on InvestingPro to gather valuable insights such as:

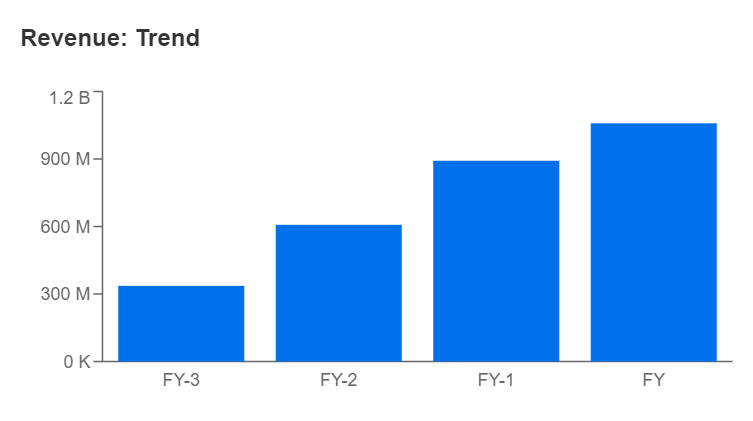

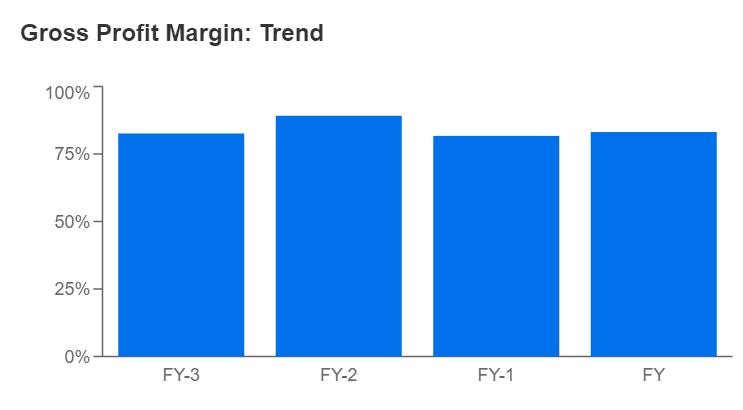

The revenue has trended up over time, and profit margins of over 80% have remained steady.

Source: InvestingPro

Source: InvestingPro

The growth rate of EPSd (diluted earnings per share) is still negative because most of the expenses come from solid marketing activity that impacts 70% of turnover at the moment (a growing company typically has high marketing costs).

Balance Sheet and Cash Flows

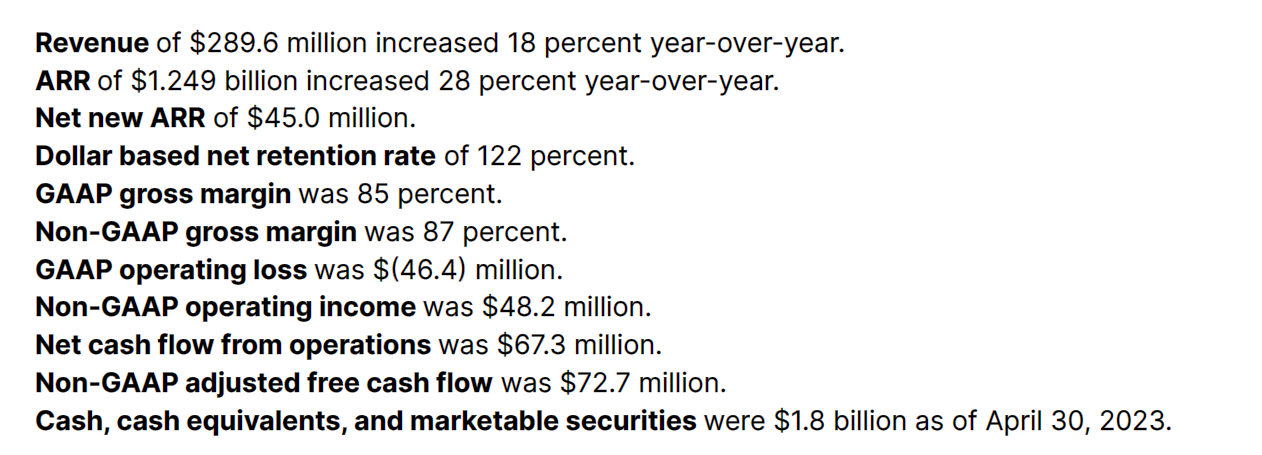

Between cash and short-term investments, UiPath has about 1.8 billion and total current assets of around 2.3 billion. Compared to current liabilities of 0.6 billion, this suggests an excellent short-term balance.

The Debt to Equity ratio is also excellent here, practically 0.

As expected, the company has reported positive cash flow for the first quarter. The company released the following data recently:

Conclusion

When evaluating a growing company, it is crucial to consider its future potential rather than comparing it to mature stocks. In my opinion, two key aspects stand out:

- 127% customer retention rate

- Prevalence of recurring revenues (subscription services).

These two points above represent a business model that should ensure sustainability in the medium to long term, allowing the company to continue to do well in two areas (robotics and AI) that have double-digit growth prospects in the coming years.

I believe discussing Fair Value for this company is insignificant currently, despite projections of a $19 price. If the trend continues, the future target range could be $22 to $27.

It's important to note that small-cap growth companies often experience significant volatility, as seen in this stock's recent post-quarterly performance, as it dipped 17% before recovering.

InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Disclaimer: The author owns UiPath shares. This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any asset is highly risky and evaluated from multiple points of view; therefore, any investment decision and the associated risk remain with the investor.