This article was written exclusively for Investing.com

- An almost one-way move hits a temporary wall

- Virtually impossible to pick tops and bottoms in any markets

- Demographics continue to favor agricultural commodities

- Weather will be critical over the coming months

- Never fear missing a move

Markets have an uncanny habit of rising to levels that often seem illogical, unreasonable, and irrational. They can fall to prices on the downside that seem beyond reason.

During April 2020, crude oil futures in the US moved below zero for the first time since they began trading on the CME’s NYMEX division in the early 1980s. When those holding long positions on futures contracts for landlocked crude oil that requires delivery in Cushing, Oklahoma, had nowhere to store the energy commodity, the price fell to an incredible negative $40.32 per barrel.

Crude oil became a bearish hot potato on the expiring May futures contract on Apr. 20. It fell to a price that few thought possible. Everyone knew that the price was unsustainable, but those holding long positions without access to storage had no choice but to liquidate at market prices. A commodity that falls to negative $40 could always fall further.

We have seen the same dynamic operate on the upside. In 2011, the cotton price rose to a record high of $2.27 per pound. Before 2010, cotton never traded over $1.18. While market participants knew the 2011 high was unsustainable, those holding short positions had no choice but to close the risk position at the market price.

Anyone who has been in the market for decades knows that saying never is nothing more than an invitation for “never” to occur.

Over the past months, corn, soybean, and wheat prices have experienced the most substantial rallies in years. The three leading grains rose to over six-year highs.

The trajectory of the rallies was so steep that common sense dictated the odds favored a correction. However, there is always a chance that stepping in front of a bull market charge could be financial suicide. Meanwhile, grain prices briefly hit a wall on the upside recently.

When a market runs out of steam on the upside, gravity can be a powerful force. Price momentum creates trends, and trends reflect the wisdom of the crowd. A market price is a level where buyers and sellers meet in a transparent environment. The momentum of a trend is the most significant factor for traders and investors as it establishes a price. Trends can ignore supply and demand fundamentals for extended periods, which is why the trend is always a trader or an investor’s best friend.

An almost one-way move hits a temporary wall

Nearby soybean futures on the CME’s CBOT division rose from $8.0825 per bushel in April 2020 to a high of $14.3825 in mid-January. The 77.9% move took the oilseed futures price to the highest price since June 2014, an over six and one-half year high.

Source, all charts: CQG

The weekly chart shows that soybean futures ran out of upside steam during the week of Jan. 19, falling to a low of $12.98 on Jan. 25 before recovering last week.

CBOT corn futures rose from $3.0025 per bushel in late April 2020 to a high of $5.4150 in mid-January. The over 80% gain took the price to a seven and one-half year high.

The weekly chart shows the correction to a low of $4.9250 on Jan. 25 before turning higher and putting in a bullish reversal on the weekly chart. March futures traded to a higher high of $5.5375 last week.

Meanwhile, the nearby CBOT wheat futures price rallied from $4.6825 in June 2020 to a high of $6.93 in mid-January 2021, a move of 48%. Soft red winter wheat futures traded to the highest price since May 2014.

The weekly wheat chart illustrates that wheat futures fell to a low of $6.2425 on July 25. Wheat recovered to over the $6.60 level at the end of last week. Gravity hit all three leading grain markets. Higher price levels have increased volatility.

Virtually impossible to pick tops and bottoms in any markets

Markets tend to teach us lessons repeatedly. They tend to rise a lot higher than most market participants believe possible during bullish trends and fall far lower than logic dictates during bearish periods.

Picking tops or bottoms in markets is nothing more than an exercise in ego. Trading with trends increases the odds of success.

The price of any asset is always the correct price at any point in time because it is the level buying and selling reach equilibrium. Markets move higher when buyers are more aggressive than sellers, and vice versa. When it comes to the grains, following the trend offered substantial profits over the past months. Even if the bullish path had ended in late January, those who followed the market’s momentum took a healthy chunk out of the soybean, corn, and wheat markets.

Once again, the market taught us that the power of momentum and trends is the most influential factor for success.

Demographics continue to favor agricultural commodities

The grain markets had been in bearish trends from 2012 through mid-2020. Attempts to rally ran into selling over the eight years. However, the fundamental equation’s demand side continued to underpin the markets causing higher lows even during the bearish period.

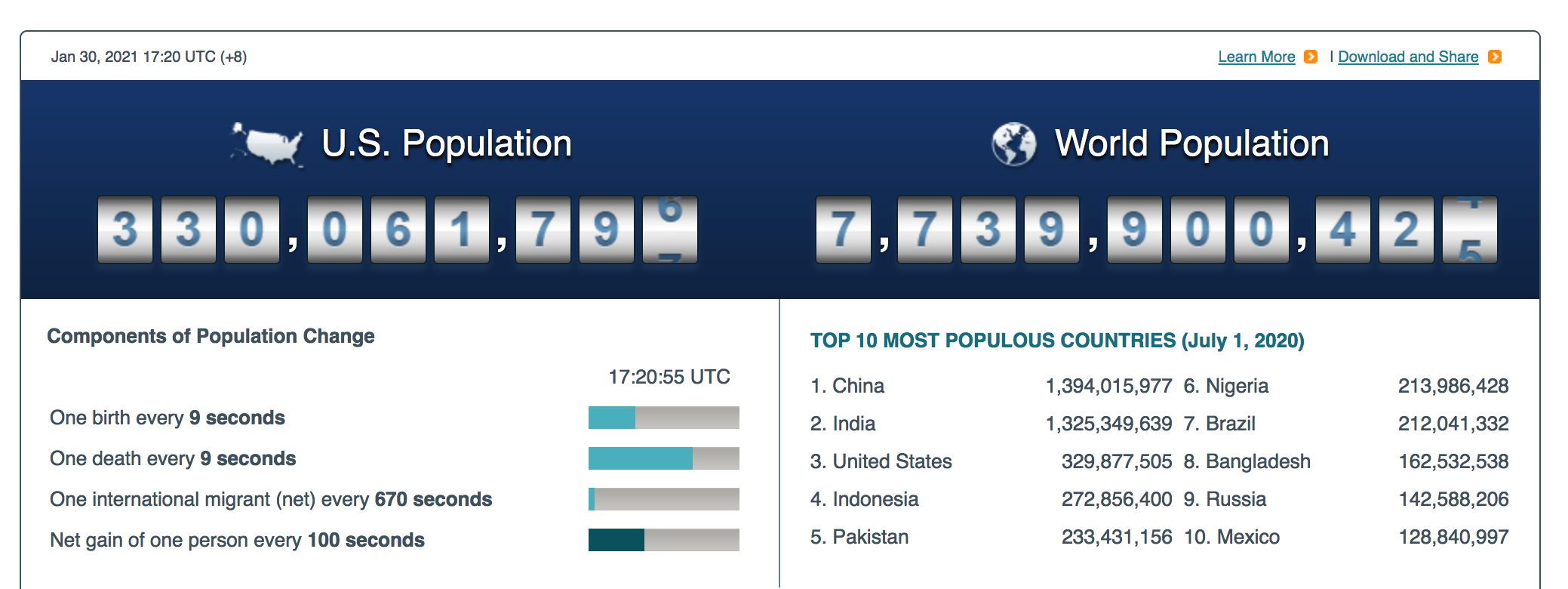

At the turn of this century, approximately six billion people inhabited the earth. As of Jan. 29, that number increased by 29%.

Source: https://www.census.gov/popclock/

As the chart above shows, the number of people requiring daily nutrition stood at nearly 7.74 billion at the end of last week. Grains are essential ingredients in many food products.

While farming technology has improved production efficiency, the weather in critical growing regions is always the most influential factor for supplies each year. Before the most recent rally, the 2012 highs in corn, soybean, and wheat futures markets were because of drought conditions.

Meanwhile, the growing addressable market for food worldwide has put pressure on prices despite eight consecutive years of bumper crops. The price action since the summer of 2020 came after a derecho impacted US supplies and dry conditions, and problems associated with COVID-19 in South America caused output below market expectations.

We are now going into the 2021 crop year in the northern hemisphere, with prices at the highest levels in over half a decade. Demographics continue to support grain prices as the global population grows by approximately 20 million per quarter.

Weather will be critical over the coming months

The US is the world’s leading soybean and corn producer and exporter and a leading exporter of wheat. Russia has been the leader in wheat exports over the past years. The planting season for the grains in the northern hemisphere will begin in March and April. Crops will grow from April through August, and the harvest comes during the fall months.

We are heading into the 2021 crop year with prices at the highest levels in over half a decade. Any weather issues that cause supply shortages over the coming months could continue to have an explosive impact on prices, given the ever-rising addressable market for agricultural products.

Aside from the weather, COVID-19 continues to pose unique challenges for farming and the supply chain. The move to the highest prices since 2013 and 2014 in the grain and oilseed futures arena since the summer of 2020 has put these commodities in a particularly vulnerable position going into the new crop year. Over the coming months, weather conditions may be the most significant factor in years as the world is more reliant on bumper supplies each crop year.

Never fear missing a move

Grain and agricultural commodity markets also face a declining US dollar, which is the benchmark pricing mechanism. A weakening dollar tends to push prices higher. Simultaneously, central bank liquidity and government stimulus at record levels in 2020 and 2021 are pushing inflationary pressures higher. While the weather is critical, an almost perfect bullish storm exists, created by a falling dollar, monetary, and fiscal policies.

Attempting to identify a trend is the logical approach for participating in markets for those looking for profits. Meanwhile, picking a bottom or a top is not rational as markets often move to unreasonable levels during trends.

Trading with trends avoids the human impulses that cause us to fear missing a move to the up or downside. A successful trader or investor operates with confidence instead of fear. Following trends precludes the fear of missing a move as it allows us to remain in risk positions without the pressure to pick a target on the up or the downside. Trend followers never buy lows or sell highs as they tend to be long at the top and short at the bottom. However, a trend-following approach allows for taking a substantial percentage out of a trend over time.

The fear of missing a move causes many market participants to buy tops and sell bottoms. A trend-following approach trains us to go with the flow, avoid emotional impulses, and achieve success through a market’s momentum.

I remain bullish on the grain markets but will pay strict attention to the price trends instead of the fundamentals over the coming months as I expect lots of volatility after the recent moves. Gravity briefly hit the grain markets over the past sessions.

A continuation of the bullish trend will depend on the weather, the currency markets, and the path of inflationary pressures. Since gravity is always a powerful force, the risk of corrections tends to rise with prices. Bull market corrections can be vicious, as the grain markets reminded us in January.