The US Congress faces a deadlock as the political impasse over lifting the debt ceiling worsens and short-term Treasury bond yields start to rise.

Monday saw a sharp increase to selling of short-term dated bills due for maturity within the next month. In fact, the yield for Treasury bills due to mature on November 12th rose as high as 0.178% before easing towards the end of the trading day yesterday. However, without a resolution in sight for the debt ceiling crisis, distortions to the bond market are likely to continue.

As we near the top range of the US government debt limit, Congressional leaders appear to be no closer to reaching a deal. Failure to reach a deal for an extension by the 3rd of November would likely see the superpower potentially run out of cash to meet its obligations. In fact, Treasury Secretary Jacob Lew has stated that the US will exhaust their cash management measures by the expiry of the deadline.

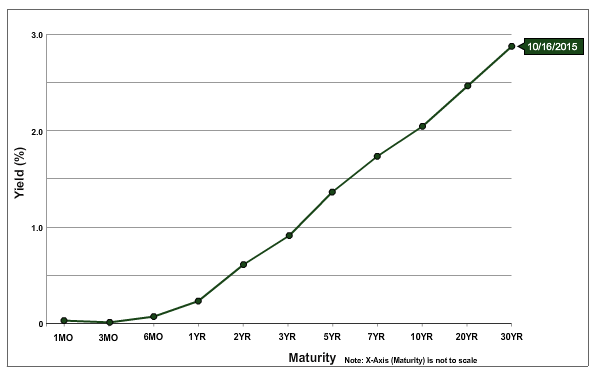

At this point, it is largely the short-term dated Treasury instruments that are being impacted by the uncertainty. However, as we approach the debt ceiling deadline the yield curve is likely to steepen for a wider range of maturity dates. Despite the absence of a deal, a new issuance of 3- and 6-Month dated bonds drew strong demand from the market.

The most likely scenario is that Congressional leaders will reach a compromise at the 11th hour that would see the debt limit extended for some time in exchange for a range of spending concessions. Given the previous debt ceiling show downs, we are likely to see November bond yields spike as we near the deadline and then decline sharply as a deal is reached. In fact, this scenario has plenty of support given that December and January Treasuries have traded at rates below those maturing in November indicating that the market does not expect a default.

Ultimately, a deal extending the debt ceiling is highly likely to be reached and the resultant fall-out within the bond market will be limited to spiking yields. However, never underestimate the ability of Congress to cause volatility within the debt markets as they vacillate over the outcome.