Originally published by Guppytraders.com

The rebound rally in gold is well established with a move above $1220. The upside target is near $1290. Its good to see the gold uptrend continuing but the upside target delivers 5.7% profit. Rather than trade gold there are more effective and profitable ways to trade this rebound. Golds companion, silver, has similar characteristics but offers a higher return for the same behavior.

Silver lags the gold price behavior. Silver has a resistance level near $18.75 and then at $21.00. The $18.75 level is the equivalent to the $1290 resistance level on the gold chart. Silver lags gold so the silver price is only just moving above the Traders ATR breakout line near 17.30.

A breakout at this level has target near $18.72. This trade offers a 8.3% return compared with a 5.7% return from gold for the same price behavior move.

Silver has a longer term upside target of $21.00. That’s 16.6% from the current price near $18.00.

Silver is slower to move but it has more room to move and this delivers better profits. Note the silver price is shown in cents.

The ATR breakout level is near $17.21. This was decisively broken. This breakout is confirmed with the Guppy Multiple Moving Average. The long term GMMA has compressed. The short term GMMA is moving above the long term GMMA.

The uptrend rally starting 2016 December with silver was well defined using a Guppy Multiple Moving Average indicator. The long term GMMA is compressed and this generally shows investors are changing their attitude towards silver.

The developing separation in the long term GMMA confirms a continuation of the rally uptrend. The same confirmation features are seen on the gold chart. Aggressive traders use the ANTSSYS method to trade the rally breakout above $17.60 and they buy on the dips. Cautious traders and investors wait for rebound proof with a move above $18.00 before joining the rally for a move towards $21.00.

The similarity in the patterns on the gold and silver charts means the silver price follow the behaviour of the gold price. The best trade is to watch gold and execute the trade on the same price move in silver .

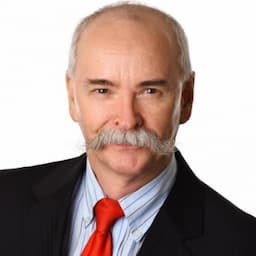

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.