- Investing in cheap undervalued stocks can offer potential growth without the need for significant capital.

- Using the InvestingPro Stock Screener, I searched for the top ten stocks currently trading under $20 that present compelling investment opportunities.

- Despite a difficult near-term outlook, the stocks chosen for this list demonstrate attractive business metrics and long-term growth potential.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

Investing in cheap, high-quality stocks priced under $20 can offer investors an exciting opportunity to diversify their portfolio and potentially capitalize on underpriced assets.

Using the InvestingPro Advanced Stock Screener, I've identified these ten stocks based on their strong long-term tailwinds and significant upside potential according to InvestingPro's AI models.

Want to find stocks with explosive growth potential, just like the 10 we identified?

InvestingPro's best-in-breed and newly upgraded screener empowers you to:

- Target (NYSE:TGT) underpriced stocks poised for significant returns.

- Leverage advanced filters to identify hidden gems.

- Gain a monthly edge with AI-picked buys and sells (less than $9/month).

Subscribe now for less than $9 a month and position your portfolio one step ahead of everyone else!

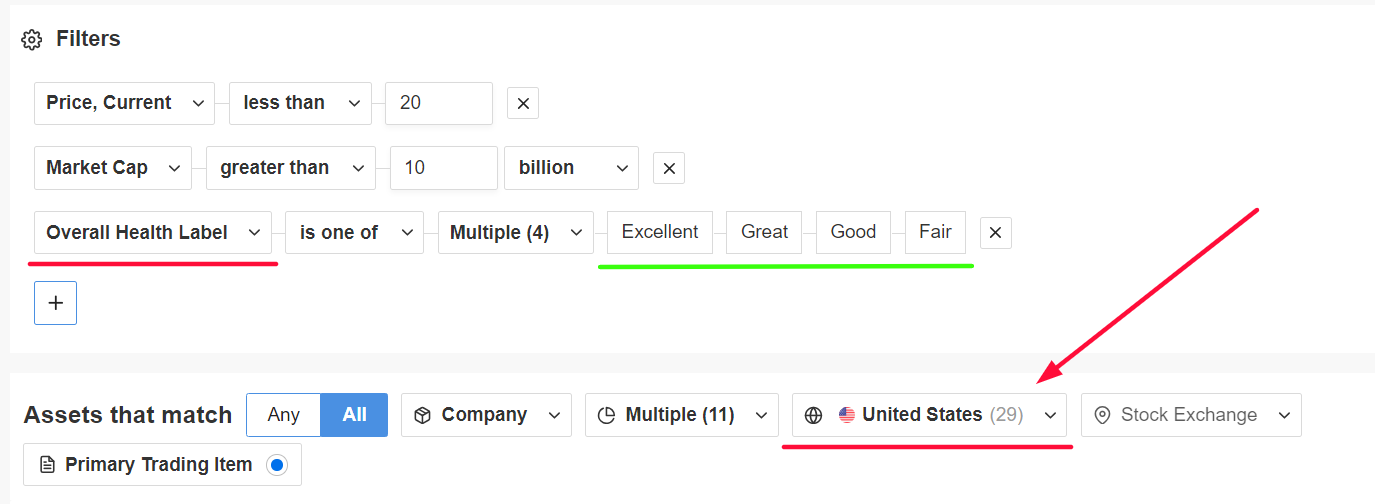

Now, for starters, first scanned for stocks priced below $20, with a market cap greater than $10 billion, and that have an InvestingPro Overall Health Label of ‘Excellent’, ‘Great’, ‘Good’, or ‘Fair’.

Source: InvestingPro

Once the criteria were applied, I was left with a total of 29 companies.

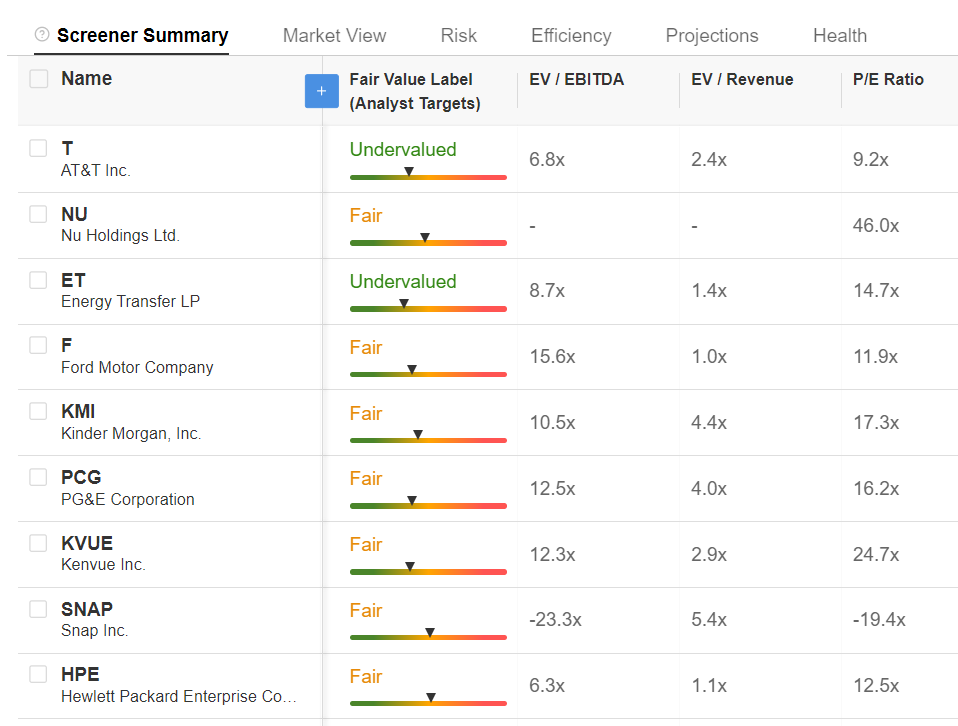

Source: InvestingPro

Here are ten stocks priced under $20 that investors may consider adding to their portfolios, sorted by their market value.

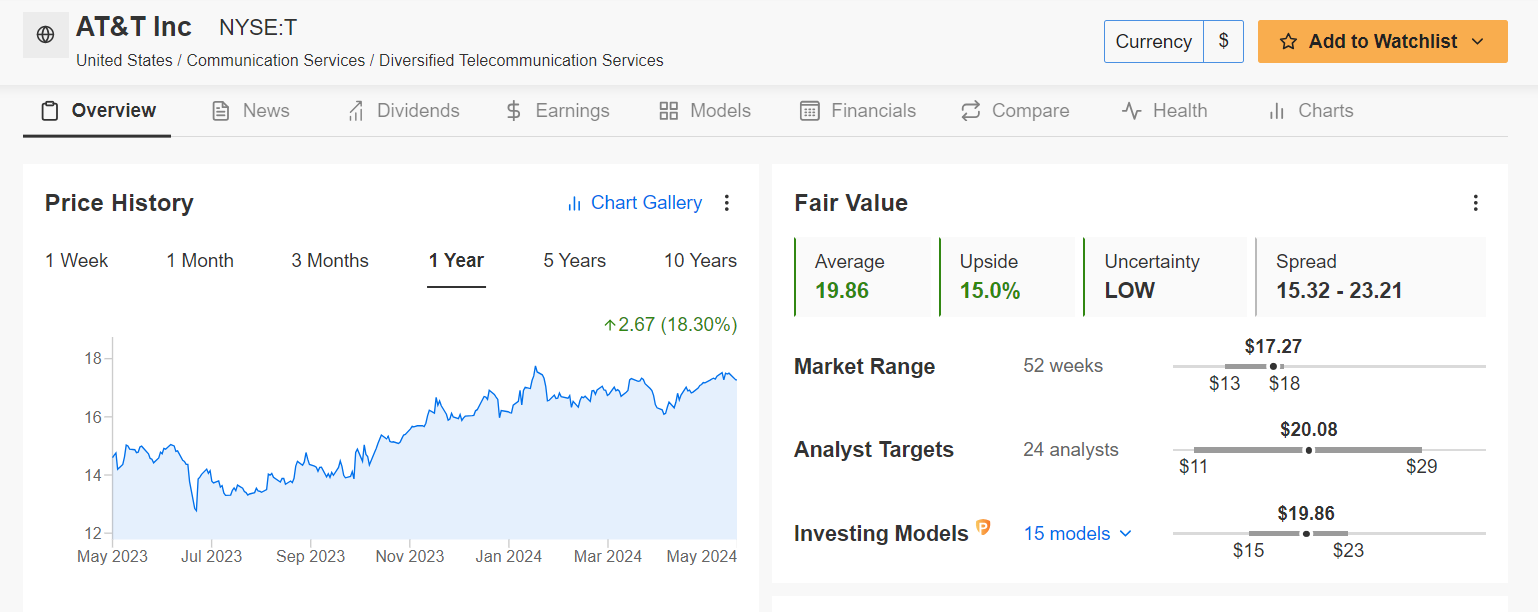

1. AT&T - Telecommunications

- Tuesday’s Closing Price: $17.27

- Market Cap: $123.8 Billion

AT&T (NYSE:T) is the world's largest telecommunications company and the leading provider of mobile telephone services in the U.S.

The Dallas, Texas-based blue-chip has carried out sweeping measures to return to its telecom roots as it transitions from a struggling media conglomerate into a more streamlined organization with a cleaner, healthier balance sheet.

Additionally, AT&T's extensive 5G rollout, robust fiber network expansion and partnerships for streaming services like HBO Max provide multiple avenues for growth. The telecoms giant’s recent focus on debt reduction and operational efficiency also supports its positive outlook.

InvestingPro Insights: AT&T boasts a solid Financial Health Score, reflecting its stable cash flow and balance sheet as well as its attractive valuation.

Source: InvestingPro

ProTips also points out that AT&T has paid out an annual dividend to shareholders in every year dating back to 1983, offering investors a reliable income stream.

Current Fair Value estimates indicate that T stock is trading at a substantial discount. InvestingPro’s AI models predict a potential upside of 15% from the current market value of $17.27. That would bring shares closer to their ‘Fair Value’ price target of $19.86.

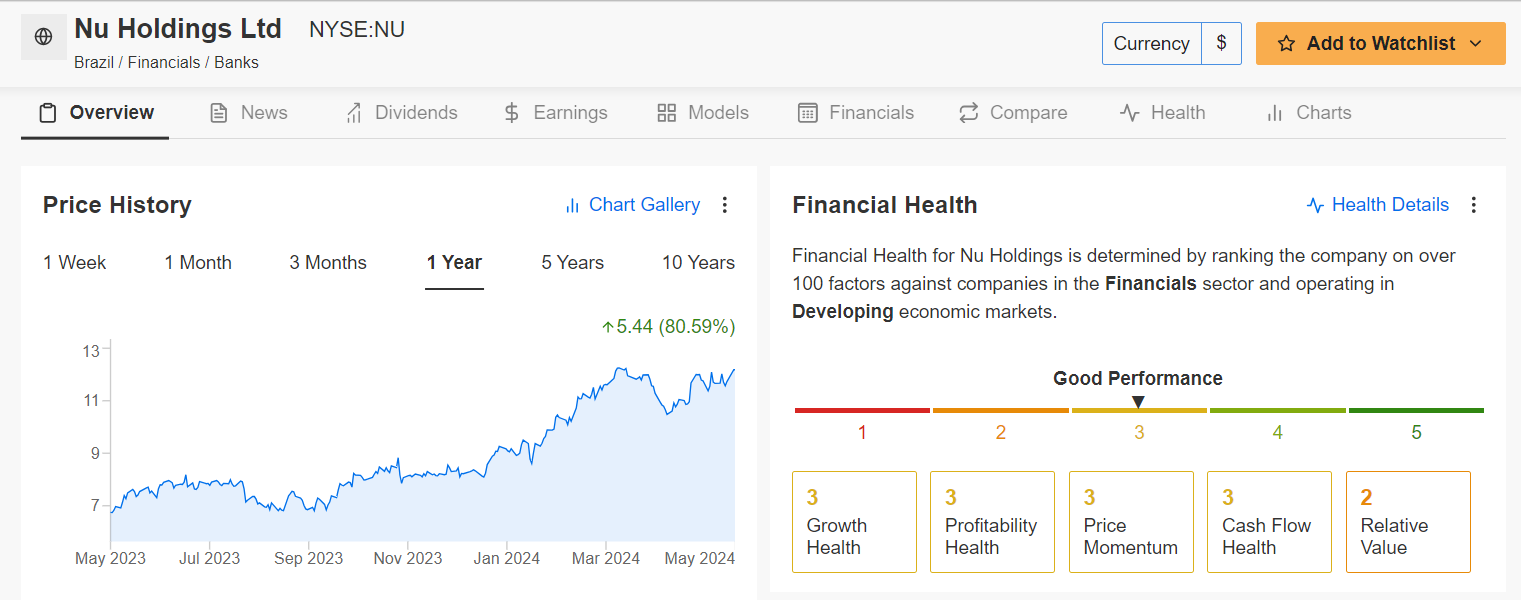

2. Nu Holdings - Financial Technology

- Tuesday’s Closing Price: $12.19

- Market Cap: $58.2 Billion

Nu Holdings (NYSE:NU) is a major player in Latin America's digital banking sector, with 80.4 million customers in Brazil and 1.5 million between Mexico and Colombia.

The Brazil-based fintech company is expected to benefit from the growing adoption of digital financial services in the region, providing significant growth potential.

Moreover, its innovative products and user-friendly platform continue to attract a large customer base, driving revenue growth. The strategic expansion into new markets further supports its growth trajectory. It should also be noted that Nu Holdings is a top Warren Buffett stock, which underscores its strong investment potential.

InvestingPro Insights: Nu Holdings has an above-average Financial Health Score of 2.98 out of 5.0, supported by its rapid customer growth and expanding product offerings.

Source: InvestingPro

ProTips also highlights several positive trends the financial services company has working in its favor, including a healthy growth outlook and improved profitability trends.

Moreover, Wall Street remains optimistic about the neobank, as per an Investing.com survey, which revealed that 11 analysts have a Buy-equivalent rating on the stock vs. five Hold-equivalent ratings and just one Sell rating. The average NU stock analyst price target is around $12.50, representing an upside of approximately 3% from current levels.

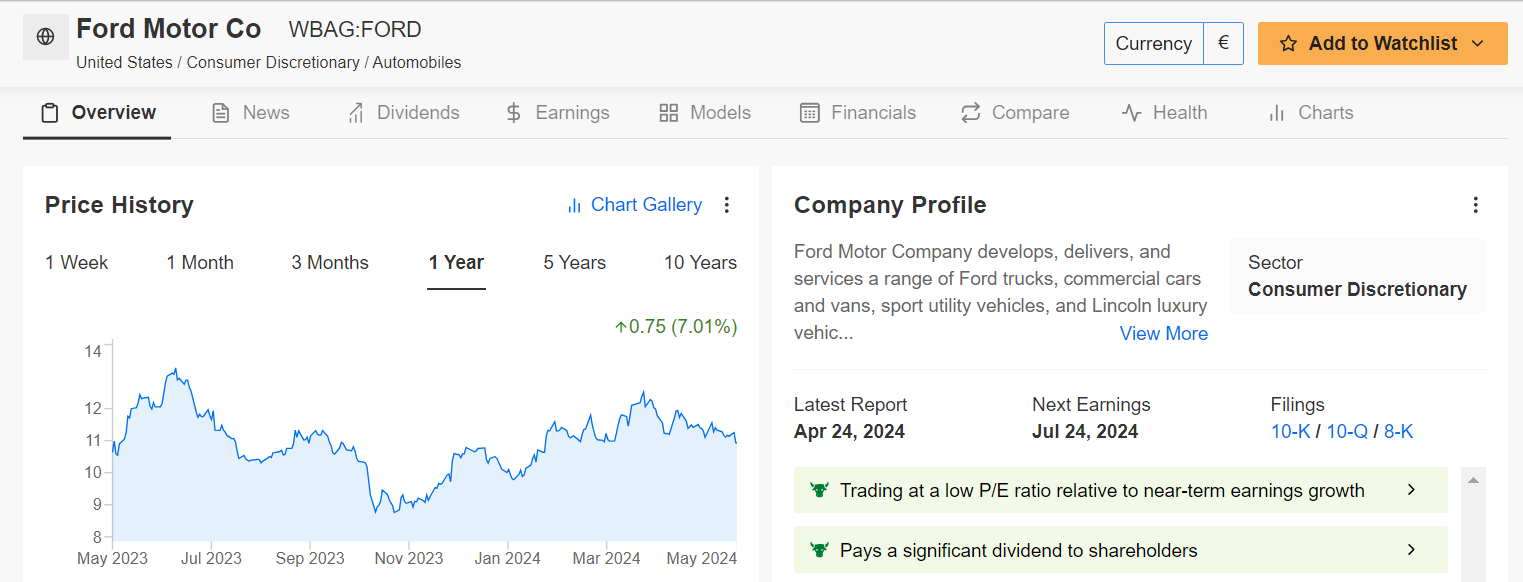

3. Ford - Automotive

- Tuesday’s Closing Price: $11.68

- Market Cap: $46.6 Billion

Ford (NYSE:F)'s aggressive push into electric vehicles (EVs) and its strong legacy in traditional auto manufacturing make it a compelling investment.

The Detroit-based automaker’s strong brand recognition and leadership in the truck market provide a solid foundation for future success. The launch of new EV models like the F-150 Lightning is expected to drive future growth.

Additionally, Ford’s investments in autonomous driving technology and strategic alliances for EV battery production bolster its long-term prospects. The company’s robust sales in emerging markets also contribute to its growth outlook.

InvestingPro Insights: Ford's Financial Health Score is strong, highlighting its successful restructuring efforts and strategic investments in EV technology.

Source: InvestingPro

As per ProTips, the carmaker’s tremendously low valuation combined with its strong dividend and improving fundamentals make it an attractive option amid the current macro environment.

Indeed, Wall Street has a long-term bullish view on F stock, with 24 out of 29 analysts surveyed by Investing.com rating it as either ‘Buy’ or ‘Hold’. Shares have an average analyst price target of $14.21, representing a potential upside of 21.7% from last night’s closing price of $11.68.

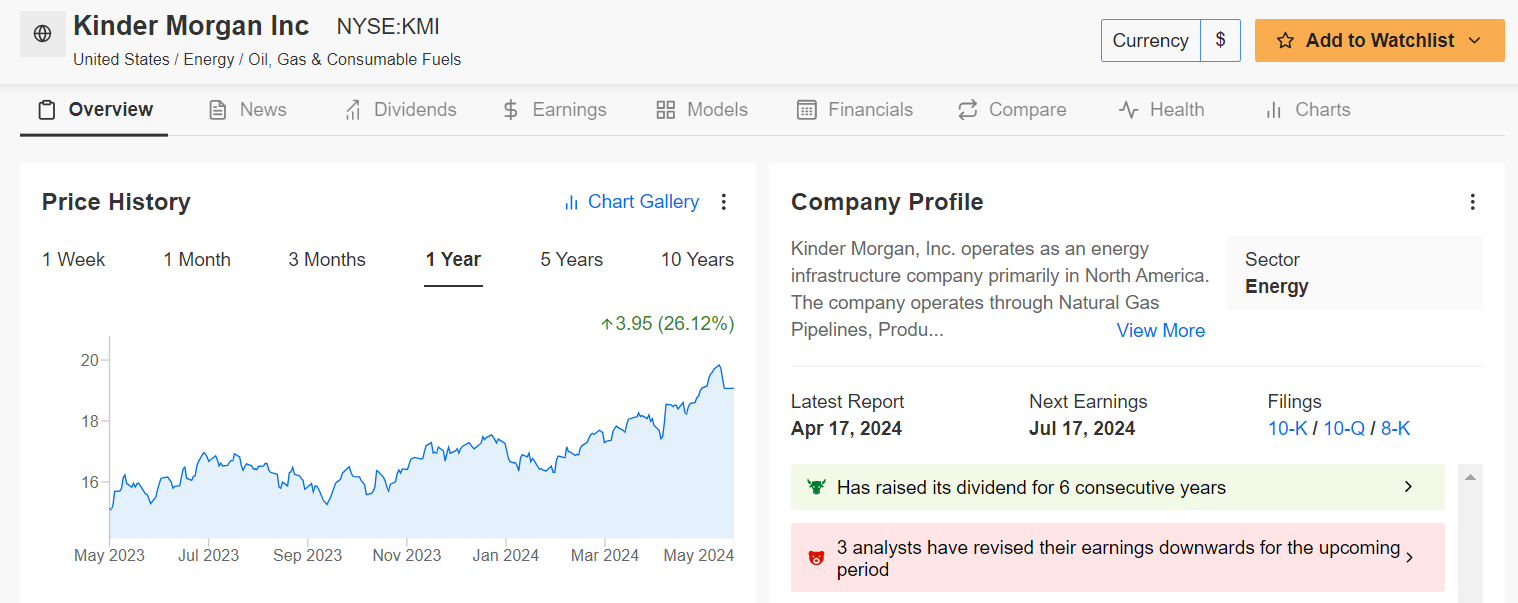

4. Kinder Morgan - Energy

- Tuesday’s Closing Price: $19.08

- Market Cap: $42.3 Billion

Kinder Morgan (NYSE:KMI) is a leading energy infrastructure company with a vast network of pipelines and storage facilities, making it a significant player in the U.S. energy sector.

The Houston, Texas-based energy firm - which operates approximately 85,000 miles of pipelines and 152 terminals - is the largest U.S. independent transporter of refined petroleum products and of carbon dioxide, which positions it favorably in a market where efficient logistics are crucial.

The ongoing demand for energy and the company's stable cash flow make it a solid investment. The shift towards cleaner energy sources and Kinder Morgan’s investments in renewable energy projects provide additional growth opportunities.

InvestingPro Insights: Kinder Morgan has a reasonable ‘Financial Health Score’ due to its strong cash flow and promising fundamentals.

Source: InvestingPro

In addition, Kinder Morgan also offers investors an annual dividend payout of $1.15 per share at a sky-high yield of 6.03%, one of the highest in the midstream energy sector. The energy pipeline giant has increased its dividend payout for six years in a row.

Not surprisingly, KMI stock remains a favorite on Wall Street, with 19 of 20 analyst ratings collected by Investing.com reflecting a bullish recommendation with fairly high conviction. Among those surveyed, Kinder Morgan shares, which closed last night’s session at $19.08, had roughly 8% upside potential.

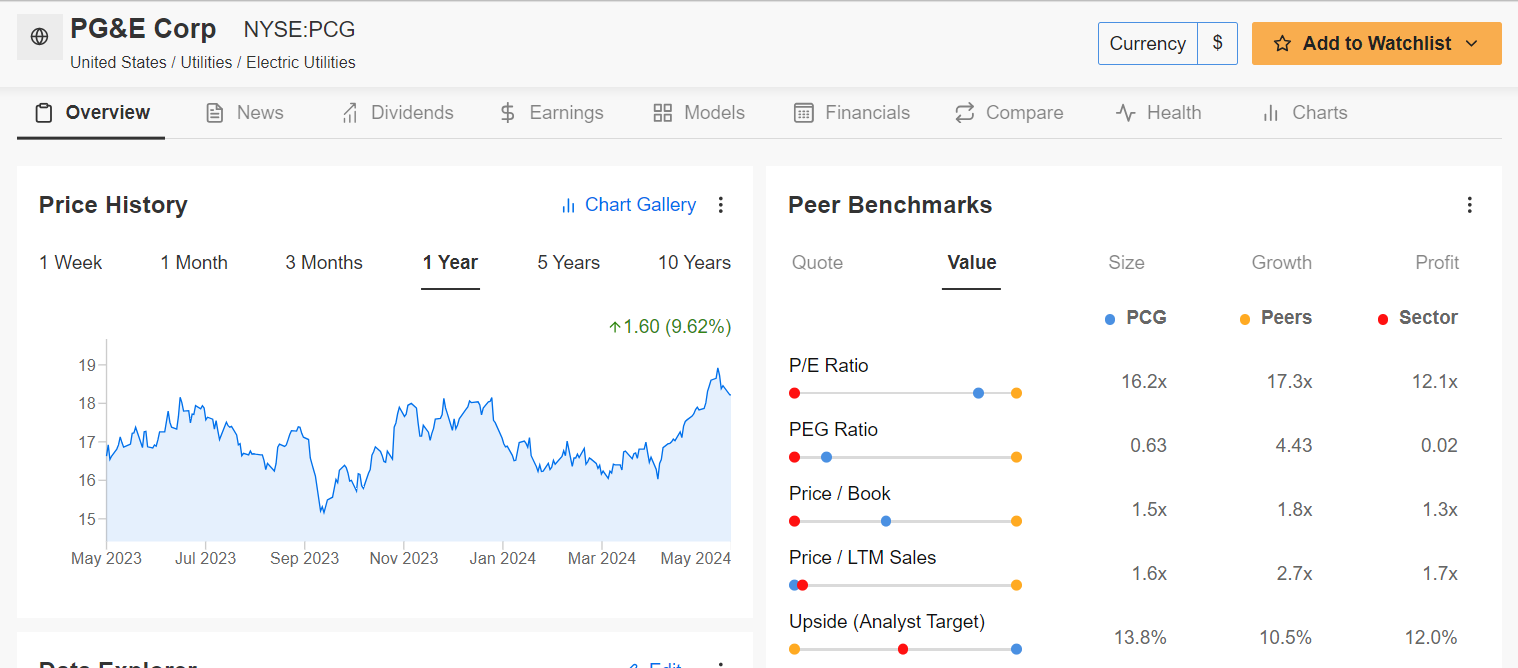

5. PG&E Corporation - Utilities

- Tuesday’s Closing Price: $18.23

- Market Cap: $39 Billion

PG&E Corp (NYSE:PCG) is a key player in California’s energy market, driving advancements in renewable energy integration. The company provides natural gas and electricity to 5.2 million households in the northern two-thirds of the state.

The electric utilities provider is positioned to benefit from the ongoing infrastructure investments and regulatory support for utility companies. Its efforts to improve safety and reliability should enhance its market position.

Furthermore, the ongoing push towards renewable energy and modernization of the grid provides growth prospects. Additionally, PG&E’s strategic cost management initiatives are expected to improve its financial performance.

InvestingPro Insights: PG&E’s Financial Health Score reflects its improving operational efficiency and financial stability, combined with its attractive valuation.

Source: InvestingPro

With a P/E ratio of around 16.0, PCG stock comes at a substantial discount when compared to industry peers such as NextEra Energy (NYSE:NEE), Duke Energy (NYSE:DUK), and Dominion Energy (NYSE:D), which trade at 21.1-times, 24.5-, and 27.9-times forward earnings, respectively.

It is worth mentioning that most analysts remain generally bullish on PG&E’s stock, as per an Investing.com survey, which revealed that all 17 analysts covering the name rated it as a ‘Buy’ or ‘Hold’. Among those surveyed, PCG stock had a roughly 10.6% upside potential to $20.16/share.

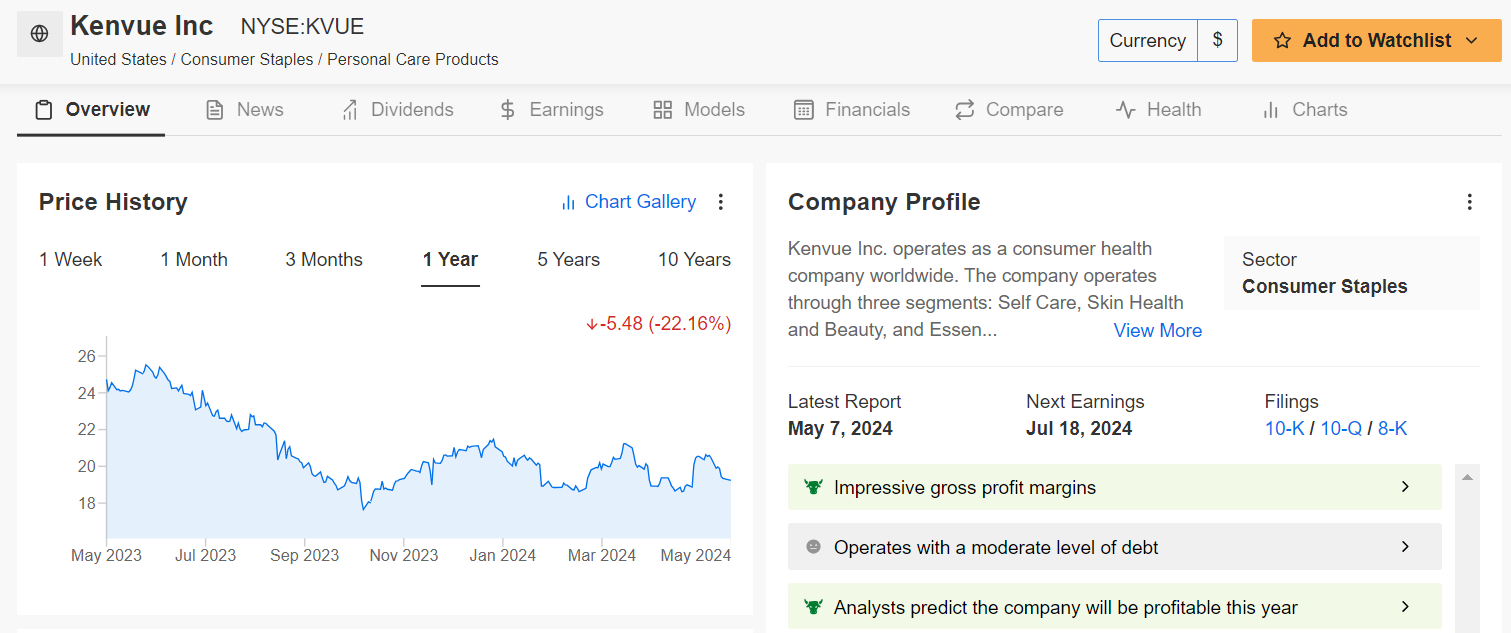

6. Kenvue - Consumer Goods

- Tuesday’s Closing Price: $19.25

- Market Cap: $36.9 Billion

Kenvue(NYSE:KVUE)’s impressive portfolio includes some of the most trusted and recognized brands in the health and wellness industry.

Formerly the Consumer Healthcare division of pharmaceutical giant Johnson & Johnson, Kenvue (NYSE:KVUE) is the proprietor of well-known brands such as Band-Aid, Tylenol, Visine, Aveeno, Benadryl, Listerine, and Neutrogena skin and beauty products.

The New Jersey-based company is expected to capitalize on the growing consumer focus on health and wellness. Its diverse product portfolio supports stable revenue growth. The consumer health firm’s strong brand recognition and innovative product launches continue to drive consumer demand.

InvestingPro Insights: Kenvue has a decent Financial Health Score, underpinned by strong brand equity and consistent demand.

Source: InvestingPro

Demonstrating the strength and resilience of its business, ProTips mentions that Kenvue has a healthy profitability outlook thanks to its robust earnings prospects and upbeat gross profit margins.

The AI-powered quantitative models in InvestingPro point to a gain of 8.4% in KVUE stock from Tuesday’s closing price of $19.25, aligning it with its 'Fair Value' price target estimated at $20.86 per share. Kenvue made its trading debut in a well-received IPO in May 2023.

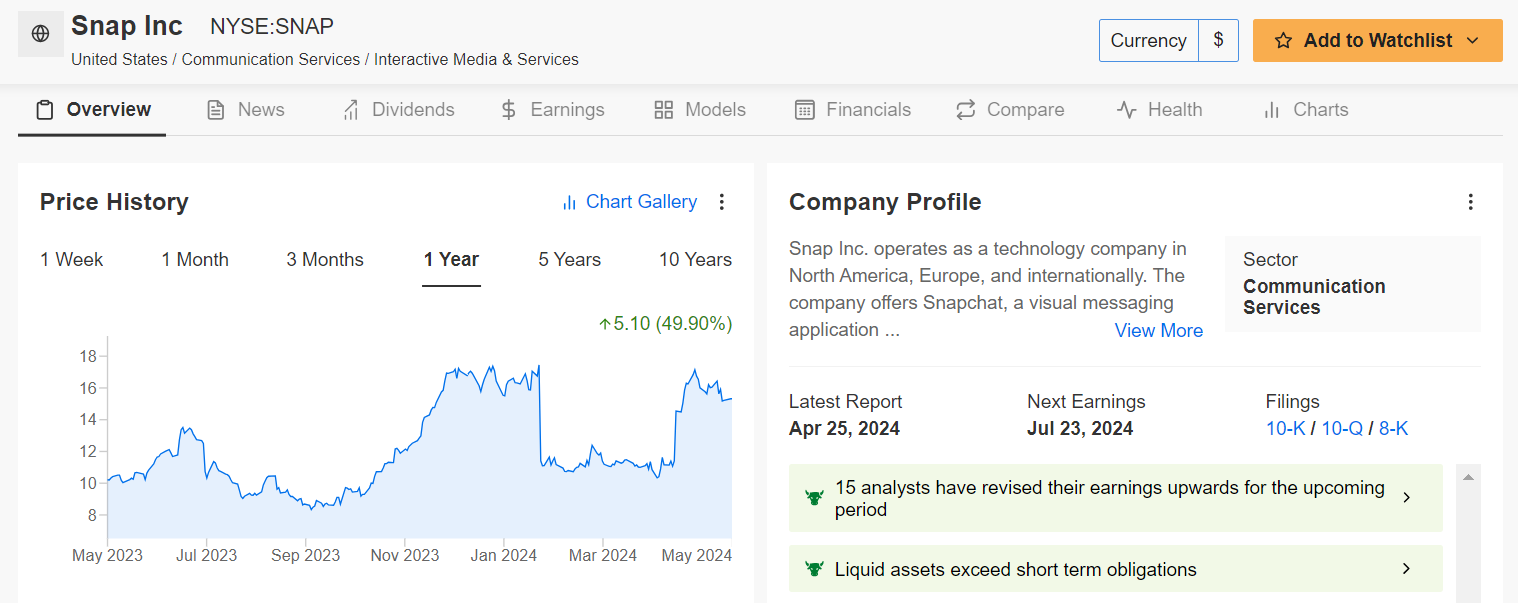

7. Snap - Technology

- Tuesday’s Closing Price: $15.32

- Market Cap: $25.1 Billion

Snap (NYSE:SNAP), the parent company of social media messaging app Snapchat, continues to attract a young demographic, driving user growth and engagement.

The Santa Monica, California-based tech company’s improving monetization strategies through advertising, augmented reality (AR) enhancements and unique user experiences are key growth drivers.

Snap’s focus on AR and immersive experiences sets it apart in the crowded social media landscape. Additionally, the social media firm’s partnerships and acquisitions aimed at enhancing its technology portfolio provide further growth avenues.

InvestingPro Insights: Snap’s Financial Health Score is solid, reflecting its growing user base and improving revenue streams.

Source: InvestingPro

In a sign of increasing optimism, EPS estimates have seen 15 upward revisions in the past 90 days, according to InvestingPro, as it benefits from increased ad spending and user engagement on its platform.

The present valuation of SNAP suggests it is slightly underpriced, as indicated by the InvestingPro AI models. There's a possibility of a 5% increase from last night’s closing price of $15.32, moving it closer to its 'Fair Value' set at $16.08 per share.

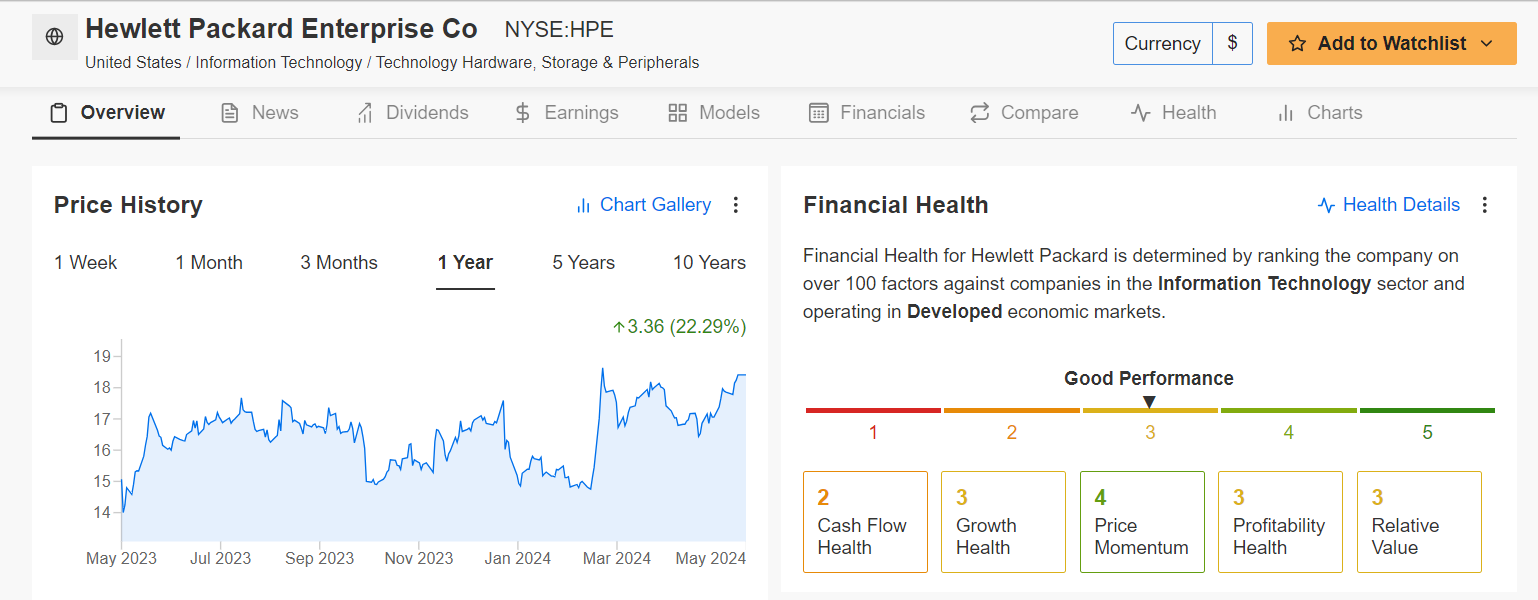

8. Hewlett Packard Enterprise - Technology

- Tuesday’s Closing Price: $18.43

- Market Cap: $24 Billion

Hewlett Packard Enterprise (NYSE:HPE) was founded in 2015 as part of the splitting of the Hewlett-Packard company. It is a business-focused organization that works in servers, storage, networking, containerization software, and consulting and support.

HPE's focus on edge computing, cloud services, and AI-driven solutions positions it well in the evolving tech landscape. Its leadership in edge computing and hybrid cloud solutions positions it at the forefront of digital transformation.

The Texas-based company’s shift to subscription-based models should enhance revenue predictability. Additionally, HPE's investment in next-generation technologies like AI and machine learning drives innovation and growth.

InvestingPro Insights: Hewlett Packard Enterprise boasts a high Financial Health Score of 2.8/5.0, supported by its strategic pivot and strong cash flow.

Source: InvestingPro

As per the InvestingPro model, HPE trades at a minor discount. There's potential for a 3% increase from Tuesday's closing price of $18.43, bringing it towards its Fair Value of $18.98 per share.

In addition, Wall Street remains optimistic about the communication equipment company, as per an Investing.com survey, which revealed that only one of 17 analysts covering the stock rated it as a ‘Sell’.

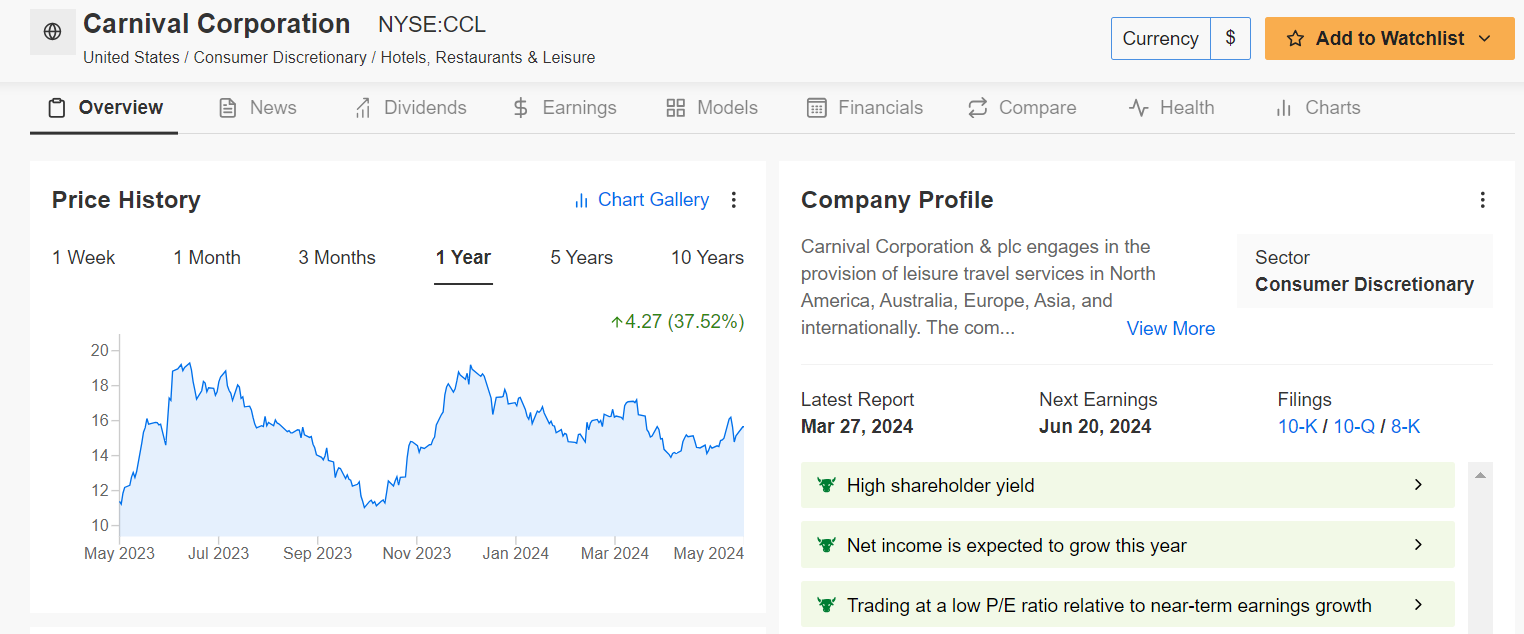

9. Carnival - Leisure & Travel

- Tuesday’s Closing Price: $15.65

- Market Cap: $17.5 Billion

Carnival (NYSE:CCL) is the world’s largest cruise line operator, with a dominant market share in the industry. The Doral, Florida-based cruise company is set to benefit from the rebound in global cruising demand thanks to favorable consumer travel trends.

Carnival’s extensive fleet and diversified cruise offerings provide a strong foundation for recovery and growth. Strategic cost management and operational efficiencies also contribute to its positive outlook.

In the short term, Carnival's growth is driven by pent-up travel demand and increased booking volumes as travelers flock to its cruises amid the ongoing improvement in tourism trends.

InvestingPro Insights: Carnival’s Financial Health Score is 3.0 out of 5.0, reflecting its improving booking trends and cost management, as well as its reasonable valuation.

Source: InvestingPro

As ProTips points out, Carnival’s share profile is fairly positive, with several bullish tailwinds working in its favor, including a healthy profitability outlook, and rising net income prospects.

Wall Street analysts surveyed by Investing.com are extremely bullish on CCL and see the stock at $21.42 per share, implying an upside potential of 36.9%. The percentage of ‘Buy’ ratings stands at 86%, ‘Hold’ 7%, and ‘Sell’ 7%.

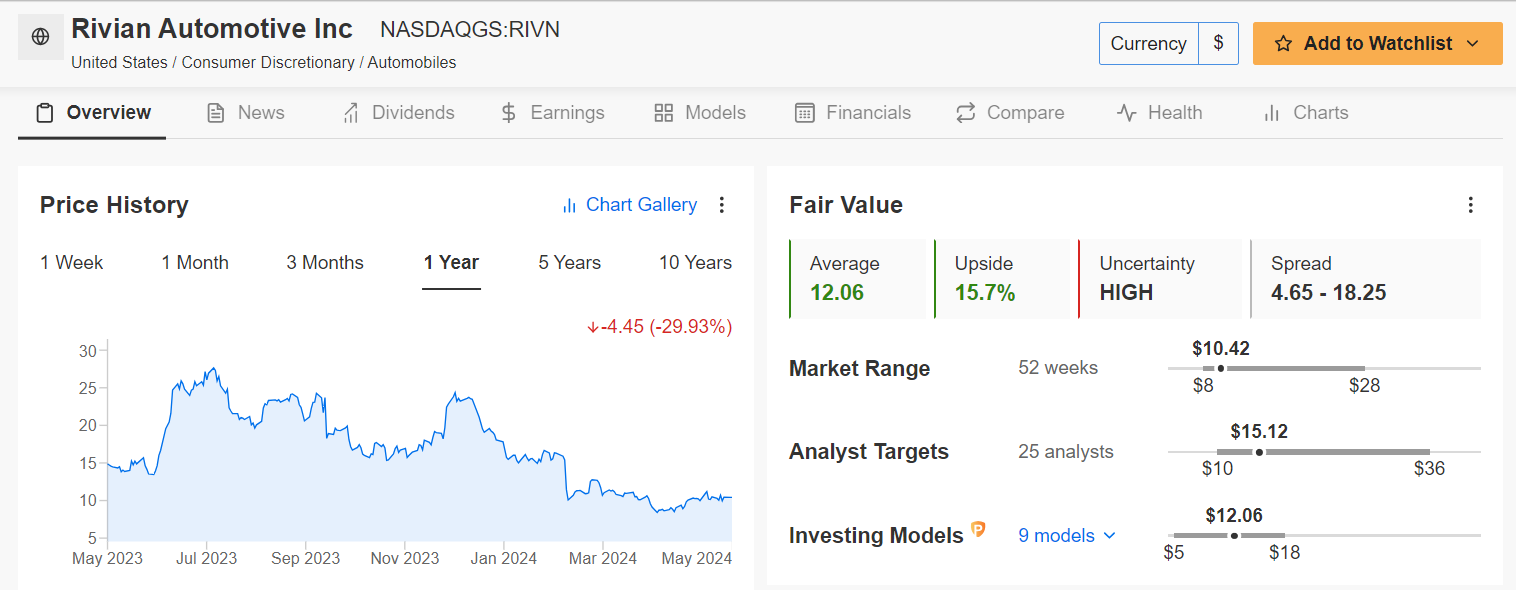

10. Rivian - Automotive

- Tuesday’s Closing Price: $10.42

- Market Cap: $10.4 Billion

Rivian (NASDAQ:RIVN) is at the forefront of the electric vehicle revolution, with strong backing and innovative product offerings. The Irvine, California-based EV maker’s focus on electric trucks and SUVs gives it a unique position in the industry.

The EV company’s strategic partnerships with major corporations for fleet sales and its plans for expanding production capacity support its long-term growth. Rivian’s strong emphasis on sustainability and cutting-edge technology also drives its market appeal.

In the short term, Rivian's growth is supported by new model launches and expanding production capabilities. Its focus on electric trucks and SUVs taps into growing consumer and commercial demand for EVs.

InvestingPro Insights: Rivian has a strong Financial Health Score, bolstered by substantial capital and strategic partnerships.

Source: InvestingPro

Fair Value estimates suggest significant appreciation potential from the current market price of $10.42. According to several valuation models, including P/E or P/S multiples, the intrinsic value for RIVN stock on InvestingPro stands at $12.06, a potential 15.7% upside.

Before investing in any stock, thorough research and consideration of your investment goals are highly recommended. It's crucial to consider the company's financial health, industry trends, and your own risk tolerance before making any investment decisions.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading amid the challenging backdrop of slowing economic growth, elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Don’t forget your 40% discount on the yearly and bi-yearly Pro plans with coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.