- Stock market near all-time highs, finding new buys is tricky.

- Fair Value tool helps uncover undervalued stocks with upside potential.

- See how Goldman Sachs and Synchrony Financial crushed the market after Fair Value signaled an upside.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

With the stock market via the S&P 500 up more than 17% year-to-date, finding new potential winners to buy now has become more challenging than ever.

Not only are stocks displaying very extended financial metrics, but several are also reaching tipping points both on the fundamental and technical sides.

Against this backdrop, being able to tell which stocks still have upside potential from those you want to run away from at all costs can prove a defining strategy for your portfolio.

That's where InvestingPro's flagship Fair Value tool can transform your investing performance. By deploying state-of-the-art financial modeling, InvestingPro's Fair can accurately tell the potential upside or downside potential of every stock in the market.

As a matter of fact, there are several great opportunities just waiting to be scooped up right now.

Need more? Let's check out two real-life examples below for more on how our Fair Value tool works:

1. Goldman Sachs: Up 57% Since Buy Signal Flashed

Goldman Sachs (NYSE:GS) is nearing the upside potential identified by InvestingPro's Fair Value tool back in March 2023, when the stock hit a low of just below $310. At that time, the tool predicted a potential rally of over 63%.

Since then, the stock has surged 57%, currently trading near $479. In the same period, the S&P 500 gained 42.5%, which means the stock beat the broader market by a healthy margin of 14.5%.

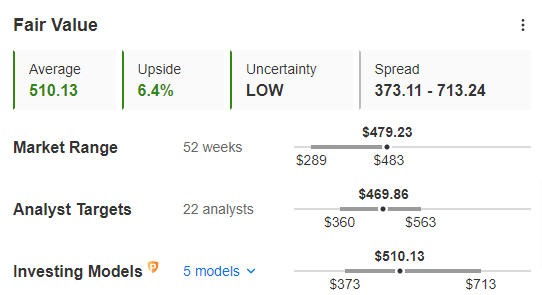

With earnings looming, the Fair Value tool now suggests a more modest upside of 6.4% from current levels.

Source: InvestingPro

Analysts are expecting a minor EPS increase of roughly 0.3% to $8.40 for Q2. This raises the question: can Goldman Sachs exceed expectations and reach the full 63.4% upside potential identified last year?

Source: InvestingPro

The answer might be revealed in the upcoming earnings report. Investors, particularly InvestingPro subscribers, can leverage the Fair Value tool to determine their next move after the stock reaches its projected upside.

2. Synchrony Financial Beats Broader Market by Almost 30%

Synchrony Financial (NYSE:SYF) has been a breakout star for investors who heeded InvestingPro's fair value call in March 2023. The consumer finance company, trading at $28.50 then, sported an upside potential of 65% according to the fair value tool.

Not only did SYF fulfill that prediction, it smashed it, surging a staggering 72.2% as of today's price. This stellar performance handily outpaced the broader market by a hefty margin of almost 30%, with the S&P 500 gaining a respectable 42.5% during the same period.

With earnings on the horizon and a projected EPS of $1.37, a key question emerges: has Synchrony already reached its full potential according to InvestingPro's fair value model?

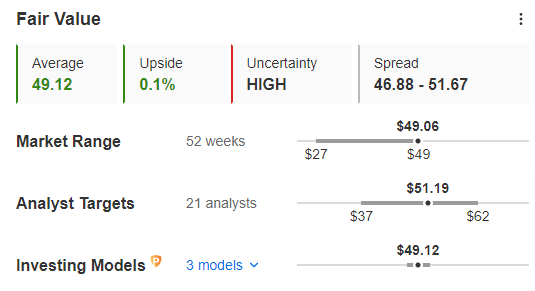

The answer, for now, is yes. Our current fair value suggests the stock is already priced accurately.

Source: InvestingPro

So, for InvestingPro subscribers sitting on these impressive gains, the dilemma arises: sell before earnings, or hold on and see what the report reveals?

The answer, along with a deeper dive into Synchrony's future, awaits savvy traders who utilize InvestingPro’s tools to make investment decisions.

Bottom Line

While investors who were fortunate enough to buy Goldman Sachs and Synchrony Financial when our Fair Value tool identified them as buys are now laughing all the way to the bank, these are just a select few from a much larger list of potential successes.

It is true that every bull market has new stocks that defy every prediction and fly regardless of their fundamentals. However, even more importantly, in every bull market, nearly all the fundamentally strong stocks gain.

That's why understanding the real financial value of an instrument, whether long or short, is what ultimately separates amateurs from pros.

So, will you keep on talking chances or make sure to put your money only on the best bets out there?

For less than $8 a month, the decision has never been easier.

*Subscribe via this link with an extra 10% discount using our exclusive coupon code OAPRO1.

Disclosure: The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.