-

Despite a challenging year with a stock price drop of over 41%, ACADIA Pharmaceuticals is seen by InvestingPro and Wall Street analysts as undervalued, with expectations of significant upside potential.

-

Cable One's stock has fallen more than 23% YTD, but recent analyst commentary and InvestingPro's predictions of a substantial price increase suggest the stock could be an attractive investment opportunity.

- In this piece, we will discuss each stock in detail and try and determine if now is the right time to buy.

- Subscribe to InvestingPro now for under $9 a month and never miss another bull market again!

Mid-cap stocks hold a distinct, frequently overlooked niche in the investment landscape, balancing the high-growth, high-risk associated with small-cap stocks against the stability and maturity of large-cap counterparts.

This equilibrium provides investors with a rare mix of potential for growth and relative stability - a combination hard to find in the more extreme ends of the market cap spectrum.

In this piece, we spotlight two mid-cap companies: ACADIA Pharmaceuticals (NASDAQ:ACAD) and Cable One (NYSE:CABO).

Both companies have encountered substantial declines in their stock prices amid various challenges. However, they are currently viewed as undervalued based on InvestingPro analysis and could be ripe for a rebound.

1. ACADIA Pharmaceuticals

Shares of ACADIA Pharmaceuticals saw a significant drop, falling over 41% since the start of the year, mainly attributed to the company's failure in the Phase 3 ADVANCE-2 trial, a lackluster sales forecast for Daybue, and a miss on Q4 EPS expectations.

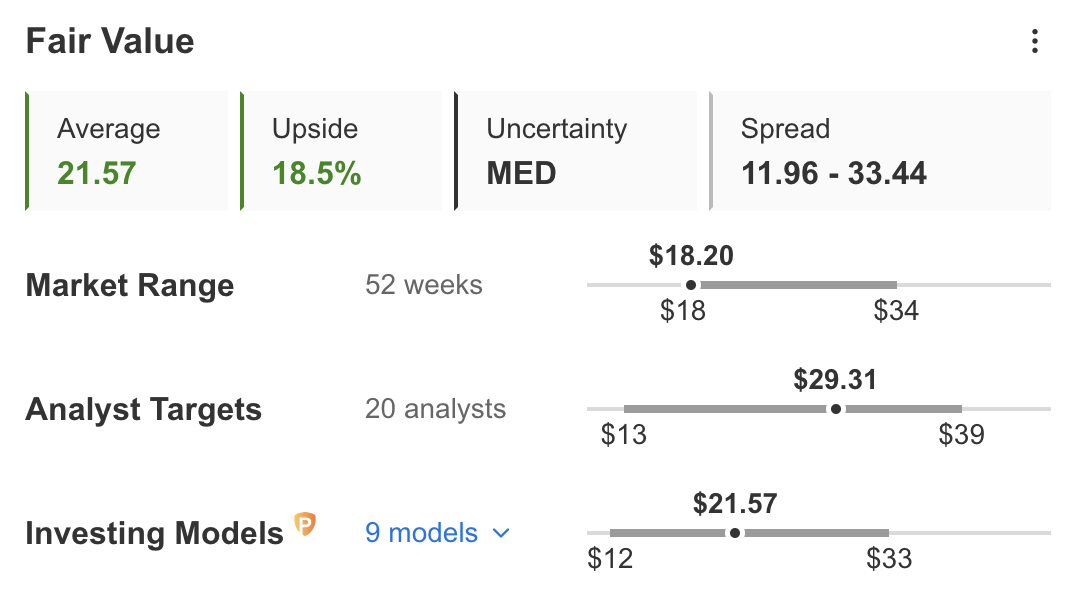

However, InvestingPro's Fair Value analysis indicates an upside potential of 18.5% for ACADIA, suggesting the stock is oversold. This sentiment is echoed by Wall Street analysts who foresee a more optimistic growth potential of over 60%.

Source: InvestingPro

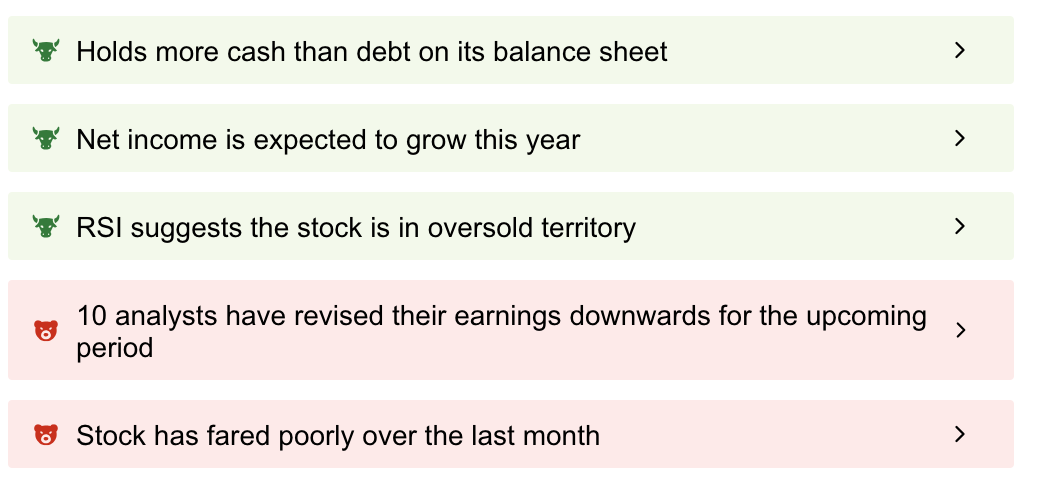

InvestingPro's analysis points to several strengths of ACADIA, including a healthy cash position, an anticipated increase in net income this year, and indications from the Relative Strength Index (RSI) that the stock is in an oversold territory.

Source: InvestingPro

Conversely, some areas of concern include a disappointing stock performance over the past month and adjustments of earnings expectations downward by analysts for the upcoming period, a shift that followed the Q4 report in February.

However, over the last 12 months, there has been a positive shift in the EPS forecast for this quarter. Analysts have revised their expectations upwards by 135.2%, changing from an anticipated loss of $0.18 per share to an expected earnings of $0.063 per share.

Source: InvestingPro

Cable One

Much like ACADIA, Cable One has also seen its shares fall sharply, with a decline of more than 23% YTD.

The EPS Forecast Trend for Cable One for the upcoming first quarter of 2024, which is set for May 2, shows that analysts have revised their EPS expectations downward by 29.4% over the last 12 months, from $15.23 per share to $10.75 per share.

Source: InvestingPro

Earlier this month, MoffettNathanson upgraded Cable One from Neutral to Buy, despite reducing its price target from $835 to $615. The firm highlighted challenges, particularly Cable One's broadband pricing strategy, crucial for its growth.

The analyst noted that forgoing growth in broadband average revenue per user (ARPU) could halt the company's overall growth.

Moreover, MoffettNathanson pointed out Cable One's lack of a wireless strategy, suggesting it could affect the company's valuation negatively but also potentially make it an attractive acquisition target.

Despite these issues, MoffettNathanson believes “Cable One’s valuation is simply too low, and its assets too attractive, for it to remain at this price".

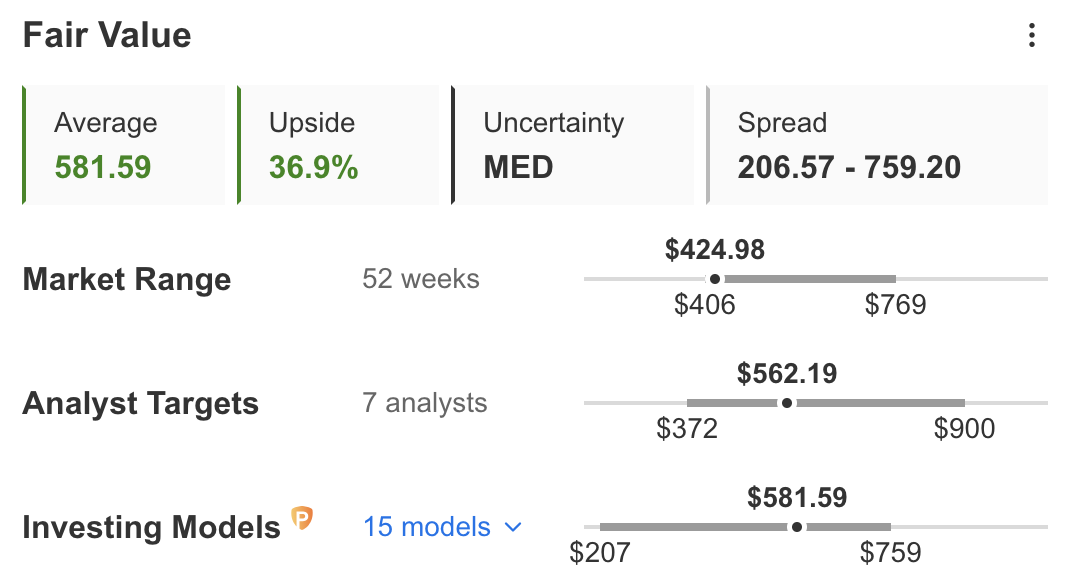

Furthermore, InvestingPro's fair value assessment also indicates that the stock is currently undervalued, with investment models predicting a potential 36.9% increase in the stock price.

This projection aligns closely with Wall Street analysts' expectations, which forecast an approximate 32.2% rise in price.

Source: InvestingPro

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.