This article was written exclusively for Investing.com

- Crude oil and sugar fell to new lows in April

- Sugar is all about Brazil where the sweet commodity has a dual role

- The Brazilian currency is another factor for the sugar market that created an almost perfect bearish storm

When most people think of crude oil, the last commodity that then comes to mind is sugar. Crude oil is the leading member of the energy sector within the commodities market. The crude oil futures contract typically has the highest level of trading volume and open interest—also known as the largest number of open long and short positions. Crude oil futures trade on the NYMEX division of the Chicago Mercantile Exchange.

Sugar, an agricultural commodity, belongs to the softs sector. It tends to have the highest level of volume and open interest of all of the soft commodities that trade on the Intercontinental Exchange or ICE.

The prices of sugar and crude oil futures correlate well because, in some parts of the world, sugar is the primary ingredient in the biofuel ethanol. Indeed, crude oil and sugar fell to new lows in April.

As most will remember, April was an ugly month in the crude oil market. In fact, it was the ugliest month ever for the energy commodity in the NYMEX futures market.

Source, all charts: CQG

As the quarterly chart highlights, the price of nearby crude oil futures fell below the record low from 1986 at $9.75 per barrel. It also dropped below zero to an incredible low of -$40.32.

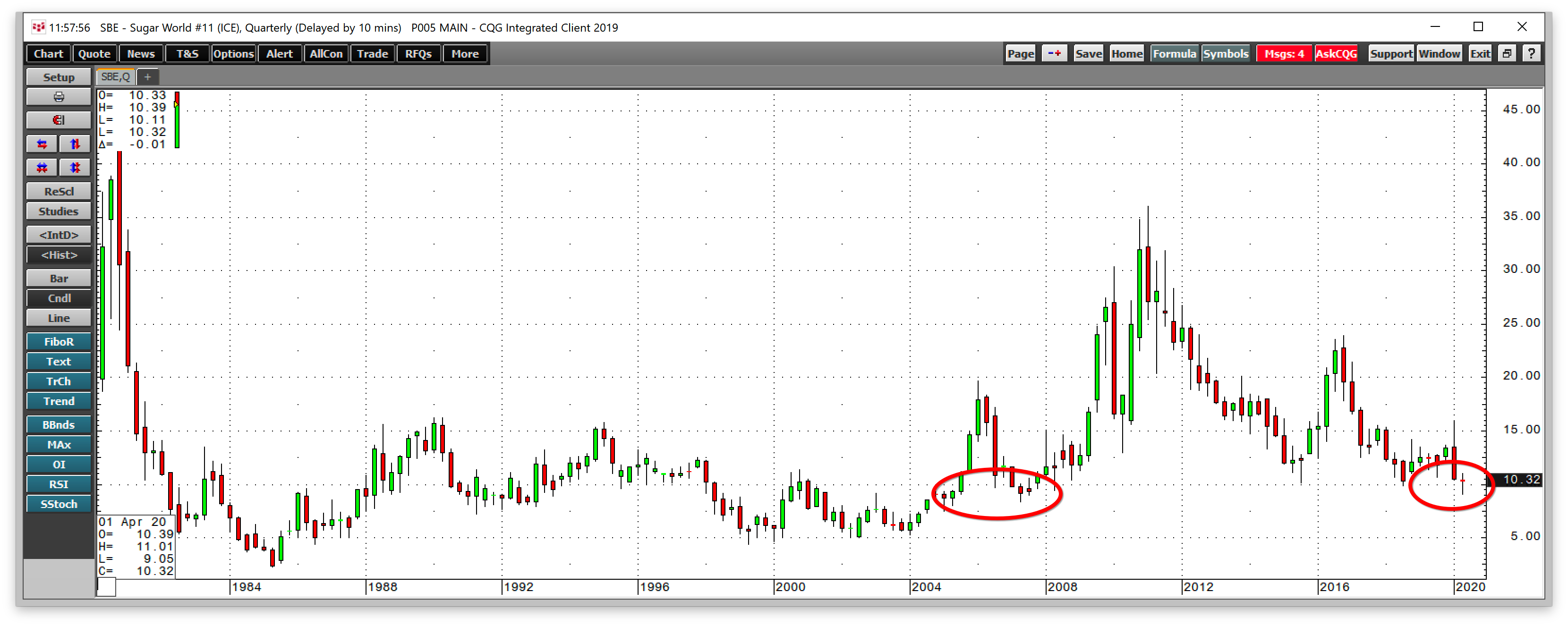

Sugar futures also made a multiyear low last month.

The price of sugar futures on the Intercontinental Exchange declined to a low of 9.05 cents per pound in April. The last time the sweet agricultural commodity fell below that price was back in September 2007.

Brazil is the world’s leading producer and exporter of sugarcane. Which means sugar is all about Brazil where the ag commodity plays a dual role.

While sugar is a critical ingredient in many food products, it is also the primary input in the production of ethanol in Brazil, South America’s most populous and leading economy. Brazil and the US are the two top ethanol producers in the world. In the US, corn is the ingredient in the biofuel, but in Brazil, it is all about sugar.

The quarterly chart shows that the price of Ethanol Futures declined to a record low of 79.9 cents per gallon in April 2020. Crude oil weighed on ethanol, and ethanol sent sugar to the lowest price in thirteen years.

Brazil's currency, the real, is another key factor in the sugar market. Its recent decline created an almost perfect bearish storm.

At the same time that crude oil selling was making the price of sugar a lot less sweet, the price action in the Brazilian currency added to the bearish price action in the sugar futures market.

Since Brazil is the leading producer, the local production costs that include labor to grow, mill and transport sugar are in local currency terms. The ICE futures price sugar in US dollar terms, so when the value of Brazil’s currency declines, it tends to put pressure on the price of the soft commodity.

The chart above, of the foreign exchange relationship between the US dollar and the Brazilian real shows that the real fell to its lowest level at $0.16775 against the dollar in May. The trend in the currency pair has been lower since the real traded to a high of $0.65095 against the US currency in 2011.

Sugar is highly sensitive to energy prices, but it also reflects the currency differential between Brazil’s currency and the US dollar. Sugar traded to a high of 36.08 cents per pound in 2011 when the real hit $0.65095 against the dollar. At 10.29 cents at the end of last week, the price of sugar had declined by 71.48% since 2011. At $0.1734 against the dollar, the Brazilian currency dropped by 73.36%. The bottom line is that the price of sugar in Brazil in May 2020 is 1.88% higher than it was in 2011 when it was trading at over 36 cents per pound in dollar terms.

When trading or investing in the sugar market, crude oil and the Brazilian real are two critical factors to watch. Each can influence the path of least resistance of the price of the sweetest commodity.