“…I expect that inflation will return to 2 percent over the next few years as the temporary factors that are currently weighing on inflation wane, provided that economic growth continues to be strong enough to complete the return to maximum employment and long-run inflation expectations remain well anchored. Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter. But if the economy surprises us, our judgments about appropriate monetary policy will change.” – Chair Janet Yellen in “Inflation Dynamics and Monetary Policy“, September 24, 2015, at the Philip Gamble Memorial Lecture, University of Massachusetts, Amherst, Amherst, Massachusetts

Let there be no doubt, the Federal Reserve WANTS to start hiking rates before 2015 ends. The quote above should clarify her position on timing as well as the Fed’s general bias to start hiking rates. These words were necessary because the Fed got the wrong market outcome from its September meeting.

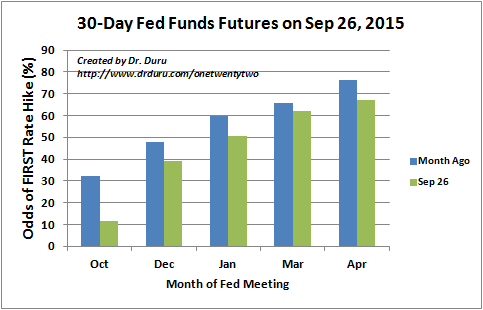

The market’s extreme reaction to the rate inaction of the September Fed meeting pushed the odds of the first rate hike out all the way to March, 2016. The Fed must now tease, cajole, and even exhort the market into bringing expectations back to 2015. To this end, I am expecting follow-up speeches and utterances from Fed members to better align with Yellen’s approach.

The calculus for the timing of the first rate hike, and likely for subsequent rate hikes, is relatively simple:

- The Fed does not want to surprise financial markets given the fragility of global macroeconomic conditions. A surprise has the strong potential for generating undesirable instability.

- The Fed will hike exactly when the market expects it to hike.

- The Fed must convince markets to price in odds for a hike when the Fed wants to hike in order to avoid #1.

Everything the Fed has done this year is consistent with this calculus. The Fed went into its September meeting with a market unprepared for a hike based on the 30-Day Fed Fund futures prices. The Fed HAD to point to China and global economic conditions as reasons to further delay a first rate hike because the market had already assumed these conditions made a September hike extremely unlikely.

Going into the September meeting, I marveled at the persistence of the pundits and economists who preferred to ignore market reality and stick to their own personal beliefs and assessments of what the Fed will do. I suspect these same people will continue to miss the intertwined dynamic between the Fed and the market as we go into the first rate hike. This disconnect spells opportunity. The opportunity in the immediate wake of the September meeting was to fade commodity and related “risk-on” plays that rallied for a short spell.

So far, Yellen’s efforts have already started to pay off…just barely. The market has brought in the odds for the first hike back to January, 2016 (50/50).

The market now assigns 50% odds to a first rate hike at the January, 2016 meeting

Source: CME Group FedWatch Tool

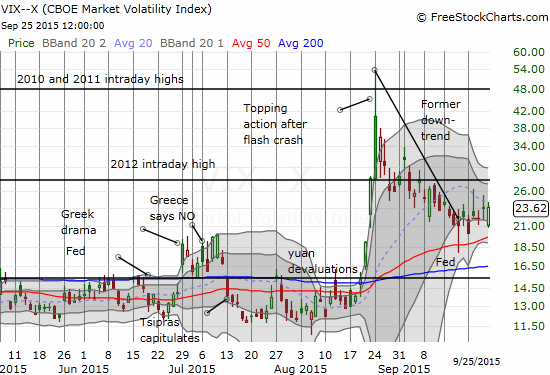

As the Fed continues its work to get Fed Futures to a December rate hike, I expect volatility to remain a bit elevated. The adjustment process will make the Fed sound hawkish at the exact time that global economic conditions continue to cause fear and concern in financial markets (look no further than the big earnings warning from global industrial titan Caterpillar (NYSE:CAT)). Notice that volatility has essentially churned since the Fed September meeting with an ever so slight upward bias.

The volatility index (VIX) is in a post-Fed holding pattern for now

Source: FreeStockCharts.com

Perhaps volatility will resume its downward momentum after the adjustment process ends.

In the meantime, earnings warnings from the likes of Caterpillar, Inc. (CAT) will keep the market on edge about the potential for a more dramatic slowdown in China.

Caterpillar, Inc. (CAT) collapses again on poor earnings news

Source: FreeStockCharts.com

Then again, there is Nike (NYSE:NKE) which had glowing words for China in its recent earnings report. For example…

“Now turning to China, where revenue grew an impressive 30% for the quarter, on both a reported and currency-neutral basis. While we’re very mindful of the macroeconomic volatility in China, our brand has never been stronger and our marketplace has never been more healthy. We have momentum across nearly all key categories, as well as continued strength in our DTC business. EBIT for China grew 51% in Q1, due to very strong revenue growth, gross margin expansion and SG&A leverage.”

“All told, the incredible growth we saw in China this quarter reflects our ongoing efforts to align the marketplace to the category offense, a strategy that we expect will drive growth in this critical geography for many years to come.”

“So, we’re very mindful of the macroeconomic volatility in the marketplace. But we continue to really focus on the things that we can control which is how we continue to bring excitement to the marketplace and also continue to align the marketplace around our category offense and we’re seeing success from that perspective.”

Nike (NKE) gaps up 8.9% to a fresh all-time high as results in China help bolster confidence in future sales growth.

Source: FreeStockCharts.com

Perhaps China’s transition to a consumer-led rather than an infrastructure-led, capital-intensive, export-driven economy is proceeding just fine after all…